ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

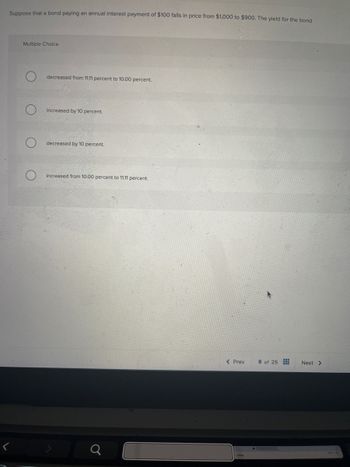

Transcribed Image Text:Suppose that a bond paying an annual interest payment of $100 falls in price from $1,000 to $900. The yield for the bond

Multiple Choice

decreased from 11.11 percent to 10.00 percent.

O

increased by 10 percent.

decreased by 10 percent.

increased from 10.00 percent to 11.11 percent.

<

Q

< Prev

8 of 25

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 2. Pretend that today is your birthday and you decide to start saving for your retirement. You will retire on your 65th birthday and need $4,000 per month for the next 20 years, increasing $100 per month after the first month. You will make your first withdrawal on your 65th birthday, the day you retire. You will make the first deposit today in an account paying 7% interest compounded daily, and continue to make the same $123.07 equal weekly deposits up to your 60th birthday, then you stop making deposits. What birthday are you celebrating today? Create a cash flow diagram.arrow_forward48. An annual interest payment divided by current price of bond is considered as. i am not satisfy give downvote A. current yield B. maturity yield C. return yield D. earning yieldarrow_forwarddo fastarrow_forward

- Please see attachment and type out the correct step by step answer with proper explanation of the each option given within 40 50 minutes . Will give upvote only for the correct answer.thank you .arrow_forwardThe price of a bond with no expiration date is originally $1,000 and has a fixed annual interest payment of $150. If the price of the bond then falls by $100, what will be the interest rate yield to a new buyer of the bond? Multiple Choice 16.7 percent 8.4 percent 15 percent 13.6 percent 10 percentarrow_forwardA bond that is currently selling at $1,000 offers to pay $50 annually. What is the percentage rate of return on the bond? Multiple Choice 5 percent 10 percent 20 percent 50 percentarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education