Advanced Engineering Mathematics

10th Edition

ISBN: 9780470458365

Author: Erwin Kreyszig

Publisher: Wiley, John & Sons, Incorporated

expand_more

expand_more

format_list_bulleted

Question

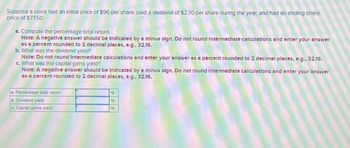

Transcribed Image Text:Suppose a stock had an Initial price of $96 per share, paid a dividend of $2.70 per share during the year, and had an ending share

price of $77.50.

a. Compute the percentage total return.

Note: A negative answer should be Indicated by a minus sign. Do not round Intermediate calculations and enter your answer

as a percent rounded to 2 decimal places, e.g., 32.16.

b. What was the dividend yield?

Note: Do not round Intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.

c. What was the capital gains yield?

Note: A negative answer should be Indicated by a minus sign. Do not round Intermediate calculations and enter your answer

as a percent rounded to 2 decimal places, e.g., 32.16.

Percentage total return

b. Dividend yield

c. Capital gains yield

96

%

96

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 6 images

Knowledge Booster

Similar questions

- $3,000 is invested for 18 months compounded at the interest rate of 0.75% every month. Give your answer correct to the nearest cent, wherever necessary. a. Calculate the final value of this investmentb. What is the increase in value obtained in part (a) as against investing the same amount for same time at same rate but at simple interest.arrow_forwardWhat simple interest rate is necessary for $850 to be worth $1200 after 14 years? Enter your answer as a percentage, rounded to one decimal place (tenth of a percent) if rounding is necessary.arrow_forwardSuppose you'd like to save enough money to pay cash for your next car. The goal is to save an extra $25,000 over the next 5 years. What amount must be deposited quarterly into an account that earns 4.2% interest in order to reach your goal? Round your answer to the nearest cent, if necessary.arrow_forward

- Need only handwritten solution only (not typed one).arrow_forwardassume you will put down 10% on a house that costs 424,900 dollars, and borrow the rest. What is the dollar amount of thge down payment? and the dollar amount you will borrow?arrow_forwardFind the accumulated amount after 7 years if $400 is invested at 7% per year, compounded: (Round each answer to the nearest cent.) a. Annually: 2$ 826.06 b. Semiannually: 2$ 492.70 c. Quarterly: d. Monthly: $ %24arrow_forward

- A bank in Mississauga has a buying rate of ¥1 = C$0.01054. If the exchange rate is ¥1 = C$0.01074, calculate the rate of commission that the bank charges to buy currencies. % Round to two decimal placesarrow_forwardWhat is the simple interest rate on a $1600 investment paying $580.32 interest in 11.7 years? % (round to the nearest tenth of a percent)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education

Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY

Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Advanced Engineering Mathematics

Advanced Math

ISBN:9780470458365

Author:Erwin Kreyszig

Publisher:Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:9780073397924

Author:Steven C. Chapra Dr., Raymond P. Canale

Publisher:McGraw-Hill Education

Introductory Mathematics for Engineering Applicat...

Advanced Math

ISBN:9781118141809

Author:Nathan Klingbeil

Publisher:WILEY

Mathematics For Machine Technology

Advanced Math

ISBN:9781337798310

Author:Peterson, John.

Publisher:Cengage Learning,