FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

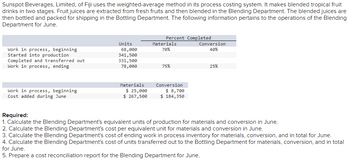

Transcribed Image Text:Sunspot Beverages, Limited, of Fiji uses the weighted-average method in its process costing system. It makes blended tropical fruit

drinks in two stages. Fruit juices are extracted from fresh fruits and then blended in the Blending Department. The blended juices are

then bottled and packed for shipping in the Bottling Department. The following information pertains to the operations of the Blending

Department for June.

Percent Completed

Units

68,000

Materials

70%

Conversion

40%

341,500

Work in process, beginning

Started into production

Completed and transferred out

Work in process, ending

331,500

78,000

75%

25%

Work in process, beginning

Materials.

$ 25,000

Conversion

$ 8,700

$ 184,350

Cost added during June

$ 267,500

Required:

1. Calculate the Blending Department's equivalent units of production for materials and conversion in June.

2. Calculate the Blending Department's cost per equivalent unit for materials and conversion in June.

3. Calculate the Blending Department's cost of ending work in process inventory for materials, conversion, and in total for June.

4. Calculate the Blending Department's cost of units transferred out to the Bottling Department for materials, conversion, and in total

for June.

5. Prepare a cost reconciliation report for the Blending Department for June.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A-1arrow_forwardAlaskan Fisheries, Inc., processes salmon for various distributors and it uses the weighted-average method in its process costing system. The company has two processing departments—Cleaning and Packing. Data relating to pounds of salmon processed in the Cleaning Department during July are presented below: Percent Completed Pounds of Salmon Materials Labor and Overhead Work in process inventory, July 1 20,000 100 % 30 % Work in process inventory, July 31 25,000 100 % 60 % A total of 380,000 pounds of salmon were started into processing during July. All materials are added at the beginning of processing in the Cleaning Department. Required: Compute the Cleaning Department's equivalent units of production for materials and for labor and overhead in the month of July.arrow_forwardBuilder Products, Incorporated, uses the weighted-average method in its process costing system. It manufactures a caulking compound that goes through three processing stages prior to completion. Information on work in the first department, Cooking, is given below for May: Production data: Pounds in process, May 1; materials 100% complete; conversion 80% complete Pounds started into production during May Pounds completed and transferred out Pounds in process, May 31; materials 60% complete; conversion 20% complete Cost data: Work in process inventory, May 1: Materials cost Conversion cost Cost added during May: Materials cost Conversion cost 10,000 100,000 ? 15,000 $ 1,500 $ 7,200 Check my work $ 154,500 $ 90,800 Required: 1. Compute the equivalent units of production for materials and conversion for May. 2. Compute the cost per equivalent unit for materials and conversion for May. 3. Compute the cost of ending work in process inventory for materials, conversion, and in total for May.…arrow_forward

- sarrow_forwardSunspot Beverages, Limited, of Fiji uses the weighted-average method in its process costing system. It makes blended tropical fruit drinks in two stages. Fruit juices are extracted from fresh fruits and then blended in the Blending Department. The blended juices are then bottled and packed for shipping in the Bottling Department. The following information pertains to the operations of the Blending Department for June. Units Percent Completed Materials Conversion Work in process, beginning 100,000 70% 40% Started into production 477,500 Completed and transferred out 467,500 Work in process, ending 110,000 75% 25% Materials Conversion Work in process, beginning $ 41,300 $ 15,100 Cost added during June $ 442,700 $ 321,500 Required: 1. Calculate the Blending Department's equivalent units of production for materials and conversion in June. 2. Calculate the Blending Department's cost per equivalent unit for materials and conversion in June. 3.…arrow_forwardUnit Information with BWIP, FIFO Method Jackson Products produces a barbeque sauce using three departments: Cooking, Mixing, and Bottling. In the Cooking Department, all materials are added at the beginning of the process. Output is measured in ounces. The production data for July are as follows: Production: Units in process, July 1, 70% complete* 10,100 Units completed and transferred out 90,000 Units in process, July 31, 80% complete* 15,000 * With respect to conversion costs. Required: Question Content Area 1. Prepare a physical flow schedule for July. Jackson ProductsPhysical Flow ScheduleFor the Month of July Units to account for: Units, beginning work is process (70% complete) Units started during July Total units to account for fill in the blank 2bb1ebfa004eff9_5 Units accounted for: Units completed and transferred out: Started and completed From beginning work in process From beginning work in…arrow_forward

- Unit Information with BWIP, FIFO Method Jackson Products produces a barbeque sauce using three departments: Cooking, Mixing, and Bottling. In the Cooking Department, all materials are added at the beginning of the process. Output is measured in ounces. The production data for July are as follows: Production: Units in process, July 1, 60% complete* 10,100 Units completed and transferred out 80,000 Units in process, July 31, 80% complete* 15,100 * With respect to conversion costs. Required: Question Content Area 1. Prepare a physical flow schedule for July. Jackson ProductsPhysical Flow ScheduleFor the Month of July Units to account for: Total units to account for Units accounted for: Units completed and transferred out: Total units accounted for 2. Prepare an equivalent units schedule for July using the FIFO method. Enter percentages as whole numbers. If an amount box…arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardAztec Inc. produces soft drinks. Mixing is the first department, and its output is measured in gallons. Aztec uses the FIFO method. All manufacturing costs are added uniformly. For July, the mixing department provided the following information: Production: Units in process, July 1, 40% complete 20,000 gallons Units completed and transferred out 135,000 gallons Units in process, July 31, 45% complete 24,000 gallons Costs: Work in process, July 1 $40,000 Costs added during July 372,060 Required: Prepare a production report. Aztec Inc. Mixing Department Production Report For the Month of July (FIFO Method) Unit Information Physical flow: Units to account for: Units Units in beginning WIP Units started Total units to account for Units to account for: Units Units started and completedarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education