A First Course in Probability (10th Edition)

10th Edition

ISBN: 9780134753119

Author: Sheldon Ross

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Question

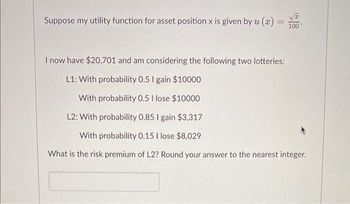

Transcribed Image Text:Suppose my utility function for asset position x is given by u (x)

100

I now have $20,701 and am considering the following two lotteries:

L1: With probability 0.5 I gain $10000

With probability 0.5 I lose $10000

L2: With probability 0.85 I gain $3,317

With probability 0.15 I lose $8,029

What is the risk premium of L2? Round your answer to the nearest integer.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Avicenna, a major insurance company, offers five-year life insurance policies to 65-year-olds. If the holder of one of these policies dies before the age of 70, the company must pay out $27,400 to the beneficiary of the policy. Executives at Avicenna are considering offering these policies for $765 each. Suppose that for each holder of a policy there is a 3% chance that they will die before the age of 70 and a 97% chance they will live to the age of 70. If the executives at Avicenna know that they will sell many of these policies, should they expect to make or lose money from offering them? How much? To answer, take into account the price of the policy and the expected value of the amount paid out to the beneficiary. Avicenna can expect to make money from offering these policies. In the long run, they should expect to make dollars on each policy sold. O Avicenna can expect to lose money from offering these policies. In the long run, they should expect to lose dollars on each policy…arrow_forwardA company estimates that 0.1% of their products will fail after the original warranty period but within 2 years of the purchase, with a replacement cost of $350. If they offer a 2 year extended warranty for $18, what is the company's expected value of each warranty sold?arrow_forwardYour school is selling raffle tickets as a fundraiser. They sell tickets for $5 each, there are 10 winners for $20, 5 winners for $30, and 1 winner for $100. If 200 tickets are sold what is your expected value?arrow_forward

- you are thinking of selling your house and you reckon that there is a 0.1 probability that you will sell it for $120 000, a 0.5 probability that you will receive $100 000 for it and a 0.4 probability that you will only receive $80 000. What is the expected selling price of the property? Interpret your result.arrow_forwardJohn and Larry are fundraisers for UNO. A wealthy benefactor says that he will match whatever John raises in the month of June – so if John raises 10,000 the benefactor will contribute an additional 10,000; if John raises 15,000, the benefactor will contribute an additional 15,000, etc. If John’s average monthly fundraising figure (expected value) is $25,000, and Larry’s is $30,000, what is the expected value for how much money UNO will raise in June?Explicitly state any properties of expectation you use to justify your conclusion.arrow_forwardA company offers a 2-year warranty on a product for $35. Replacing the product to the consumer who purchases the warranty costs the company $200. The quality control division estimates that 0.25% of their products will fail within the fırst 2 years. What is the company's expected value for each warranty sold?arrow_forward

- here is a 0.9988 probability that a randomly selected 28-year-old male lives through the year. A life insurance company charges $176 for insuring that the male will live through the year. If the male does not survive the year, the policy pays out $80,000 as a death benefit. Complete parts (a) through (c) below. a. From the perspective of the 28-year-old male, what are the monetary values corresponding to the two events of surviving the year and not surviving? b. If the 28-year-old male purchases the policy, what is his expected value? c. Can the insurance company expect to make a profit from many such policies? Why?arrow_forwardAssume that the probability of a security breach is 1 percent. The chance of your computer system being damaged during such an attack is 5 percent. If the system is damaged, the average estimated damage will be $ 50 million. What is the expected loss in dollars? In the above question, an insurance agent is willing to insure your facility for an annual fee of $35,000.00. Should the company accept the offer based on the cost benefit analysis?arrow_forwardQ17. A single share of a stock was purchased prior to the company's release of its quarterly report. There is a 58% chance that the company will meet the quarterly sales expectations for its new product two weeks from now, and the value of the stock will go to $440. Otherwise, the company will not meet the quarterly sales expectations, and the value of the stock will go down to $100. What is the expected value of the stock two weeks from now? (Round to the nearest dollar. Do not enter $ sign.)arrow_forward

- You have inherited a lottery ticket which might be a $10,000 winner. You have a 0.25 chance of winning the $10,000 and a 0.75 chance of winning $0. You have an opportunity to sell the lottery ticket for $2,500 - What is your expected return and what should you do if are risk averse?arrow_forwardTrevor is interested in purchasing the local hardware/sporting goods store in the small town of Dove Creek, Montana. After examining accounting records for the past several years, he found that the store has been arossina over $850 per day about 55% of the business days it is open. Estimate the probability that the store will aross over $850 for the following. (Round your answers to three decimal places. (a) at least 3 out of 5 business davs (b) at least 6 out of 10 business days (c) fewer than 5 out of 10 business days (d) fewer than 6 out of the next 20 business days (e) more than 17 out of the next 20 business daysarrow_forward1. ABC inc. stock is currently selling for $30, one year from today the stock price can either increase by 20% or decrease by 15%. The probability of an increase in the stock price is equal to 0.3. The one-year risk-free rate is 5% What is the value of a European put that expires in one year with an exercise price of $24. 2. Graphically, show the value and the profit and loss of the following butterfly position: Long in a call with an exercise price of $30, short in 2 calls with an exercise price of $45, and long in a call with an exercise price of 60. All calls are written on the same stock and have the same maturity. 3. "Early exercise of an American option on a stock that does not pay any dividend is not optimal regardless of whether the option is a Call or a Put". True, False, or Uncertain. Explain.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

A First Course in Probability (10th Edition)ProbabilityISBN:9780134753119Author:Sheldon RossPublisher:PEARSON

A First Course in Probability (10th Edition)ProbabilityISBN:9780134753119Author:Sheldon RossPublisher:PEARSON

A First Course in Probability (10th Edition)

Probability

ISBN:9780134753119

Author:Sheldon Ross

Publisher:PEARSON