ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

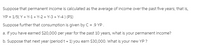

Transcribed Image Text:Suppose that permanent income is calculated as the average of income over the past five years; that is,

YP = 1/5( Y + Y-1 + Y-2 + Y-3 + Y-4 ) (P1)

Suppose further that consumption is given by C = .9 YP.

a. If you have earned $20,000 per year for the past 10 years, what is your permanent income?

b. Suppose that next year (period t + 1) you earn $30,000. What is your new YP ?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- U(C1, C2) = c₁0.8 20.4 where c₁ is the quantity of current consumption goods and c₂ is the quantity of future consumption goods. Consider a consumer whose income is y₁ = 100 in the current period and y₂ = 140 in the future period. The consumer pays lump-sum taxes t₁ and t₂ == = 20 in the current period 10 in the future period. The real interest rate is r = 0.1, or 10%, per period. (a) Write down the consumer's budget constraint for each period and derive the consumer's lifetime budget constraint. What is the value of the consumer's lifetime wealth? [Note: Lifetime wealth is the present value of the consumer's lifetime disposable income] (b) Draw the lifetime budget line on the (C1, C2) plane with c₁ on the horizontal axis and C₂ on the vertical axis. Include the values of the intercepts and the endowment point in your graph. What is the slope of the budget line? (c) What are the two conditions that the consumer's optimal choice of (C1, C2) must satisfy? Find the consumer's optimal…arrow_forwardWhat is the formula for calculating Net Present Value (NPV)? a) NPV = Total Revenue - Total Costs b) NPV = Total Costs - Total Benefits c) NPV = Initial Investment - Total Revenue d) NPV = Total Benefits - Initial Investmentarrow_forwardRefer to the below figure: the saving function can be given as: Aggregate consumption (C) 270 200 130 60 450 100 S = -60 -0.3Y O S = -60+ 0.3Y O S = 60+ 0.7Y O S = -60 -0.7Y O S = -60 +0.7Y 200 300 Aggregate income (Y)arrow_forward

- Mary has income of $2000 today and $1000 tomorrow. She can lend and borrow at an interest rate of 20%. There is 10% inflation. Her preferences for intertemporal consumption are represented by the following utility function u(c, c) = min{c1, 2c2} (a) What is her optimal consumption bundle?arrow_forwardAssume that the production function for a country is given by Y=√K and annual investment is given by the function I=γ×YI where γ=0.280, and that the yearly depreciation rate is 4.67%. Suppose that this year, the output in the country is 1, and a neighbor country's output is 50% higher. Calculate the time it would take for the country's output to catch up with its neighbor's output. Assume the neighbor country's economy is neither growing nor shrinking.arrow_forwardIf C = 32 + 0.90Y, how much would an individual save when income is 953? Select one: O a. 63.30 О Б.-825.7О О с. 889.70 O d. 825.70arrow_forward

- Suppose that there are T periods to maximize over. Show that the intertemporal budget constraint is Ct+2 Yt+2 Yt+1 (1+r) (1+r)² (1 + r)² Ct + Ct+1 (1 + r) + 2+...+ Ct+T+1 (1+r)² \ T = Yt + + +...+ Yt+T+1 (1+r)arrow_forwardOn December 31, 2021, Annie bought a fitness center with exercise equipment and a building worth $400,000. During 2022, she bought some new equipment for $200,000. At the end of 2022, her equipment and building were valued at $590,000. What was Annie's gross investment during 2022? Thanks! !@$arrow_forwardAssume that Andrew Marcus is 25 years old and expects to live until the age of 75. (a) If he wins €20 million in cash (after taxes) in the lottery and retires, how much will he consume each year if he wants to have constant consumption and use up all his wealth by the time he dies? Assume the real interest rate is zero. (75 words max) (b) If his total income in the year he wins the lottery is his lottery winnings, what will his average propensity to consume be for that year? (75 words max) (c) If he has no other earnings in later years but continues his constant consumption, what will his average propensity to consume be for those later years? (75 words max) (d) What is Andrew's "permanent income" in the year he wins the lottery? What is his "transitory income"? (75 words max)arrow_forward

- Consider an economy where individuals live for two periods only. Their utility function over consumption in periods 1 and 2 is given by U = 2 log(C1) + 2 log(C2), where C1 and C2 are period 1 and period 2 consumption levels respectively. They have labor income of $100 in period 1 and labor income of $50 in period 2. They can save as much of their income in period 1 as they like in bank accounts, earning interest rate of 5 percent per period. They have no bequest motive, so they spend all their income before the end of period 2. a. What is each individual’s lifetime budget constraint? If they choose consumption in each period so as to maximize their lifetime utility subject to their lifetime budget constraint, what is the optimal consumption in each period? How much do the consumers save in the first period? b. Suppose that the government introduces a social security system that will take $10 from each individual in period 1, put it in a bank account, and transfer it back to…arrow_forwarddo fast.arrow_forwardPatience has a utility function 1/2 1/2 U(cl, c2) = c? + 0.80c/? where c is her consumption in period 1 and c is her consumption in period 2. Her income in period 1 is 3 times as large as her income in period 2. At what interest rate will she choose to consume the same amount in period 1 as in period 2? a. 2 b. 0.13 c. 0.25 d. 0 е. О.38 20% 13% 25% 0%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education