ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

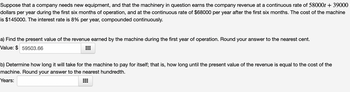

Transcribed Image Text:Suppose that a company needs new equipment, and that the machinery in question earns the company revenue at a continuous rate of 58000t + 39000

dollars per year during the first six months of operation, and at the continuous rate of $68000 per year after the first six months. The cost of the machine

is $145000. The interest rate is 8% per year, compounded continuously.

a) Find the present value of the revenue earned by the machine during the first year of operation. Round your answer to the nearest cent.

Value: $ 59503.66

b) Determine how long it will take for the machine to pay for itself; that is, how long until the present value of the revenue is equal to the cost of the

machine. Round your answer to the nearest hundredth.

Years:

⠀

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Q.4. Subject :- Economicarrow_forwardI borrowed $25,000 with an add-on rate, 4% for two years and I have to make weekly payments. Using this information, determine the amount of weekly instalment I will be making. a) Between $234 and $245 b) None of the answers is correct c) Between $254 and $265 d) Between $334 and $345 e) Between $354 and $365arrow_forwardBefore last year, Ellie (Luke's wife) taught music and earned $30,400. She also earned $9,600 by renting out their basement as a studio apartment. Ellie saves every month. At the end of a typical year she would have saved a total of 10% from her wages and the income earned from the basement for the entire year, and earned a total of 0.5% in interest (for the entire year). At the beginning of last year, Ellie stopped teaching music. She also stopped renting out their basement, and began to use it as the office for her new web design business. The balance on her savings account was $150,000, and she took $5,000 from this account to buy a new laptop computer and a new printer (which also functions as a scanner and a facsimile). She also borrowed $12,000 from the local bank to purchase additional machinery and equipment (a graphics tablet, desktop computer, studio camera and an external hard drive). Her loan payment is $250 per month. During last year, she paid $3,000 for the lease of a…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education