ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Igrushka is a profit-maximizing firm producing wooden dolls-a capital-intensive good-which are sold in its home country, Russia, and abroad in

France. Igrushka chose foreign production as a method of penetrating the French market and has to decide whether it is more efficient to directly

invest in France to establish a production subsidiary or to license the technology to a French firm to produce its goods.

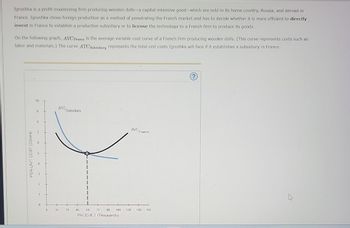

On the following graph, AVCFrance is the average variable cost curve of a French firm producing wooden dolls. (This curve represents costs such as

labor and materials.) The curve ATCSubsidiary represents the total unit costs Igrushka will face if it establishes a subsidiary in France.

PER-UNIT COST (Dollars)

10

9

8

1

0

0

ATC

15

Subsidiary

30

45 60 75 90 105 120

PRODUCT (Thousands)

AVC France

135 150

?

4

Transcribed Image Text:Suppose Igrushka estimates the demand for wooden dolls in France as 75,000 toys per year.

Based on the curves AVC France and ATC Subsidiary, what is Igrushka's best strategy?

O.Reassess the market potential in France.

License production technology to a French firm.

O Establish a subsidiary factory in France.

Suppose that Igrushka found a way to acquire capital at a lower cost than that paid by the French firm.

Which of the following best describes how Igrushka's decision making may change?

The decision to license instead of forming a subsidiary will occur at a higher level of output.

The decision to form a subsidiary instead of licensing will occur at a lower level of output.

The subsidiary becomes completely inefficient at a lower level of output.

O The decision to license instead of forming a subsidiary will occur at a lower level of output..

e Cardinus

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 1arrow_forwardThe Cuckoo rice cooker, made by the Cuckoo Company, Inc., is an electric rice cooker that promises perfectly made rice with each use. When the rice is done, a jingle plays (in this case, a silly rhyming song, "Your rice is done, so it's time to have some, you no longer have to wait, so go get your plate."). It is unique in that many of its components are from abroad: the voice that sings the jingle was recorded by the SingMore Company in Korea, the constructed steel body of the rice cooker is made by the FunPots Company in the United States, the rice scooper is produced by the ScoopMore company in Taiwan, and the full assembly of the rice cooker is completed in China by the Cuckoo Company, Inc., which also distributes it to retailers in North America. The entire process of the creation of the Cuckoo rice cooker, as described, is best illustrated by which of the terms?arrow_forward#3 defarrow_forward

- 2. Two cereal firms that set prices and sell differentiated products propose to merge. Firm 1sells CrunchyCrunch for a price of $10 with a marginal cost of $6. Firm 2 sells FibryFibre for aprice of $12 and a marginal cost of $6.(a) When the price of CC rises, 20% of its lost demand goes to FF. What is the marginal costreduction for CC that is required to offset the upwards pricing pressure on the CC price?(b) You are employed as a consultant by the merging firms. You know that the DOJ knowsthat the marginal cost of FF will fall by 50 cents as a result of the merger, but that the agency isunsure of the diversion between FF and CC. How small will you need to claim that the diversionis in order for there to be no net upwards pricing pressure on the CC price?arrow_forwardUnder what condition will L&P agree to produce the allocatively efficient quantity?arrow_forwardAt what price would a customer in Europe be charged when buying a new BMW? Please do not put a separation comma between every 3 digits. For example, if the answer is 65 thousand dollars, put 65000 in the answer field.arrow_forward

- Pls solve all questionsarrow_forwardDoan's Headphones company is innovative enough to have a monopoly in their market where they sell 80 million headphones each year. The marginal cost of making headphones is very low and Doan's analytic's department realize that if it dropped prices by 30% sales would rise enough that the company's profits would also increase. This result suggests that at Doan's current output: Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a MC=MR b MC is lower than MR MC is higher than MRarrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- If the average revenue is given by AR = 400 – 20x, then the quantity that maximiz the revenue is Select one: O a 10 Ob 20 Oc 100 Od. 200 Oe None of the abovearrow_forward9arrow_forwardAssume Allergan, Inc. is facing a capacity constraint in manufacturing Botox®. Analytically, this implies its marginal cost curve is extremely steep. As Botox® is oftentimes used for cosmetic reasons, it is reasonable to assume consumers have quite elastic demand curves. Hypothetically, assume a forthcoming study will highlight the safety of Botox® for cosmetic procedures. Given this potential study, where should Allergan, Inc. focus its strategic resources? a. Operations, specifically finding ways to lower costs in an effort to justify a price increase. b. Staffing, specifically preparing to significantly increase its staff to prepare for a large increase in the number of units of Botox® sold. c. Marketing/Pricing, specifically preparing to significantly raise the price for Botox®.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education