ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

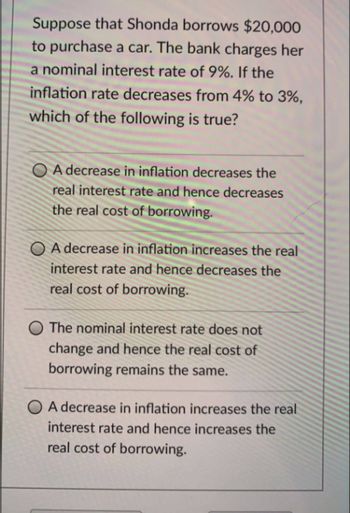

Transcribed Image Text:Suppose that Shonda borrows $20,000

to purchase a car. The bank charges her

a nominal interest rate of 9%. If the

inflation rate decreases from 4% to 3%,

which of the following is true?

OA decrease in inflation decreases the

real interest rate and hence decreases

the real cost of borrowing.

OA decrease in inflation increases the real

interest rate and hence decreases the

real cost of borrowing.

O The nominal interest rate does not

change and hence the real cost of

borrowing remains the same.

O A decrease in inflation increases the real

interest rate and hence increases the

real cost of borrowing.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Darshan needs to borrow money to become a nurse practitioner. Suppose that compensation of nurse practitioners is expected to increase. Assuming nothing else changes, this means that if Darshan borrows now, his cost of borrowing money is expected to due to the following factor: O Decreasing preferences for future consumption. O Rising benefits of becoming a nurse practitioner. Rising compensation of nurse practitioners provokes inflation. Which of the following events could decrease the cost of money? Check all that apply. The Federal Reserve purchases Treasury securities held by banks Inflation increases The federal deficit decreases The Federal Reserve sells Treasury securities to banks decrease increasearrow_forward1arrow_forwardSuppose you start saving for retirement when you are 31 years old. You invest $5,200 the first year and increase this amount by 4% each year to match inflation for a total of 25 years. The interest rate is 9% per year. 1. How much will you have in account immediately after making the last deposit at age 55 OA. $1,174,047 OB. $71,848 OC. $578,420 O D. $619,553 www 2. How much will you have, if the interest rate was only 4% per year (instead of 9%)? OA. $125,000 B. $303,117 OC. $333,230 OD. $346,559arrow_forward

- Question 2 The GDP deflator in year 4 is 120 and the GDP deflator in year 5 is 130. The rate of inflation between years 4 and 5 is O -10%. O 7.7%. O 8.33%. O 10%.arrow_forwardPlease confirm my answer and justify!arrow_forward12. Inflation-induced tax distortions Loc receives a portion of his income from his holdings of interest-bearing U.S. government bonds. The bonds offer a real interest rate of 4.5% per year. The nominal interest rate on the bonds adjusts automatically to account for the inflation rate. The government taxes nominal interest income at a rate of 10%. The following table shows two scenarios: a low-inflation scenario and a high- inflation scenario. Given the real interest rate of 4.5% per year, find the nominal interest rate on Loc's bonds, the after-tax nominal interest rate, and the after-tax real interest rate under each inflation scenario. Inflation Rate Real Interest Rate Nominal Interest Rate After-Tax Nominal Interest Rate After-Tax Real Interest Rate (Percent) (Percent) (Percent) (Percent) (Percent) 3.5 4.5 8.5 4.5 Compared with lower inflation rates, a higher inflation rate will nominal interest income. This tends to the economy's long-run growth rate. saving, thereby the after-tax…arrow_forward

- QUESTION 20 Table: The table below is for an imaginary economy of Orangeland where a typical consumer basket consists of 2 blankets and 10 coffees. Price of a Price of a Year Blanket Coffee 2017 $40 $3 2018 $45 $4 2019 $50 $5 Refer to Table. If the base year is 2018, then the economy's inflation rate in 2019 was O a. 15.38 percent. O b. 13.98 percent. Oc. 25.00 percent. O d. 20.00 percent.arrow_forwardSuppose a basket of goods and services has been selected to calculate the CPI and 2012 has been selected as the base year. In 2012, the basket's cost was S77: in 2013. the basket's cost was $82; and in 2014, the basket's cost was $90. The value of the CPI in 2014 was O a. 109.8 and the inflation rate was 9.8%. O b. 109.8 and the inflation rate was 16.9%. O c. 116.9 and the inflation rate was 9.8. O d. 116.9 and the inflation rate was 16.9%.arrow_forwardQuantity of Nominal interest rate money demanded Quantity of money supplied (percent per year) (trillions of dollars) (trillions of doll ars) 2.9 2.5 2.8 2.5 2.7 2.5 8 2.6 2.5 9. 2.5 2.5 10 2.4 2.5 The above table has the demand and supply for money. What is the equilibrium nominal interest rate? O a. 7 percent O b. 6 percent O c. 9 percent O d. 5 percent O e. 8 percentarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education