ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Given the solution for a to c. Show clear working for questions d to f

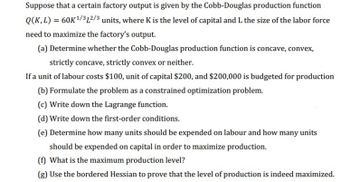

Transcribed Image Text:Suppose that a certain factory output is given by the Cobb-Douglas production function

Q(K,L) = 60K¹/312/3 units, where K is the level of capital and L the size of the labor force

need to maximize the factory's output.

(a) Determine whether the Cobb-Douglas production function is concave, convex,

strictly concave, strictly convex or neither.

If a unit of labour costs $100, unit of capital $200, and $200,000 is budgeted for production

(b) Formulate the problem as a constrained optimization problem.

(c) Write down the Lagrange function.

(d) Write down the first-order conditions.

(e) Determine how many units should be expended on labour and how many units

should be expended on capital in order to maximize production.

(f) What is the maximum production level?

(g) Use the bordered Hessian to prove that the level of production is indeed maximized.

Transcribed Image Text:4:08 AO

Expert Solution

bartleby.com/questions-and-

• Q is the output level

• K is the level of capital input

• L is the level of labor input

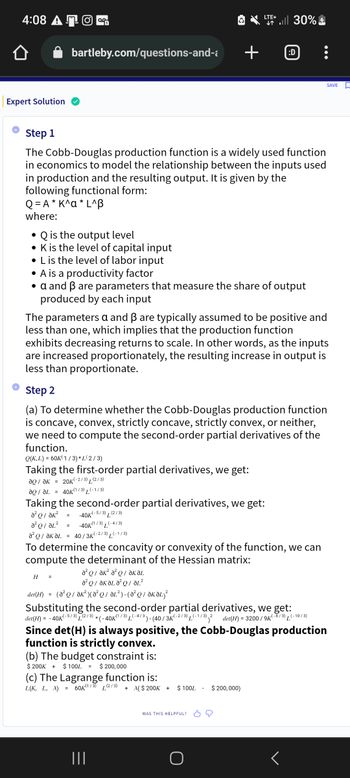

Step 1

The Cobb-Douglas production function is a widely used function

in economics to model the relationship between the inputs used

in production and the resulting output. It is given by the

following functional form:

Q=A* K^a* L^B

where:

• A is a productivity factor

• a and ẞ are parameters that measure the share of output

produced by each input

²01²

-40K(1/3) L(-4/3)

Ə²Q/ƏKƏL = 40 / 3k K(-2/3) L(-1/3)

=

The parameters a and ß are typically assumed to be positive and

less than one, which implies that the production function

H =

exhibits decreasing returns to scale. In other words, as the inputs

are increased proportionately, the resulting increase in output is

less than proportionate.

Step 2

(a) To determine whether the Cobb-Douglas production function

is concave, convex, strictly concave, strictly convex, or neither,

we need to compute the second-order partial derivatives of the

function.

Q(K,L) = 60K(1/3)* L(2/3)

Taking the first-order partial derivatives, we get:

?Q / ?к = 20K(-2/3)(2/3)

aQ/L = 40K(1/3) (-1/3)

Taking the second-order partial derivatives, we get:

a²Q/ Ək²

= -40K K(-5/3) (2/3)

a²Q/ ak² a² QƏKƏL

²/ KA²²

det(H) = (a²Q/ƏK²) (A²Q/ ƏL²)-(0²Q / ƏKƏL)²

ŵ

LTE+

↓↑

To determine the concavity or convexity of the function, we can

compute the determinant of the Hessian matrix:

(b) The budget constraint is:

$ 200K + $ 100L = $ 200,000

all 30%

(c) The Lagrange function is:

L(K, L, X) = 60K(1/3) (2/3)

+ >($ 200K +

+ :D

|||

det(H) = -40K

(-5/3) T

(2/3),

Substituting the second-order partial derivatives, we get:

*(-40K(¹/3) L(-4/3) - (40/3K-2/3) L(-1/3) 2 det(H) = 3200/9K(-8/3) (-10/3)

Since det(H) is always positive, the Cobb-Douglas production

function is strictly convex.

$ 100L

WAS THIS HELPFUL?

$ 200,000)

SAVE

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Most manufacturing companies divide manufacturing costs into which three broad categories?arrow_forwardCEO of Ganymede company produces goods with 500 customers where the number of customers is equal to Q produced, with the cost function TC = 2Q2 + 400Q + 1,300,000. Questions a. Determine fixed costs, variable costs and average costs that the customer musr pay. Describe the calculations! b.If the item sells for 5,000 and 7,000, determine the position of the company and can the company grow?arrow_forward

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education