ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Suppose that for every increase in the interest rate of one percentage point, the level of investment spending declines by $0.5 billion. Based on the

changes made to the money market in the previous scenario, the new interest rate causes the level of investment spending to by

Taking the multiplier effect into account, the change in investment spending will cause the quantity of output demanded to

known as the

by

at every price level. The impact of an increase in government purchases on the interest rate and the level of investment spending is

effect.

Use the purple line (diamond symbol) on the graph at the beginning of this problem to show the aggregate demand curve (AD) after accounting for

the impact of the increase in government purchases on the interest rate and the level of investment spending.

Hint: Be sure your final aggregate demand curve (ADS) is parallel to AD, and AD. You can see the slopes of AD, and AD; by selecting them on the

graph

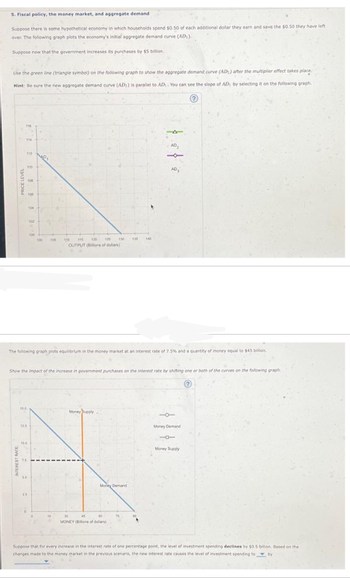

Transcribed Image Text:5. Fiscal policy, the money market, and aggregate demand

Suppose there is some hypothetical economy in which households spend $0.50 of each additional dollar they earn and save the $0.50 they have left

over. The following graph plots the economy's initial aggregate demand curve (AD).

Suppose now that the government increases its purchases by $5 billion.

Use the green line (triangle symbol) on the following graph to show the aggregate demand curve (AD) after the multiplier effect takes place

Hint: Be sure the new aggregate demand curve (AD) is parallel to AD, You can see the slope of AD, by selecting it on the following graph.

?

114

112

15.0

110

104

12.5

75

10.0

102

100

2.5

100 105

The following graph plots equilibrium in the money market at an interest rate of 7.5% and a quantity of money equal to $45 billion.

115

110

120 125 130 135

OUTPUT (lions of dollars)

Show the impact of the increase in government purchases on the interest rate by shifting one or both of the curves on the following graph

Ⓒ

Money Supply

Morey Demand

30

45

60

MONEY (Bilions of dollars)

140

76

AD₂

A

AD₂

0-

Money Demand

Money Supply

Suppose that for every increase in the interest rate of one percentage point, the level of investment spending declines by $0.5 billion. Based on the

changes made to the money market in the previous scenario, the new interest rate causes the level of investment spending to by

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Consider a hypothetical economy where there are no taxes and no foreign trade, and households spend $0.90 of each additional dollar they earn and ; the marginal propensity to save (MPS) for this save the remaining $0.10. The marginal propensity to consume (MPC) for this economy is economy is ; and the multiplier for this economy is Suppose investment spending in this economy decreases by $150 billion. The decrease in investment will lead to a decrease in income, generating a decrease in consumption that decreases income yet again, and so on. Fill in the following table to show the impact of the change in investment spending on the first two rounds of consumption spending and, eventually, on total output and income. Hint: Be sure to enter a negative sign in front of the number if there is a decrease in consumption. Change in Investment Spending = -$150 billion First Change in Consumption = $ Second Change in Consumption $ Total Change in Output = $ billion billion billion In reality,…arrow_forward5. Graphing the saving and consumption functions from MPC Consider a hypothetical economy in which the marginal propensity to consume (MPC) is 0.5. That is, if disposable income increases by $1, consumption increases by 50¢. Suppose further that last year, disposable income in the economy was $300 billion and consumption was $250 billion. Based on these data, use the blue line (circle symbols) to plot this economy's consumption function on the following graph. REAL CONSUMER SPENDING (Billions of dollars) 700 600 500 400 300 200 100 0 Aa Aa -100 Consumption Fn. O O 0 100 200 300 400 500 600 700 800 REAL DISPOSABLE INCOME (Billions of dollars) Help Clear All Suppose that this year, disposable income is projected to be $340 billion. Based on your analysis, you would expect consumption to be and saving to bearrow_forwardThe levels of real disposable income and aggregate expenditures for an economy are given in the following table. -- Use the blue points (circle symbol) to plot the expenditures line for this economy on the following graph. Line segments will automatically connect the points. The black line represents the 45-degree line, where aggregate expenditures equal real GDP. Use the black point (plus symbol) to indicate equilibrium real GDP. - - In the previous graph, if the economy produces at an output level that is higher than equilibrium GDP, then the economy is in because aggregate expenditures are real GDP, and unplanned inventory investment is Read GDP (Y) Aggregate Expenditures (AE) (Trillions of dollars per year) (Trillions of dollars per year) 0 1 1 1.75 2 2.5 3 3.25 4 4 5 4.75 6 5.5 7 6.25 8 7 Use the blue points (circle symbol) to plot the expenditures line for this economy on the following graph. Line segments will automatically connect the points. The black line represents the…arrow_forward

- Suppose there is some hypothetical economy in which households spend $0.50 of each additional dollar they earn and save the $0.50 they have left over. The following graph plots the economy's initial aggregate demand curve (AD₁). Suppose now that the government increases its purchases by $3.5 billion. Use the green line (triangle symbol) on the following graph to show the aggregate demand curve (AD2) after the multiplier effect takes place. Hint: Be sure the new aggregate demand curve (AD2) is parallel to AD₁. You can see the slope of AD₁ by selecting it on the following graph. PRICE LEVEL 116 114 112 110 108 106 104 102 100 100 AD1 102 106 108 110 OUTPUT (Billions of dollars) 104 112 114 1 116 AD2 AD 3 ?arrow_forward5:06 A & & & P M Page 4 of 5 QUESTION 4 The figure below shows the planned Aggregate Expenditure function for a hypothetical economy (AEp = 1,000 + 0.5 * Y). In this economy, taxes and transfers are equal to zero, so YD =Y. What is the value of unplanned investment expenditure (Iµ) when GDP = 3,000? Suppose that, next period, autonomous consumption increased by 100 and every thing else remained the same. Under these new circumstances, what would the value of unplanned investment be when GDP = 3,000? 5,000 4, 500 4, 000 3, 500 3,000 AEp = 1,000 + 0.5*Y 2, 500 2000 1, 500 1,a00 500 500 1,000 1, 500 2,000 2 500 3,000 3,500 4,000 4,500 5,000 REAL GDP Page 5 of 5 QUESTION A5 a. Suppose that some kind of significant economic event has occurred, and you learn that the event will de finitely cause the aggregate price level to decrease, but that its effect on short-run equilibrium real GDP cannot be determined without knowing the exact PLANNED AGGREGATE EXPENDITUREarrow_forwardThe following table provides data for output (real GDP) and saving. a. Fill in the missing numbers (gray-shaded cells) in the table. Instructions: In the table, enter your answers for consumption as a whole number. Round your answers for APC and APS to 3 decimal places. Round your answers for MPC and MPS to 1 decimal place. If you are entering any negative numbers be sure to include a negative sign (-) in front of those numbers. Level of Output and Income (GDP = DI) Consumption Saving АРС APS MPC MPS 496 -0.033 -0.015 $480 $-16 1.033 520 528 -8 1.015 560 560 1.000 0.000 592 624 600 0.987 0.013 640 16 0.975 0.025 680 656 24 0.965 0.035 720 688 32 0.956 0.044 760 720 40 0.947 0.053 800 752 48 0.940 0.060arrow_forward

- #1 Consider an economy defined by the following (in $billions and price level is fixed): C = 25+ 0.6YD T = 10+ 0.15Y 1 = 30 G = 40 X = 15 M = 0.01Y a) What is the marginal propensity to spend and what is the aggregate expenditure multiplier?arrow_forwardDiscuss the multiplier effect including a description of what it describes in macroeconomic terms, how it is determined and an illustration of how it is defined.arrow_forwardEconomics 1. Graphing the consumption function from the MPC Consider a hypothetical economy in which the marginal propensity to consume (MPC) is 0.75. That is, if disposable income increases by $1, consumption increases by 75c. Suppose further that last year disposable income in the economy was $500 billion and consumption was $400 billion. On the following graph, use the blue line (aircle symbol) to plot this economy's consumption function based on these data. (?) 700 600 300 -100 400 500 600 700 100 200 300 DISPOSABLE INCOME (Blions of dotans) From the preceding data, you know that the level of savings in the economy last vear was s billion and the marginal propensity to save in this economy is Suppose that this year, disposable income is projected to be $700 billion. Based on your analysis, you would expect consumption to be S billion and savings to be S billion, CONSUMPTION (Bilions of dolars)arrow_forward

- Illustrate how changes in investment (or other components of total spending) can increase or decrease real GDP by the multiplier effect.arrow_forwardIs this example also an example of economically rational decision making? “In 2019, I started my small business by selling prints of my photographs. Now it’s temporarily closed. During this time I had the option of shipping my prints through USPS or UPS. I decided to ship my prints through USPS instead of UPS since it was a bit expensive at the time. My prints that were shipped out from USPS arrived in time and came in good condition. The opportunity cost is the cost of UPS shipping.”arrow_forwardComplete the statements and then calculate the change in consumption. The consumption function shows the relationship between consumption spending and The slope of the consumption function is the Changes in consumption can be predicted by multiplying the change in by the If the MPC = 0.80 and disposable income increases by $1000, then consumption will increase by what amount? Assume that there is no multiplier effect.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education