FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

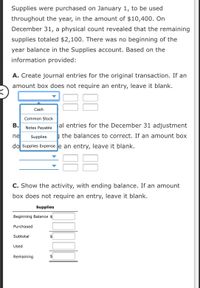

Question

Transcribed Image Text:Supplies were purchased on January 1, to be used throughout the year, in the amount of $10,400. On December 31, a physical count revealed that the remaining supplies totaled $2,100. There was no beginning of the year balance in the Supplies account. Based on the information provided:

**A.** Create journal entries for the original transaction. If an amount box does not require an entry, leave it blank.

- Dropdown options: Cash, Common Stock, Notes Payable, Supplies, Supplies Expense

**B.** Create journal entries for the December 31 adjustment reflecting the balances to correct. If an amount box does not require an entry, leave it blank.

- Dropdown options: Cash, Common Stock, Notes Payable, Supplies, Supplies Expense

**C.** Show the activity, with ending balance. If an amount box does not require an entry, leave it blank.

| Supplies | |

|---------------------|--------------|

| Beginning Balance | $ |

| Purchased | $ |

| Subtotal | $ |

| Used | $ |

| Remaining | $ |

![**Supplies Accounting Exercise**

Supplies were purchased on January 1, to be used throughout the year, in the amount of $10,400. On December 31, a physical count revealed that the remaining supplies totaled $2,100. There was no beginning-of-the-year balance in the Supplies account. Based on the information provided:

**A. Journal Entries for the Original Transaction**

Create journal entries for the original transaction. If an amount box does not require an entry, leave it blank.

- [Dropdown] ______ [$]

- [Dropdown] ______ [$]

**B. Journal Entries for December 31 Adjustment**

Create journal entries for the December 31 adjustment needed to correct the balances. If an amount box does not require an entry, leave it blank.

- [Dropdown] ______ [$]

- [Dropdown] ______ [$]

**C. Supplies Activity with Ending Balance**

Show the activity, with ending balance. If an amount box does not require an entry, leave it blank.

- **Supplies**

- Beginning Balance: [$] ______

- Purchased: [$] ______

- Subtotal: [$] ______

- Used: [$] ______

- Remaining: [$] ______

**Note:** There are dropdown menus and boxes for entering amounts related to journal entries and supplies account details.](https://content.bartleby.com/qna-images/question/11de2924-4cc1-4750-958e-08c098876e74/6816c88c-ec23-4a1e-8c3c-6f92d1dd5b93/2y1xak7h_thumbnail.jpeg)

Transcribed Image Text:**Supplies Accounting Exercise**

Supplies were purchased on January 1, to be used throughout the year, in the amount of $10,400. On December 31, a physical count revealed that the remaining supplies totaled $2,100. There was no beginning-of-the-year balance in the Supplies account. Based on the information provided:

**A. Journal Entries for the Original Transaction**

Create journal entries for the original transaction. If an amount box does not require an entry, leave it blank.

- [Dropdown] ______ [$]

- [Dropdown] ______ [$]

**B. Journal Entries for December 31 Adjustment**

Create journal entries for the December 31 adjustment needed to correct the balances. If an amount box does not require an entry, leave it blank.

- [Dropdown] ______ [$]

- [Dropdown] ______ [$]

**C. Supplies Activity with Ending Balance**

Show the activity, with ending balance. If an amount box does not require an entry, leave it blank.

- **Supplies**

- Beginning Balance: [$] ______

- Purchased: [$] ______

- Subtotal: [$] ______

- Used: [$] ______

- Remaining: [$] ______

**Note:** There are dropdown menus and boxes for entering amounts related to journal entries and supplies account details.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Presented below is information for Blossom Company. 1. Beginning-of-the-year Accounts Receivable balance was $20,800. 2. Net sales (all on account) for the year were $109,600. Blossom does not offer cash discounts. 3. Collections on accounts receivable during the year were $81,000. (a) Prepare (summary) journal entries to record the items noted above. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) No. Account Titles and Explanation 1. 2. Your answer is correct. 3. (b) No Entry No Entry Accounts Receivable Sales Revenue Cash Accounts Receivable eTextbook and Media List of Accounts Accounts receivable turnover Debit Days to collect accounts receivable times 0 days 109,600 81000 Compute Blossom's accounts receivable turnover and days to collect receivables for the year. The company does not believe it will have any bad debts. (Round answers…arrow_forwardDo not provide answer in image formatarrow_forwardThe cash register tape for Sheridan Industries reported sales of $27,292.00. Record the journal entry that would be necessary for each of the following situations. (a) Sales per cash register tape exceeds cash on hand by $53.50. (b) Cash on hand exceeds cash reported by cash register tape by $22.00. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 2 decimal places, e.g. 52.75.) No. Account Titles and Explanation Debit Credit (a) (b)arrow_forward

- 3. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule. 4. Assume that the allowance for doubtful accounts for Trophy Fish Company has a debit balance of $4,400 before adjustment on December 31. Journalize the adjusting entry for uncollectible accounts. Refer to the Chart of Accounts for exact wording of act titles.arrow_forwardJournalize the following transactions, using the direct write-off method of accounting for uncollectible receivables. Mar. 17: Received $2,710 from Shawn McNeely and wrote off the remainder owed of $3,630 as uncollectible. If an amount box does not require an entry, leave it blank. Mar. 17 July 29: Reinstated the account of Shawn McNeely and received $3,630 cash in full payment. If an amount box does not require an entry, leave it blank. July 29 July 29arrow_forwardJournalize the adjusting entries at July 31 on the books of Lance Company.arrow_forward

- The following data were selected from the records of Fluwars Company for the year ended December 31, current year: Balances at January 1, current year: Accounts receivable (various customers) $ 116,000 Allowance for doubtful accounts 12,700 The company sold merchandise for cash and on open account with credit terms 1/10, n/30, without a right of return. The following transactions occurred during the current year: Sold merchandise for cash, $258,000. Sold merchandise to Abbey Corp; invoice amount, $42,000. Sold merchandise to Brown Company; invoice amount, $53,600. Abbey paid the invoice in (b) within the discount period. Sold merchandise to Cavendish Inc.; invoice amount, $56,000. Collected $119,100 cash from customers for credit sales made during the year, all within the discount periods. Brown paid its account in full within the discount period. Sold merchandise to Decca Corporation; invoice amount, $48,400. Cavendish paid its account in full after the…arrow_forwardThe year-end financial statements of Prize Inc. include the accounts receivable footnote:Total accounts and other receivables at December 31 consisted of the following: (in millions) Year 2 Year 1 Total accounts and other receivables $444.4 $476.6 Allowance for doubtful accounts (6.0) (8.4) Total accounts and other receivables, net $438.4 $468.2 The balance sheet reports total assets of $2,984.1 million at December 31, Year 2.The common-size amount for gross accounts and other receivables are: Select one: a. $444.4 million b. None of these are correct. c. 14.7% d. 14.9% e. $438.4 millionarrow_forwardPresented below is information for Waterway Company. 1. Beginning-of-the-year Accounts Receivable balance was $22,100. 2. Net sales (all on account) for the year were $101,300. Waterway does not offer cash discounts. Collections on accounts receivable during the year were $86,000. 3. (a) Prepare (summary) journal entries to record the items noted above. (If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.).arrow_forward

- The following account balances come from the records of Ourso Company: Beginning Balance $2,945 123 Ending Balance $3,665 Accounts receivable Allowance for doubtful accounts 171 During the accounting period, Ourso recorded $12,350 of sales revenue on account. The company also wrote off a $183 account receivable. Required a. Determine the amount of cash collected from receivables. b. Determine the amount of uncollectible accounts expense recognized during the period. a. Collections of accounts receivable b. Uncollectible accounts expensearrow_forwardThe cash register tape for Tamarisk Industries reported sales of $8,103.30.Record the journal entry that would be necessary for each of the following situations. (a) Sales per cash register tape exceeds cash on hand by $59.85. (b) Cash on hand exceeds cash reported by cash register tape by $33.39. (Round answers to 2 decimal places, e.g. 52.75. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Transactions Account Titles and Explanation Debit Credit (a) enter an account title enter a debit amount rounded to 2 decimal places enter a credit amount rounded to 2 decimal places enter an account title enter a debit amount rounded to 2 decimal places enter a credit amount rounded to 2 decimal places enter an account title enter a debit amount rounded to 2 decimal places enter a credit amount rounded to 2 decimal places (b) enter an account title enter a debit amount rounded to 2 decimal…arrow_forwardAllowance Method Journalize the following transactions, using the allowance method of accounting for uncollectible receivables: Oct. 2. Received $1,970 from Ian Kearns and wrote off the remainder owed of $1,360 as uncollectible. If an amount box does not require an entry, leave it blank. Oct. 2 Dec. 20. Reinstated the account of Ian Kearns and received $1,360 cash in full payment. Reinstate Collectionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education