Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

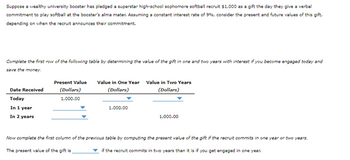

Transcribed Image Text:Suppose a wealthy university booster has pledged a superstar high-school sophomore softball recruit $1,000 as a gift the day they give a verbal

commitment to play softball at the booster's alma mater. Assuming a constant interest rate of 9%, consider the present and future values of this gift,

depending on when the recruit announces their commitment.

Complete the first row of the following table by determining the value of the gift in one and two years with interest if you become engaged today and

save the money.

Date Received

Today

In 1 year

In 2 years

Present Value

(Dollars)

1.000.00

Value in One Year Value in Two Years

(Dollars)

(Dollars)

The present value of the gift is

1,000.00

1.000.00

Now complete the first column of the previous table by computing the present value of the gift if the recruit commits in one year or two years.

if the recruit commits in two years than it is if you get engaged in one year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Your grandfather wants to establish a scholarship in his father’s name at a local university and has stipulated that you will administer it. As you’ve committed to fund a $10,000 scholarship every year beginning one year from tomorrow, you’ll want to set aside the money for the scholarship immediately. At tomorrow’s meeting with your grandfather and the bank’s representative, you will need to deposit$200,000 (rounded to the nearest whole dollar) so that you can fund the scholarship forever, assuming that the account will earn 6.00% per annum every year.arrow_forwardYou and your sister are planning a large anniversary party 3 years from today for your parents' 50th wedding anniversary. You have estimated that you will need $6,500 for this party. You can earn 2.6 percent compounded annually on your savings. How much would you and your sister have to deposit today in one lump sum to pay for the entire party? Can the excel and calculator solution be provided?arrow_forward← A newborn child receives a $8,000 gift toward a college education from her grandparents. How much will the $8,000 be worth in 19 years if it is invested at 5.9% compounded quarterly? It will be worth $ (Round to the nearest cent.)arrow_forward

- A wealthy graduate of a local university wants to establish a scholarship to cover the full cost of one student each year in perpetuity at her university. To adequately prepare for the administration of the scholarship, the university will begin awarding it starting in three years. The estimated full cost of one student this year is $32,000 and is expected to stay constant in real terms in the future. If the scholarship is invested to earn an annual real return of 10 percent, how much must the donor contribute today to fully fund the scholarship? Note: Negative value should be indicated by a parenthesis. > Answer is complete but not entirely correct. $(240,421) X Contributionarrow_forwardA wealthy graduate of a local university wants to establish a scholarship to cover the full cost of one student each year in perpetuity at her university. To adequately prepare for the administration of the scholarship, the university will begin awarding it starting in three years. The estimated full cost of one student this year is $38,000 and is expected to stay constant in real terms in the future. If the scholarship is invested to earn an annual real return of 5 percent, how much must the donor contribute today to fully fund the scholarship?arrow_forwardFrancis wants to start a foundation that will pay its beneficiaries $64,000 per year forever, with the first cash flow occurring one year from today. If the funds will be invested to earn 7% per year, how much must Frank donate today? Enter your answer as a positive number rounded to the nearest penny.arrow_forward

- Ethan is creating a college investment fund for his daughter. He will put in $21,000 per year for the next 17 years and expects to earn a 12% annual rate of return. How much money will his daughter have when she starts college? Use Appendix C to calculate the answer. Multiple Choice $1,014, 538 $1,015,551 $1,027,291 $1,026,564arrow_forward4. Mr. Richman has offered to give the New Life Hospice Center $100,000 today or $300,000 when he dies. If the hospice center earns 14% on its investments, and it expects Mr. Richman to live for 12 years, which alternative should they take? Take the gift now or later? Discuss in narrative and include your calculations and citations with your answer.arrow_forwardUse a financial calculator or computer software program to answer the following questions: a) Melanie is trying to save money for retirement and has a future goal of $750,000 at the end of 20 years. Determine the present value of her goal using a discount rate of 12%. b) How would the present value change if the $750,000 is to be received at the end of 15 years instead? Explain the impact and show your work?arrow_forward

- George has planned ahead and identified his dream house purchase in 3 years’ time. The current value of the house is $580 000. It is expected that the house will increase in value at a rate of 4.5% p.a. 3, Does the amount saved in part (ii) meet the 10% requirement from the bank as a deposit at the end of year 3?Show formula, variables, calculations and a concluding statement in your response.arrow_forwardYou calculate that you will need $75,000 in ten years to be able to pay for your daughter's college education. If you invest $20,000 today, what rate of return will you need to achieve this goal? Select one: A. Between 12% and 13% B. Between 13% and 14% C. Between 14% and 15% D. Between 15% and 16%arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education