ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

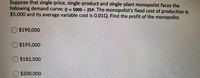

Transcribed Image Text:Suppose that single-price, single-product and single-plant monopolist faces the

following demand curve: Q

$5,000 and its average variable cost is 0.01Q. Find the profit of the monopolist.

5000

25P. The monopolist's fixed cost of production is

O $190,000

O$195,000

$182,500

$200,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- A monopolist with constant marginal cost c and a linear market demand given by Q(p) = A - bp, charges a price of $10 when c = $5. When c decreases to c = $4, the monopolist's price will O not change O decrease by less than $1 O decrease by $1 O decrease by more than $1 O depending on the demand elasticity any of the above is possiblearrow_forwardQuestion 9 Because a monopolist has market power, which of the following is NOT a characteristic of a monopolist? O It faces a horizontal demand curve O It faces a downward-sloping demand curve O When it produces an extra unit of output, it must lower its price for on all units sold O Its marginal revenue curve is below its demand curvearrow_forwardSuppose that for a monopolist, MR=MC=$10 and P=$15 at the profit-maximizing level of output. At this level of output, the firm A. Is earning profit B will shut down if AVC>$15 C is making $5 profit on each unit sold D will shut down if ATC>$15 E is losing $5 per unit producedarrow_forward

- Assuming that the price is greater than the average variable cost, a monopolist maximizes profits at the output for which (picture a graph): O price is equal to marginal revenue in the downward part of the marginal cost curve O marginal cost is equal to marginal revenue in the upward sloping part of the marginal cost curve O average variable cost and average total cost are in the downward part of their curves and price is equal to marginal cost O average total cost is at the lowest pointarrow_forwardExhibit 10-4 $/0 MC ATC 24 /t 10 The non-discriminating monopolist in Exhibit 10-4 should: O Produce 10 units at a price of $36 per unit. O Produce 10 units at a price of $24 per unit. O Produce 10 units at a price of $40 per unit. O Produce 15 units at a price of $32 per unit. O We cannot determine what the firm should do without knowing its average variable cost.arrow_forwardPlease helparrow_forward

- A single-price monopolist is currently producing at an output level where marginal revenue is $14, marginal cost is $16, AVC=$13, and ATC= $15. It is assumed that the monopolist, as usual, chooses its price on the demand curve. To maximize profit or minimize losses in the short run, this monopolist should O A. decrease the price and increase the level of output. O B. increase the price and the level of output. O C. leave the market. O D. decrease the price and the level of output. O E. increase the price and decrease the level of output.arrow_forwardThe quantity sold by a monopolist using first degree price discrimination is higher than the quantity sold by a monopolist who cannot price discriminate. O True O Falsearrow_forwardIf a monopolist with significant barriers to entry is making positive economic profit in the short run, what do we expect to happen as the market transitions to the long run? O The profit will increase since the monopolist has no competition, they can just raise the price to earn higher profits. O It will decrease as positive economic profit signals new firms to enter the market, increasing the market supply, and lowering the prevailing price. O It will increase, in the long run firms will drop out the market increasing the monopolists dominance in the marketplace. O The profit will stay the same, strong barriers to entry prevent new competition.arrow_forward

- QUESTION 23 If the monopolist shown in the following figure could practice first-degree price discrimination, the producer surplus would be: Price (dollars) 50 40 30 20 10 $0. $225. $450. $900. O $1,200. 30 50 60 MR 100 MC Quantityarrow_forwardQuestion 30 Demand: P=120-Q Marginal Revenue: MR=120-2Q Total Cost: TC=Q² Marginal Cost: MC=2Q For this monopolist, the profit-maximizing price is and the profit-maximizing quantity is 90, 30 30, 90 40, 80 None of these answers O O Oarrow_forwardIf a monopolist faces an inverse demand curve, p(y) = 100-2y and has constant marginal costs of $32 and zero fixed costs and if this monopolist is able to practice perfect price discrimination, its total profits will be O a. $1,156. O b. $17. O c. $578. O d. $1,734. O e. $289.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education