Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

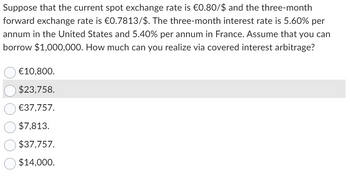

Transcribed Image Text:Suppose that the current spot exchange rate is €0.80/$ and the three-month

forward exchange rate is €0.7813/$. The three-month interest rate is 5.60% per

annum in the United States and 5.40% per annum in France. Assume that you can

borrow $1,000,000. How much can you realize via covered interest arbitrage?

€10,800.

$23,758.

€37,757.

$7,813.

$37,757.

$14,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Today's spot exchange rate: 1 euro = $1.25.US interest rate (home interest rate) is 7%.EU interest rate (foreign interest rate) is 10%.a) If the IRP (Interest rate parity) holds, what should the forward exchange rate be today?b) Assume that today, you invest $500 in the EU market for one year and at the same time, enter a currency forward contract to sell euro in a year at the forward rate from part a). If today's spot exchange rate is: 1 euro=$1.32 instead of $1.25, show how much profits or losses you make next year.arrow_forward29) Suppose that the two-year interest rates in Australia and the United States are 4.6% and 0.4% per annum, respectively, and the spot exchange rate between the Australian dollar (AUD) and the US dollar (USD) is 1.0500 USD per one unit of AUD. What is the theoretical forward exchange rate from the perspective of an Australian investor wanting to purchase USD in two years' time? A. 1.0134 AUD per USD. B. 1.0258 AUD per USD. C. 1.0234 AUD per USD..arrow_forwardA European firm borrows MXN from a Mexico bank at a 7% interest rate. Over that same time, the Euro appreciates 2.70% against the MXN. What is the European firm's €-denominated equivalent cost of borrowing?arrow_forward

- Newstar Co. expects to pay 500,000 euro in one year. Assume the annual interest rate of borrowing or lending euro is 1% and the annual interest rate of borrowing or lending U.S. dollar is 2%. The spot rate of euro is $1.12 per euro. How much guaranteed amount of U.S. dollar does the company expect to pay after hedging the euro payable transaction in the international money market? (pick the closest answer) A. 565,545 USD. B. 554,510 USD. C. 562,786 USD. D. 576,912 USD.arrow_forwardSuppose that the interest rate on a US dollar deposit is 3% and the interest rate on a Japanese yen deposit is 1%. Today’s exchange rate is $1/¥ and the expected rate one year in the future is $1.2/¥, so $100 today can be exchanges for ¥100. Which currency deposit yield a higher expected rate of return (which currency investors should be willing to hold)? Why?arrow_forwardSuppose that the current EUR/GBP exchange rate is £0.86 per euro. The current 6-month interest rates are: GBP 4%, EUR 6%. There are three 6-month forward contracts available, with the following exchange rates: Contract A B C EUR/GBP 0.86 0.85 0.90 You expect to incur an expense of €50,000 in six months. Can you identify any relevant risk in terms of the EUR/GBP exchange rate? Would you use any of the available forward contracts to hedge against this risk? Explain and provide an example.arrow_forward

- Suppose the current exchange rate for the Polish zloty is Z3.3. The expected exchange rate in 5 years. The expected exchange rate in 5 years is Z3.56. What is the difference in the annual inflation rates for the United States and Poland over this period? Assume that the anticipated rate is constant for both countries.arrow_forwardSuppose that the one-year interest rate is 5.0 percent in the United States and 3.5 percent in Germany, and that the spot exchange rate is $1.12/€ and the one-year forward exchange rate, is $1.16/€. Assume that al of these rates will be used and a speculator can borrow $1,000,000 or €1,000,000. This is an example whether Uncovered Interest Arbitrage is possible O This is an example of whether Purchasing Power Parity holds This is an example whether fisher effect holds O None of the above This is an example whether Covered Interest Arbitrage is possiblearrow_forwardSuppose that the annualized inflation in the US is 3% while annual inflation in Europe is 1%. If the current exchange rate is $1.40 per Euro that would you expect the exchange rate to be in one year? If the exchange rate one year from now turns out to be $1.50 per Euro, what has happened to the real exchange rate?arrow_forward

- The 1 year (lending or borrowing) rate in the UK is 8%; the 1 year (lending or borrowing) rate in the United States is 5%. Currently the spot exchange rate if $1.81 per British pound; the 1 year forward rate is $1.79 per British pound. If you are able to borrow $1,000,000 in the US to lend (as British pounds) in the UK, how much a risk free profit can you create over the next year? Give typing answer with explanation and conclusionarrow_forwardPlease Help The Swiss Franc is trading at 1.1464 $/ SFr, the euro is trading at 1.0828 $/euro. If you can buy or sell SFr/euro at 0.9451, is there an arbitrage? If so, how much can you make with one round - trip using $1,000,000 ? Please Helparrow_forwardSuppose that the current spot exchange rate is €0.830/S and the three-month forward exchange rate is €o.815/S. The three-month interest rate is 6.00 percent per annum in the United States and 5.40 percent per annum in France. Assume that you can borrow up to $1,000,000 or €830,000. Show how to realize a certain profit via covered interest arbitrage, assuming that you want to realize profit in terms of U.S. dollars. Also determine the size of your arbitrage profit.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education