Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Pls solve this question correctly instantly in 5 min i will give u 3 like for sure

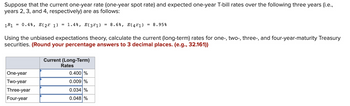

Transcribed Image Text:Suppose that the current one-year rate (one-year spot rate) and expected one-year T-bill rates over the following three years (i.e.,

years 2, 3, and 4, respectively) are as follows:

1R1 = 0.4%, E(2r 1) = 1.4%, E(3²1) = 8.6%, E(4²1) = 8.95%

Using the unbiased expectations theory, calculate the current (long-term) rates for one-, two-, three-, and four-year-maturity Treasury

securities. (Round your percentage answers to 3 decimal places. (e.g., 32.161))

One-year

Two-year

Three-year

Four-year

Current (Long-Term)

Rates

0.400 %

0.009 %

0.034 %

0.048 %

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- * CENGAGE MINDTAP Q Search Time Value of Money I Back to Assignment Attempts Average / 1 1. Problem 5.01 (Future Value) еВook If you deposit $7,000 in a bank account that pays 9% interest annually, how much will be in your account after 5 years? Do not round intermediate calculations. Round your answer to the nearest cent. $4 Grade it Now Save & Continue Continue without savingarrow_forwardI need help answer questions 3-5 and and why or why not the company should move forward with this endeavorarrow_forwardQUESTION 5 Date 01/02/01 01/03/01 1 Mo 01/04/01 3 Mo N/A N/A N/A 6 Mo 1 Yr 5.11 5.58 5.44 5.20 5.87 4.82 4.92 5.69 4.92 5.14 5.37 4.78 5.03 Look at the yields for 01/02/01 in the above table. Which of the following best describes the shape of the yield curve at that time? O A. Inverted O B. Normal C. Flat D. Upward-Sloping 5.04 2 Yr 4.82 3 Yr 4.87 4.92 4.77 5 Yr 7 Yr 4.97 5.18 5.07 4.76 4.94 4.82 10 Yrarrow_forward

- Large speed bump $ $ $ S 1.80 16 2.10 1,920 U 480 U 400arrow_forwardMicrosoft W X Risk Analy & X 1 (1) WhatsAp x ← → CO To get future Google Chrome updates, you'll need Windows 10 or later. This computer is using Windows 7. Microsoft Word - MGMT 2023_U8_Version1_new.docx e WACC-CheatSheet....pdf Assessing P X < Instant + A X ► ● Weighted x 2022.tle.courses.open.uwi.edu/pluginfile.php/108157/mod_resource/content/3/MGMT%202023%20_U8_Version1_new.pdf 6 / 11 100% + ▶ Cost of Debt, preferred stock and common equity Having read the recommended pages, please attempt the following problems and post your response to the discussion forum for review by your tutor and peers. Video Tutor X 1. Rick and Stacy Stark, a married couple, are interested in purchasing their first boat. They have decided to borrow the boat's purchase price of $100,000. The family is in the 28% federal income tax bracket. There are two choices for the Stark family: They can borrow the money from the boat dealer at an annual interest rate of 8%, or they could take out a $100,000 second…arrow_forwardHi I need help finding the monthly payment I think I have the right formula but dont know how to solve itarrow_forward

- Pls solve this question correctly instantly in 5 min i will give u 3 like for surearrow_forwardAutoSave OFF Home Insert X Paste E36 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 A Ready D 2 - C Draw Page Layout Calibri (Body) V 11 B I U A. V V B UDENCRUIVIIVIIL & FRITCITOU. CONSOLIDATED BALANCE SHEETS Formulas V fx (In millions, except par value amounts) ASSETS CURRENT ASSETS: Cash and Equivalents Marketable Securities Receivables Inventories Other Current Assets TOTAL CURRENT ASSETS PROPERTY AND EQUIPMENT, NET OTHER ASSETS TOTAL ASSETS CURRENT LIABILITIES: Accounts Payable Other Liabilities and Accrued Expenses Income Taxes Payable TOTAL CURRENT LIABILITIES NONCURRENT LIABILITIES: Long-Term Debt Other Liabilities TOTAL NONCURRENT LIABILITIES STOCKHOLDERS' EQUITY: Class A Common Stock, $0.01 par value: 150,000 shares authorized and 103,300 shares issued Additional Paid-In Capital Retained Earnings Accumulated Other Comprehensive Income (Loss) Treasury Stock, at Average Cost - 17,662 and 16,054 at December…arrow_forwardu Online Cour X (78) Whats x M Your AccoL X M Inbox (2,74 X SP2021-AC X Answered: Ek My Home * CengageN X Bartleby Q x + D X A v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?inprogress=true FMovies | Watch M. BIO201 Connect 10. M Gmail > YouTube Fourth Homework O eBook Patents 6. MC.12.06 Instructions Chart Of Accounts General Journal 7. MC.12.07 Instructions 8. MCС.12.08 Mystic Pizza Company purchased a patent from Prime Pizza Plus on January 1, 2019, $72,000. The patent has a remaining legal life of 9 years. 9. МC.12.09 Required: 10. MC.12.10 Prepare the journal entries to record the acquisition and the amortization for 2019, assuming Mystic Pizza amortizes its patents using the 11. RE.12.01.BLANKSHEET straight-line method over the life of the asset. 12. RE.12.02 13. RE.12.03.BLANKSHEET 14. RE.12.04.BLANKSHEET 15. RE.12.05.BLANKSHEET 16. RE.12.06.BLANKSHEET 17. RE.12.07.BLANKSHEET 18. RE.12.08 O V I 12:52arrow_forward

- _mheducation.com/ext/map/index.html?_con Multiple Choice O Ryan Company purchased 80% of Chase Company for $270,000 when Chase's book value was $300,000. Chase has 50,000 shares outstanding and currently has a book value of $400,000. Assume Chase issues 30,000 additional shares common stock solely to Ryan for $12 per share. What is the new percent ownership Ryan owns in Chase? 90.0% 87.5% 82.5% Saved M Save & Exit U Sep 16arrow_forwardI Session 6 L Dashboard x Question 9 X G What is the X Login | bar x M (Alen A ezto.mheducation.com/ext/map/index.html?_con%3con&external_browser%3D0&launchUrl=https%253A%2521 - Z. M MKT 100 (Section 2. H QuickLaunchSSO : Homework Saved Asset W has an expected return of 13.6 percent and a beta of 1.37. If the risk-free rate is 4.62 percent, complete the following table for portfolios of Asset W and a risk-free asset. (Leave no cells blank - be certain to enter "O" wherever required. Do not round intermediate calculations. Enter your portfolio expected return answers as a percent rounded to 2 decimal places, e.g.., 32.16. Enter your portfolio beta answers rounded to 3 decimal places, e.g., 32.161.) Portfolio Expected Percentage of Portfolio in Asset W Portfolio Beta Return 0 % % 25 % 50 75 % 100 % 125 % 150 % ......Tarrow_forward1 2 m 4n 07 9. White 9 A Talk S Aint Ia O ENG 10 O Annota S Annota SAnnota M Recibic I Downl ssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false 台☆* + Facebook 6 Student Center Bb Blackboard WhatsApp Ggrammarly unemployment > |国Readi Maps Zoom Mark Turney owns Creative Corners. He does his banking at United Federal Bank (UFB) in Tucson, Arizona. The amounts in his general ledger for payroll taxes and the employee's withholding of Social Security, Medicare, and federal income tax as of April 15 of the current year show the following: Social Security tax payable (employer and employee), $3,020; Medicare tax payable (employer and employee), $734; FUTA tax payable, $84; SSUTA tax payable, $414; and Employees income tax payable, $4,622. Journalize the payment of the Form 941 deposit to UFB and the payment of the SUTA tax to the State of Arizona as of April 15, 20--. If an amount box does not require an entry, leave it blank. Page: POST. DATE DESCRIPTION…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education