Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

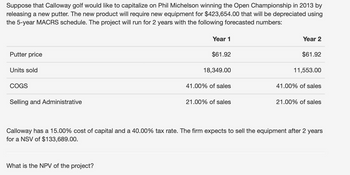

Transcribed Image Text:Suppose that Calloway golf would like to capitalize on Phil Michelson winning the Open Championship in 2013 by

releasing a new putter. The new product will require new equipment for $423,654.00 that will be depreciated using

the 5-year MACRS schedule. The project will run for 2 years with the following forecasted numbers:

Putter price

Units sold

COGS

Selling and Administrative

Year 1

What is the NPV of the project?

$61.92

18,349.00

41.00% of sales

21.00% of sales

Year 2

$61.92

11,553.00

41.00% of sales

21.00% of sales

Calloway has a 15.00% cost of capital and a 40.00% tax rate. The firm expects to sell the equipment after 2 years

for a NSV of $133,689.00.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Suppose that Calloway golf would like to capitalize on Phil Michelson winning the Open Championship in 2013 by releasing a new putter. The new product will require new equipment for $403,915.00 that will be depreciated using the 5-year MACRS schedule. The project will run for 2 years with the following forecasted numbers: Putter price Units sold COGS Selling and Administrative Year 1 What is the NPV of the project? $64.95 18,393.00 39.00% of sales 21.00% of sales Year 2 $64.95 10,084.00 39.00% of sales 21.00% of sales Calloway has a 13.00% cost of capital and a 39.00% tax rate. The firm expects to sell the equipment after 2 years for a NSV of $136,159.00.arrow_forwardPlease solve by hand or using formulasarrow_forwardConsider equipment for the expansion of a production line that will cost $600,000 up front (i.e., today, t = 0). The production line will be depreciated using a 3-year straight-line schedule. At the end of Year 3, the used equipment will have no value. The new line will generate earnings according to the schedule below. What is the Average Accounting Return (AAR) of the new production facility? Answer with a number rounded to three decimal places, e.g., 4.0877% should be entered as 4.088. Year 01 Earnings = $24,500 Year 02 Earnings = $26,000 Year 03 Earnings = $27,250arrow_forward

- A three-year-old small crane is being considered for early replacement. Its current market value is $17,500. Estimated future market values and annual operating costs for the next five years are given in the table below. What is the economic life for this crane if the interest rate is 5.1% per year? Year 0 Market Value Annual Operating Cost $17,500 1 $15,110 $4,700 2 $12,930 $4,809 3 $10,110 $4,883 4 $7,400 $4,997 5 $- $5,095arrow_forwardNPV. Grady Precision Measurement Tools has forecasted the following sales and costs for a new GPS system: annual sales of 45,000 units at $16 a unit, production costs at 37% of sales price, annual fixed costs for production at $200,000. The company tax rate is 38%. What is the annual operating cash flow of the new GPS system? Should Grady Precision Measurement Tools add the GPS system to its set of products? The initial investment is $1,320,000 for manufacturing equipment, which will be depreciated over six years (straight line) and will be sold at the end of five years for $380,000. The cost of capital is 12%. What is the annual operating cash flow of the new GPS system? $ (Round to the nearest dollar.)arrow_forwardMidwest Airlines (MWA) is planning to expand its fleet of jets to replace some old planes and to expand its routes. It has received a proposal to purchase 112 small jets over the next 4 years. What annual net revenue must each jet produce to break even on its operating cost? The analysis should be done by finding the EUAC for the 10-year planned ownership period. MWA has a MARR of 12%, purchases the jet for $22 million, has operating and maintenance costs of $3.2 million the first year, increasing 8% per year, and performs a major maintenance upgrade costing $4.5M at end of Year 5. Assume the plane has a salvage value at end of Year 10 of $13 million.arrow_forward

- Fabco, Inc., is considering purchasing flow valves that will reduce annual operating costs by $10,000 per year for the next 12 years. Fabco’s MARR is 7%/year. Using an internal rate of return approach, determine the maximum amount Fabco should be willing to pay for the valves. $arrow_forwardAylmer-in-You (AIY) Inc. projects unit sales for a new opera tenor emulation implant as follows: Year Unit Sales 1 101,000 2 115,000 3 125,000 4 145,000 5 90,000 Production of the implants will require $753,000 in net working capital to start and additional net working capital investments each year equal to 15% of the projected sales increase for the following year. (Because sales are expected to fall in Year 5, there is no NWC cash flow occurring for Year 4.) Total fixed costs are $177,000 per year, variable production costs are $309 per unit, and the units are priced at $360 each. The equipment needed to begin production has an installed cost of $10.0 million. Because the implants are intended for professional singers, this equipment is considered industrial machinery and thus falls into Class 8 for tax purposes (20%). In five years, this equipment can be sold for about 20% of its acquisition cost. AIY is in the 40% marginal tax bracket and has a required…arrow_forwardRocky Pines golf course is planning for the coming season. Investors would like to earn a 12% return on the company's $47,000,000 of assets. The company primarily incurs fixed costs to groom the greens and fairways Fixed costs are projected to be $20,000,000 for the golfing season About 450,000 golfers are expected each year. Variable costs are about $20 per golfer Rocky Pines golf course has a favorable reputation in the area and therefore, has some control over the price of a round of golf. Using a cost-plus approach, what price should the course charge for a round of golf? (Round the final answer to the nearest cent) OA $110.00 OB$76.98 OC $20.00 OD 564 44arrow_forward

- Management of Daniel Jackson, a confectioner, is considering purchasing a new jelly bean-making machine at a cost of $256,144. They project that the cash flows from this investment will be $102,150 for the next seven years. If the appropriate discount rate is 14 percent, what is the IRR that Daniel Jackson management can expect on this project? (Do not round discount factors. Round other intermediate calculations to 0 decimal places e.g. 15 and final answer to 2 decimal places, e.g. 5.25%.)arrow_forwardA manufacturer of automated optical inspection devices is deciding on a project to increase the productivity of the manufacturing processes. The estimated costs for the two feasible alternatives being compared are shown below. Use the internal rate of return (IRR) method to determine which alternative should be selected if the analysis period is 8 years and the company's MARR is 4% per year. Alternative M N Initial costs $30,000 $45,000 Net annual cash flow $4,500 $7,000 Life in years 8 8 (a) IRR of base alternative = (b) IRR of incremental cash flow = (c) Choose Alternativearrow_forwardUse an excel spreedsheet to answer this question: The National Potato Cooperative purchased a deskinning machine last year for $150,000. Revenue for the first year was $ 50,000. Over the total estimated life of 8 years, use a spreadsheet to estimate the remaining equivalent annual revenues (years 2 through 8) to ensure breakeven by recovering the investment and a return of 10% per year. Costs are expected to be constant at $42,000 per year and a salvage value of $10,000 is anticipated.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education