ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

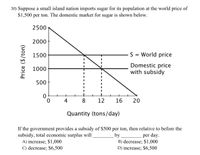

Transcribed Image Text:30) Suppose a small island nation imports sugar for its population at the world price of

$1,500 per ton. The domestic market for sugar is shown below.

2500

2000

1500

S = World price

Domestic price

with subsidy

1000

500

4

8.

12

16

20

Quantity (tons/day)

If the government provides a subsidy of $500 per ton, then relative to before the

subsidy, total economic surplus will

A) increase; $1,000

C) decrease; $6,500

by

B) decrease; $1,000

D) increase; $6,500

per day.

Price ($/ton)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Now, suppose that Island is a large exporting country with the following demand and supply functions and the free-trade world price is $5,000 per unit. D = 900,000 − 150P and S = 100,000 + 50P The Island government offers an export subsidy that increases the domestic market price to $5,500 and lowers the world price to $4,500. However, starting next month, the Island government will be removing the export subsidy in compliance with the latest international trade pact. A. What is the impact of the removal of the subsidy on domestic consumers? B. What is the change in producer surplus due to the movement to free trade? C. What is the net effect of moving to free trade on Island welfare?arrow_forwardAny help with past paper is much appreciatedarrow_forwardA large enough production subsidy can turn an imported product into an exportable product. A) false B) truearrow_forward

- Domestic demand for natural gas in a small economy is characterized by the equation P=350-5QP=350-5Q , domestic supply is characterized by the equation Q=0.5-P+35Q=0.5-P+35 , and the world price is equal to $60. An export tariff of $6 per unit will Group of answer choices result in net welfare loss of 14.6 lead to a loss in consumer surplus lead to an export level that is less than half of the original amount result in tariff revenue that is larger than the loss in producer surplusarrow_forwardAfter the creation of a free trade area involving five nations, higher-cost external producers of ri within the free trade area. This is known asarrow_forwardThe government of canada recently signed a new preferential trade agreement and has agreed to pay subsidies to poultry farmers to compensate for increased competition they may face from imports. You are employed as an analyst. In order to determine the dollar value of compensation you are required to estimate how the Canadian price of poultry and the quantity of imported poultry will change as a result of this new trade agreement. Canada is a small importing country in the world market for poultry. Provided is the following information about the Canadian poultry market: 1.The world price of poultry is $5 2.The Canadian poultry market is currently (before new trade agreement) protected by a tariff rate quota (TRQ) of the following format: -an in-quota tariff is $1/unit -the import quota volume is 100 units -the over-quota tariff is $10/unit 3.An excess demand (ED) for imports function for poultry has been estimated as P = 28 - 0.14Q a)Draw the diagram for imports in this market, and…arrow_forward

- Summarize how an online venture that sells imported Honduran coffee beans would appeal to various cultures.arrow_forwardSuppose that Canada imports pearl necklaces from India. The free market price is $111.00 per necklace. If the tariff on imports in Canada is initially 26%, Canadians pay $ per necklace. One of the accomplishments of the Uruguay Round that took place between 1986 and 1993 was significant across-the-board tariff cuts for industrial countries, as well as many developing countries. Suppose that as a result of the Uruguay Round, Canada reduces its import tariffs to 13%. Assuming the price of pearl necklaces is still $111.00 per necklace, consumers now pay the price of $ Based on the calculations and the scenarios presented, the Uruguay Round most likely hurts consumers hurts consumers in India. per necklace. in Canada andarrow_forwardThe major export-promotion agency in the U.S. is: the State Department the Commerce Department the U.S. Export Administration the International Court of Trade the U.S. Export Control Agencyarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education