Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN: 9781305506381

Author: James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

not use ai please

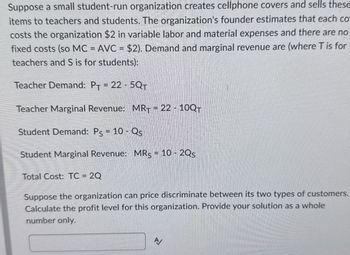

Transcribed Image Text:Suppose a small student-run organization creates cellphone covers and sells these

items to teachers and students. The organization's founder estimates that each co

costs the organization $2 in variable labor and material expenses and there are no

fixed costs (so MC = AVC = $2). Demand and marginal revenue are (where T is for

teachers and S is for students):

Teacher Demand: PT = 22-5QT

Teacher Marginal Revenue: MRT = 22-10QT

Student Demand: Ps = 10-Qs

Student Marginal Revenue: MRS = 10 - 2Qs

Total Cost: TC = 2Q

Suppose the organization can price discriminate between its two types of customers.

Calculate the profit level for this organization. Provide your solution as a whole

number only.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Natural-ExP is a unique company that is dedicated to making day trips to the Nevado de Toluca. The service includes transportation, food and guide service. Being the number of tickets sold, if the cost function of serving a new customer is Cmg = 20q, the marginal revenue function Img = 600−40q and the demand is q = (600 − p) /20. Under this scenario, what is the price of the excursion. $400 $600 $300 $100arrow_forwardOn the graph input tool, change the number found in the Quantity Demanded field to determine the prices that correspond to the production of 0, 6, 12, 15, 18, 24, and 30 units of output. Calculate the total revenue for each of these production levels. Then, on the following graph, use the green points (triangle symbol) to plot the results. Calculate the total revenue if the firm produces 6 versus 5 units. Then, calculate the marginal revenue of the sixth unit produced. The marginal revenue of the sixth unit produced is________. Calculate the total revenue if the firm produces 12 versus 11 units. Then, calculate the marginal revenue of the 12th unit produced. The marginal revenue of the 12th unit produced is_________.arrow_forwardYour firm "We Work Eot U" rents access to shared open office spaces for a price of S540 per year. The market is perfectly competitive as consumers have many of these "We Work" rental companies to choose from. Your firm's total revenue function is written: TR = (540) Q. The total cost function is written: TC = 80,000+ 40Q + 0.5Q? a. To maximize profits, what is the optimal number of office spaces to rent? Show your work. b. How much (in dollars) are total profits at the profit-maximizing output level? Show your work. c. In the long run, assuming no barriers to entry and exit into this industry, what will happen to profits and to the market price?arrow_forward

- Suppose a firm has the following expenditures per day: $250 for wages and salaries, $50 for materials, $60 for equipment, and $40 for rent. The market wage for the manager is $120 per day but the owner-manager does not draw a salary. Assume the daily revenue is $420. What is the economic profit for the firm described above? Just give formula.arrow_forwardIf revenue(q) = 9 * q, what is the marginal revenue at 11 items?arrow_forwardPlease solve for the marginal revenue function using the demand function: Q=1400-100parrow_forward

- Given cost and price (demand) functions C(g)= 110q + 44,600 and p(g) = - 2g + 860, what is the marginal revenue at a production level of 55 items? The marginal revenue is $ . (Round answer to nearest dollar.) Pr ritharrow_forwardA major software developer has estimated the demand for its new personal finance software package to be Q=1,000,000P-2 while the total cost of the package is C = 10,000+ 25Q. If this firm wishes to maximize profit, what percentage markup should it place on this product where percentage markup is defined as 100*(sale price - marginal cost)/marginal cost? 4. a. b. C. d. e. ANS: 90% 100% 20% 40% 250%arrow_forwardi need it in words not handwrittenarrow_forward

- Please help ASAP What is the firm's fixed cost? What is the profit-maximizing level of output? Given that half of the fixed cost is avoidable and the firm produces at the optimal level of output, what is the firm's avoidable cost? Should the firm shut down its production? yes or noarrow_forwardshow work pleasearrow_forwardAssume that Vartoli Saadettin decides to start up a peddler's trade. His bench is in a perfectly competitive market and has the following long-run total cost function: LRTC(q) = 80q – 8q² + q³ Vartoli Saadettin also observes that market demand is given by: Q=12500-50P. Note that Q represents the market quantity, including all the other firms in the market. a) Derive the marginal cost and average cost functions for Vartoli Saadetin. b) Calculate the long-run equilibrium quantity to produce for Vartoli Saadetin. c) Calculate the long-run equilibrium price and the number of firms in the market.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Microeconomics: Principles & PolicyEconomicsISBN:9781337794992Author:William J. Baumol, Alan S. Blinder, John L. SolowPublisher:Cengage Learning

Microeconomics: Principles & PolicyEconomicsISBN:9781337794992Author:William J. Baumol, Alan S. Blinder, John L. SolowPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...

Economics

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:Cengage Learning

Microeconomics: Principles & Policy

Economics

ISBN:9781337794992

Author:William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:9781337617383

Author:Roger A. Arnold

Publisher:Cengage Learning