Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

Sunset manufacturing began solution general accounting question

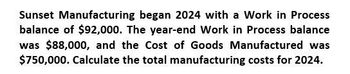

Transcribed Image Text:Sunset Manufacturing began 2024 with a Work in Process

balance of $92,000. The year-end Work in Process balance

was $88,000, and the Cost of Goods Manufactured was

$750,000. Calculate the total manufacturing costs for 2024.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A company estimates its manufacturing overhead will be $840,000 for the next year. What is the predetermined overhead rate given each of the following Independent allocation bases? Budgeted direct labor hours: 90,615 Budgeted direct labor expense: $750000 Estimated machine hours: 150,000arrow_forwardEllerson Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 278,000, direct labor cost was 189,000, and overhead cost was 523,000. During the year, 100,000 units were completed. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 2.70 is direct materials and 5.30 is overhead. What is the prime cost per unit? Conversion cost per unit?arrow_forwardEllerson Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 278,000, direct labor cost was 189,000, and overhead cost was 523,000. During the year, 100,000 units were completed. Refer to Exercise 2.21. Last calendar year, Ellerson recognized revenue of 1,312,000 and had selling and administrative expenses of 204,600. Required: 1. What is the cost of goods sold for last year? 2. Prepare an income statement for Ellerson for last year.arrow_forward

- In Orion Industrial, for the year 2021, what is the cost of goods manufactured if the beginning work in process was $35,000, ending work in process was $40,000, raw materials used were $80,000, direct labor was $60,000, manufacturing overhead was $30,000, and marketing expenses $12,000?arrow_forwardAt May 31, 2020, the accounts of Sheffield Company show the following. 1. May 1 inventories—finished goods $ 14,800, work in process $ 17,600, and raw materials $ 8,600. 2. May 31 inventories—finished goods $ 9,600, work in process $ 17,000, and raw materials $ 8,000. 3. Increases to work in process were direct materials $ 64,300, direct labor $ 51,400, and manufacturing overhead applied $ 42,100. 4. Sales revenue totaled $ 217,000. (a) Prepare a condensed cost of goods manufactured schedule for May 2020. SHEFFIELD COMPANYCost of Goods Manufactured Schedulechoose the accounting periodchoose the accounting period select an opening section nameselect an opening section name $ enter a dollar amountenter a dollar amount select an account titleselect an account title $ enter a dollar amountenter a dollar amount select an account titleselect an account title enter a dollar amountenter a dollar amount…arrow_forwardFinancial Accountingarrow_forward

- Please Solve This Question as possible fastarrow_forwardMidwest Corporation has provided the following data concerning manufacturing overhead for 2020: Estimated manufacturing overhead for the year $ 30,000 Estimated direct labor hours for the year 2,000 Two jobs were worked on during the year: Job A-101 and Job A-102. The number of direct labor-hours spent on Job A-101 and Job A-102 were 1,200 and 1,000, respectively. The actual manufacturing overhead was $37,000.What was the amount of manufacturing overhead applied to Job A-101? $24,000. $44,000. $18,000. $16,000.arrow_forwardKindly help me Accounting questionarrow_forward

- Winston Company estimates that the factory overhead for the following year will be $1,134,000. The company has decided that the basis for applying factory overhead should be machine hours, which is estimated to be 37,800 hours. The total machine hours for the year were 54,300 hours. The actual factory overhead for the year was $1,652,000. Required: (a) Determine the total factory overhead amount applied. (b) Calculate the overapplied or underapplied amount for the year. Enter the amount as positive values. (c) Prepare the journal entry to close Factory Overhead into Cost of Goods Sold. Refer to the Chart of Accounts for exact wording of account titles.arrow_forwardProvide answerarrow_forwardWinston Company estimates that the factory overhead for the following year will be $1,250,000. The company has decided that the basis for applying factory overhead should be machine hours, which is estimated to be 50,000 hours. The total machine hours for the year were 54,300. The actual factory overhead for the year was $1,375,000. Determine the over- or underapplied amount for the year. Oa. $17,500 underapplied Ob. $118,250 underapplied Oc. $17,500 overapplied Od. $118,250 overappliedarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning