ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

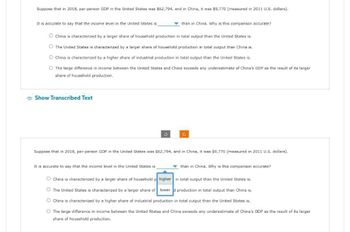

Transcribed Image Text:Suppose that in 2018, per-person GDP in the United States was $62,794, and in China, it was $9,770 (measured in 2011 U.S. dollars).

It is accurate to say that the income level in the United States is

China is characterized by a larger share of household production in total output than the United States is.

O The United States is characterized by a larger share of household production in total output than China is.

O China is characterized by a higher share of industrial production in total output than the United States is.

O The large difference in income between the United States and China exceeds any underestimate of China's GDP as the result of its larger

share of household production.

Show Transcribed Text

than in China. Why is this comparison accurate?

Suppose that in 2018, per-person GDP in the United States was $62,794, and in China, it was $9,770 (measured in 2011 U.S. dollars).

It is accurate to say that the income level in the United States is

O China is characterized by a larger share of household p

than in China. Why is this comparison accurate?

higher in total output than the United States is.

The United States is characterized by a larger share of lower d production in total output than China is.

O China is characterized by a higher share of industrial production in total output than the United States is.

O The large difference in income between the United States and China exceeds any underestimate of China's GDP as the result of its larger

share of household production.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The following table shows macroeconomic data for a hypothetical country. All figures are in billions of dollars. Billions of Dollars Gross private domestic investment 120 Depreciation 35 Exports 60 Imports 55 Government spending 130 Personal consumption expenditures 325 Indirect business taxes (net of subsidies) 20 Personal taxes 90 Employee compensation 380 Corporate profits and FICA contributions 80 Rental income 25 Net interest 35 Proprietors' income 5 Transfer payments and other income 65 Using the expenditure or income approach, GDP for this country was $ billion. Complete the following table by calculating national income, personal income, and disposable personal income for this country. (Note: Be sure to enter your figures in billions of dollars.) Billions of Dollars National Income Personal Income Disposable Personal Incomearrow_forwardQ1. An economy has the following sectors: private households, government, flour producers and bread producers. The government levies a value added tax (VAT) on both flour and bread of 10%. In 2010 flour producers pay their workers $200 and sell 300 kilos of flour to the bread makers and 240 kilos of flour to final consumers. The net price for one kilo of flour is $0.5. The bread producers pay their workers $220 and sell 175 kilo bread to domestic consumers. Moreover, 75 kilos of bread are exported (the VAT levied by the government also applies to exported goods). The net price for one kilo of bread is $2. (a) Describe briefly the three possibilities to calculate GDP. (b) What is the GDP of this economy using the three possibilities? Are your answers the same for the three possibilities? If Yes, Explain. (c) Calculate the shares of GDP attributable to labor income, capital income and indirect taxes.arrow_forwardRefer to Table below. Suppose that a simple economy produces only four goods and services: sweatshirts, dental examinations, coffee drinks, and coffee beans. Assume all of the coffee beans are used in the production of the coffee drinks. Using the information in the above table, nominal GDP for this simple economy equals: Product Quantity Price Sweatshirts 50 $35.00 Dental examinations 40 75.00 Coffee drinks 1,000 4.00 Coffee beans 2,000 0.50 a. $9,750 b. $8,750 c. 3,090 units d. $7,250arrow_forward

- Assume an economy in which only apple and orange are produced. In year 1, 200 million killograms of apple are produced and consumed and its price is $0.6 per kilogram, while 150 million killograms of orange are produced and consumed and its price is $0.7 per killogram. In year 2, 250 million kilograms of apple are produced and consumed and its price is $0.7 per kilogram, while 300 million kilograms of orange are prduced and its price is $0.8 per kilogram. (Show the results upto 1 decimal point when required) (a) If the base year is year 1 then the GDP price deflator in year 2 is (b) If the base year is year 2 then the GDP price deflator in year 1 is (c) If the base year is year 1 then the inflation rate between years 1 and 2 is (d) If the base year is year 2 then the inflation rate between years 1 and 2 is (e) The chain weighted inflation rate between year 1 and year 2 is % (f) If the base year is year 1 then CPI inflation rate is % % %arrow_forwardA typical U.S. worker today works fewer than 40 hours per week, while in 1890, he or she worked 60 hours per week. Does this difference in the length of work weeks matter in comparing the economic well-being of U.S. workers today with that of 1890? Or can we use the difference between real GDP per capita today and in 1890 to measure differ- ences in economic well-being while ignoring differences in the number of hours worked per week? Briefly explain.arrow_forwardFOOD Q ويه PP Que CLOTH 5. The above figure shows two isovalue lines V, and Va at the same relative price Po/Py. A and B are two production patterns. The quantities of cloth and food produced in each case are indicated by Qua: Qes and Qra: Qn respectively. Based on the above, which of the following is correct? A) When relative price - Po/Pr, GDP produced at A (VA) equals GDP produced at B (Vs) became they both lie on the same PPF. B) When relative price Po/P, GDP produced at A (VA) is greater than GDP produced at B (V). 1 C) If the nation produces at A when relative price PP, it is maximizing its GDP D) GDP is maximized at A if the relative price PPy decreases.arrow_forward

- a. Using the following table to calculate GDP price deflator in 2021 and 2022, and the change in overall price level from 2021 to 2022 nominal GDP in 2021 was $104,000 in 2022 was $112,000 real GDP in 2021 was $84,000 and in 2022, $88,000 b. Consider an economy, only producing two good Apple and orange in both year one need to Ken the real GDP of this economy, increase between one and two, while the nominal GDP decreases or remain the same explain your answer with a numerical example Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardConsider an economy that produces wood, boats, and has a marketing agency.This year domestic wood production generates revenues of $80. Of this $80 worth of wood, $40were purchased by the boat producer and $40 were sold abroad to a foreign company. The woodproducer paid $40 worth of wages and $10 worth of taxes.The boat producer combines the services of the marketing agency, the wood it purchased from thewood producer, and $20 worth of labor (wages) to produce $120 worth of boats. Its revenues,which include a boat produced in the previous year and that was carried as inventory, are $130.Domestic families buy all these boats. This company pays $10 worth of taxes.The marketing agency, whose sole client is the boat company, generates a revenue of $40 whichis enough to cover its labor costs of $40. This company pays no taxes.The government in this economy uses the $20 worth of taxes and builds a port. The cost of theport is $40 that are paid to workers. This port is partially financed by…arrow_forwardIn 2012, nominal GDP per capita in the US was $49.922. In Colombia, nominal GDP per capita was $7,855 the same year. Calculate the PPP-adjusted GDP for Colombia if the purchasing power of a given amount of dollars was 41% lower in the U.S. PPP-adjusted GDP Colombia $ (Round off to two decimal places)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education