Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

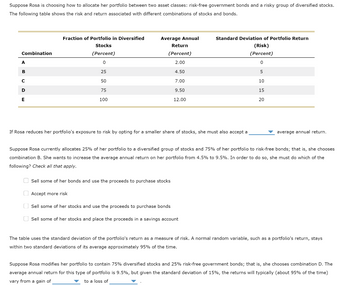

Transcribed Image Text:Suppose Rosa is choosing how to allocate her portfolio between two asset classes: risk-free government bonds and a risky group of diversified stocks.

The following table shows the risk and return associated with different combinations of stocks and bonds.

Combination

A

B

C

D

E

Fraction of Portfolio in Diversified

Stocks

(Percent)

0

25

50

75

100

Average Annual

Return

(Percent)

2.00

4.50

7.00

9.50

12.00

If Rosa reduces her portfolio's exposure to risk by opting for a smaller share of stocks, she must also accept a

Sell some of her bonds and use the proceeds to purchase stocks

Accept more risk

Standard Deviation of Portfolio Return

(Risk)

(Percent)

0

5

10

15

20

Suppose Rosa currently allocates 25% of her portfolio to a diversified group of stocks and 75% of her portfolio to risk-free bonds; that is, she chooses

combination B. She wants to increase the average annual return on her portfolio from 4.5% to 9.5%. In order to do she must do which of the

following? Check all that apply.

Sell some of her stocks and use the proceeds to purchase bonds

Sell some of her stocks and place the proceeds in a savings account

average annual return.

The table uses the standard deviation of the portfolio's return as a measure of risk. A normal random variable, such as a portfolio's return, stays

within two standard deviations of its average approximately 95% of the time.

Suppose Rosa modifies her portfolio to contain 75% diversified stocks and 25% risk-free government bonds; that is, she chooses combination D. The

average annual return for this type of portfolio is 9.5%, but given the standard deviation of 15%, the returns will typically (about 95% of the time)

vary from a gain of

to a loss of

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- After learning the course, you divide your portfolio into three equal parts (i.e., equal market value weights), with one part in Treasury bills, one part in a market index, and one part in a mutual fund with beta of 0.77. What is the beta of your overall portfolio?arrow_forwardBy looking at the sensivities of your portfolio to ds = -$2 and So = -1%, you decide to hedge delta, gamma and Vega risk of your portfolio with the underlying stock and two different options on the same asset with below data. Calculate the units of stock you need to trade to hedge away all delta, gamma and Vega risks of your portfolio.(Note that here you have to calculate the units of stock, Option A and Option B, but you will only submit the units of stock.) Variable Option A Option B Delta (A) -0.5 0.2 Gamma (T) 0.2 0.1 Vega (v) 8arrow_forwardAnna holds a portfolio comprising the following 3 stocks: X, Y and Z. Investment Amount Beta. Expected return Security X $2000. 1.3. Security Y $1000. 1. 10% Security Z. $500. 0. 2% a. Determine the expected return of security X. b. Calculate the return of Anna’s portfolio. c. Calculate the beta of Anna’s portfolio. d. To reduce the systematic risk of the portfolio, Anna is considering 3 securities to add to the portfolio. Security A has a beta of 0, security B has a beta of 0.5 and Security C has a beta of -0.3. Discuss which security will be most effective in reducing the portfolio’s systematic risk? How would portfolio expected return change (higher or lower) if you add this security?arrow_forward

- Consider the information on the market, the risk-free asset, and a mutual fund. You want to build a two-asset portfolio comprising the market portfolio and the risk-free asset such that your portfolio beta is the same as the mutual fund. What is the portfolio weight on the market in your portfolio? Mutual Fund Market Risk Free E(k) 11.1% 8.5% 2.0% Beta 1.4 1 0arrow_forwardAn investor aims to build a portfolio with annual return equal to 8.88%. In the market only two stocks (A and B) are available, with annual historical returns equal to 9.6% and 7.8% respectively. Assume future returns have the same distribution of past returns. What is the percentage of funds that the investor must allocate to the stock A and B?arrow_forwardGive typing answer with explanation and conclusionarrow_forward

- Utilizing the information below on 2 recently purchased stocks, compute the risk of the portfolio for the different levels of correlation between the 2 securities: Stock A B Expected Return 0.14 0.17 Std Dev of returns 0.11 0.11 Proportion invested 0.35 0.65 Correlation coefficient 1 0.4 0.1 0 -0.4 -1arrow_forwardCurrent yield is used to determine Seleccione una: a. A portion of the yield on an investment b. The payout of a bond investment c. The amount of money a bond investor will earn d. The coupon rate of a bond investmentarrow_forwardAs the chief investment officer for a money management firm specializing in taxable individual investors, you are trying to establish a strategic asset allocation for two different clients. You have established that Ms. A has a risk-tolerance factor of 8, while Mr. B has a risk-tolerance factor of 27. The characteristics for four model portfolios follow: ASSET MIX Portfolio Stock Bond ER σ2 1 6 % 94 % 9 % 6 % 2 25 75 10 10 3 67 33 11 14 4 88 12 12 24 Calculate the expected utility of each prospective portfolio for each of the two clients. Do not round intermediate calculations. Round your answers to two decimal places. Portfolio Ms. A Mr. B 1 2 3 4 Which portfolio represents the optimal strategic allocation for Ms. A? Which portfolio is optimal for Mr. B? Portfolio represents the optimal strategic allocation for Ms. A. Portfolio is the optimal allocation for Mr. B. For Ms. A, what level of…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education