ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Hand written solutions are strictly prohibited

Transcribed Image Text:go

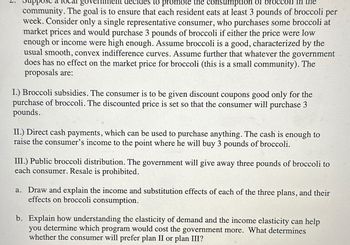

to promote the consumption of brocc

the

community. The goal is to ensure that each resident eats at least 3 pounds of broccoli per

week. Consider only a single representative consumer, who purchases some broccoli at

market prices and would purchase 3 pounds of broccoli if either the price were low

enough or income were high enough. Assume broccoli is a good, characterized by the

usual smooth, convex indifference curves. Assume further that whatever the government

does has no effect on the market price for broccoli (this is a small community). The

proposals are:

I.) Broccoli subsidies. The consumer is to be given discount coupons good only for the

purchase of broccoli. The discounted price is set so that the consumer will purchase 3

pounds.

II.) Direct cash payments, which can be used to purchase anything. The cash is enough to

raise the consumer's income to the point where he will buy 3 pounds of broccoli.

III.) Public broccoli distribution. The government will give away three pounds of broccoli to

each consumer. Resale is prohibited.

a. Draw and explain the income and substitution effects of each of the three plans, and their

effects on broccoli consumption.

b. Explain how understanding the elasticity of demand and the income elasticity can help

you determine which program would cost the government more. What determines

whether the consumer will prefer plan II or plan III?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Please no written by hand solutionsarrow_forwardPanther Acre Cattle Company - Chapter 7 Lab A typical farm or ranch problem is determining the optimum or profit-maximizing weight to sell fed cattle. Assume the feeder cattle are purchased at 600 pounds. The feed required and the weight gain is shown in the table below. Feed costs 7¢ per pound and feeder cattle prices are as follows: Weight Price per Pound 600-899 lbs 72¢ go to 3rd 900-1099 lbs decimal 1100 lbs or more 70¢ Point 67¢ Pay attention to the price changes when computing MVP. Input Output Feed Weight Selling Required Gain Weight Total Average Marginal Marginal Marginal Revenue Physical Physical Value Input (lbs) (lbs) (lbs) Product Product Product Cost 600 0 0 600 432 XXX XXX XXX XXX 500 50 So 650 468 0.10 0.083 1,100 145 as 745 536.40 0.132 6.158 1,700 235 aol 835 601.20 0.138 0.15 2,300 320 85 920 644 0.139 2,900 400 80 1,000 700 0.138 3,500 465 65 1,065 745, 50 0.133 4,100 525 60 1,125 753.75 0.128 4,700 575 SO 1,175 787.25 0.122 5,300 615 40 1,215 814.05 0.116 5,900 645…arrow_forwardDear expert don't Use chat gptarrow_forward

- Market price is always more than factor cost. True /Falsearrow_forwardA manufacturer has been selling 1000 television sets a week at $400 each. A market survey indicates that for each $10 rebate offered to the buyer, the number of sets sold will increase by 100 per week. Round your answers to the nearest dollar. (a) Find the demand function (price as a function of units sold). p(x) = (b) How large a rebate should the company offer the buyer in order to maximize its revenue? $ (c) If the company experiences a cost of C(x) = 77,000+ 130x, how should the manufacturer set the size of the rebate in order to maximize its profit? $arrow_forwardOnly typed solutionarrow_forward

- Acquiring a supplier because it becomes more profitable Question 4 options: will raise the asking price to offset any increase in cash flow over time will increase your profits will decrease your profits will make you alter operationsarrow_forwardA particular style of sunglasses costs the retaller $90 per pair. At what price should the retaller mark them so he can sell them at a 10% discount off the original price and still make 40% profit on his cost?arrow_forwardCalculate output if total revenue is $6600 and the price per UNIT is $11arrow_forward

- How many orders per year should you expect to place if your demand is 1,900 units per month and you order 356 units every time you place an order?arrow_forwardDoes providing customized products generally involve less capital investment or less skilled labor, when compared to more standardized products?arrow_forwardWhich is not a fixed cost? Group of answer choices an insurance premium of $50 per year, paid last month. monthly rent of $1,000 contractually specified in a one-year lease. a worker's wage of $15 per hour. an attorney's retainer of $50,000 per year.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education