Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

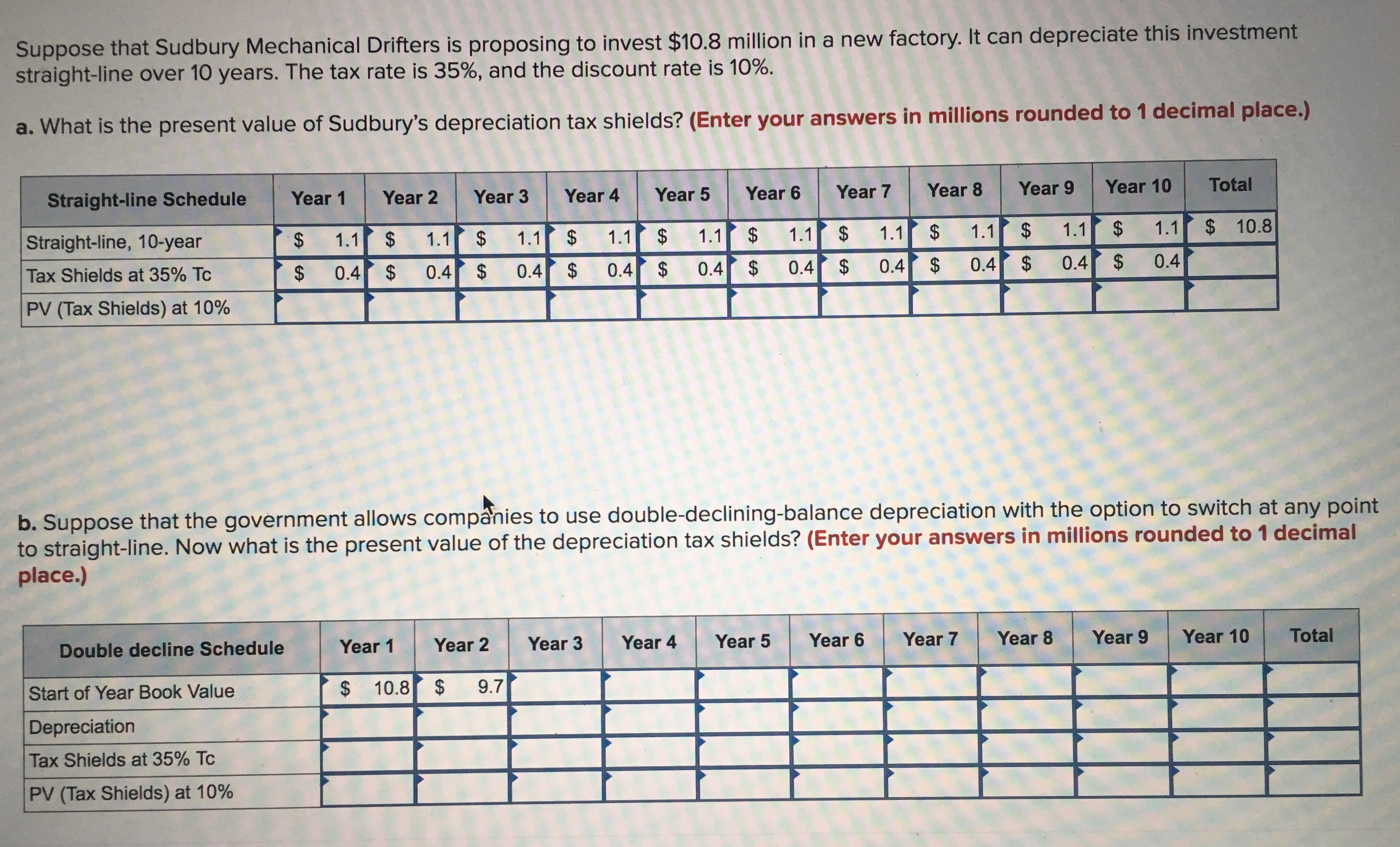

Transcribed Image Text:Suppose that Sudbury Mechanical Drifters is proposing to invest $10.8 million in a new factory. It can depreciate this investment

straight-line over 10 years. The tax rate is 35%, and the discount rate is 10%.

a. What is the present value of Sudbury's depreciation tax shields? (Enter your answers in millions rounded to 1 decimal place.)

Total

Year 10

Year 9

Year 8

Year 7

Year 6

Year 5

Year 4

Year 3

Year 2

Year 1

Straight-line Schedule

$ 10.8

$

1.1

$

1.1

$

1.1

$

1.1

$

1.1

$

1.1

$

1.1

$

$

1.1

Straight-line, 10-year

$

1.1

1.1

$

0.4

$

0.4 $

0.4

0.4

$

$

0.4

0.4 $

0.4

$

$

$

0.4

$

0.4

0.4

Tax Shields at 35% Tc

PV (Tax Shields) at 10%

b. Suppose that the government allows companies to use double-declining-balance depreciation with the option to switch at any point

to straight-line. Now what is the present value of the depreciation tax shields? (Enter your answers in millions rounded to 1 decimal

place.)

Total

Year 10

Year 9

Year 8

Year 7

Year 6

Year 5

Year 4

Year 3

Year 2

Year 1

Double decline Schedule

$

9.7

$

10.8

Start of Year Book Value

Depreciation

Tax Shields at 35% Tc

PV (Tax Shields) at 10%

EA

EA

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 3 images

Knowledge Booster

Similar questions

- What will be the annual cash outflows for Mimi Inc. if it leased a milling machine for $8, 200 per year for 5 years. Assume that the new machine cost $ 42,000 and will depreciate on a straight line basis over the 5 years and that Mimi has a tax rate of 32 percent. Question 15Select one: a. - $5,576 b. $42,000 C. -$8,264 d. $33,800 e. - $2,688arrow_forwardNeed help with this questionarrow_forwardBaghibenarrow_forward

- Question 1) Imagine you are considering buying a gold deposit. It will cost $1 million per year to construct a mine so that gold can be extracted. The construction period lasts 3 years. In the fourth year, production starts. Each year the mine operates it will yield a net return of $500,000 (total revenue minus total cost). What will you pay for the gold deposit if: (a) Interest rates are 10 percent and gold can be extracted for 10 years? (b) Interest rates are 5 percent and gold can be extracted for 6 years?arrow_forwardThis question is based on the following in formation: An investment is Machinery costing P 250,000 with a 4-year life and no salvage value is expected to produce the following net income after taxes of 30%: End of year 1 P 17,000 2 22,000 3 25,000 4 26,000 How much is the annual tax shield?How much is the annual tax shield?A. P 17,580B. P 17,850C. P 18,570D. P 18,750What is the ROI (using the cash income)? A. 6.3%B. 9%C. 31.3%D. 34%arrow_forwardAssume a machine was purchased 5 years ago for $800,000 and has been 75% depreciated. The firm decides to sell this machine for $350,000. The firm's tax rate is 20%. Calculate how much net cash the sale of this equipment will generate for the firm. Answer rounded to the nearest whole dollar; for example 42,345 for your answer.arrow_forward

- 2. You plan on buying a bottling machine for $2 million, which can be salvaged for $400,000 in 8 years. Your tax rate is 43% and the CCA rate is 30%. Your cost of capital is 13%. What is present value of the CCA tax sheild? (Answer: E) a. $338,447 b. $378,521 c. $422,781 d. $458, 402 e. $520,348arrow_forward1.arrow_forwardPlease solve it as soon as possible! . Consider an asset with an initial cost of $100,000 and no salvage value. Compute the difference in the present value of the tax shields if CCA is calculated at 20% declining balance compared to if CCA is calculated using a five-year, straight line write off. For your calculation use 30% as the tax rate and 16% as the required return. (The half-year rule applies.) The difference, to the nearest dollar, is A S1.724 B $4,129 C S4.483 d. 59,517 e.$49,969arrow_forward

- Please answer fast i give you upvotearrow_forwardProvide please answer in text Formatarrow_forwardSuppose that the marginal tax rate is 15%. If a farmer decides to purchase a combine it will increase his revenue by $6,000 per year, but it will also increase his expenses by $1,000 per year. The before tax rate on this investment is 25%. The life of this investment is 6 years. What is the present value of the after tax net return? $14,133 $12,544 $16,084 $13,706 None of the answers are correctarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education