FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

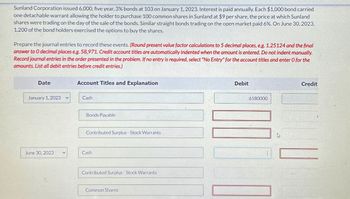

Transcribed Image Text:Sunland Corporation issued 6,000, five year, 3% bonds at 103 on January 1, 2023. Interest is paid annually. Each $1,000 bond carried

one detachable warrant allowing the holder to purchase 100 common shares in Sunland at $9 per share, the price at which Sunland

shares were trading on the day of the sale of the bonds. Similar straight bonds trading on the open market paid 6%. On June 30, 2023,

1,200 of the bond holders exercised the options to buy the shares.

Prepare the journal entries to record these events. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final

answer to O decimal places eg. 58,971. Credit account titles are automatically indented when the amount is entered. Do not indent manually.

Record journal entries in the order presented in the problem. If no entry is required, select "No Entry" for the account titles and enter O for the

amounts. List all debit entries before credit entries.)

Date

January 1, 2023

June 30, 2023

Account Titles and Explanation

Cash

Bonds Payable

Contributed Surplus - Stock Warrants

Cash

Contributed Surplus - Stock Warrants

Common Shares

Debit

6180000

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Vishalarrow_forwardplease help mearrow_forwardGerard Corporation has the following convertible bonds. A $100,000 convertible bond was issued at par on January 1, 2021, at 4%. The bond is convertible into 30,000 shares of common stock. Additionally, there was a convertible bond that was purchased on November 1, 2021, at par, for $200,000 with an interest rate of 6%, this bond is convertible into 20,000 shares of common stock. Both bonds pay interest annually. Gerard Corporation has total revenue of 800,000 and expenses of 400,000, which does not include interest expense or taxes. The tax rate is 40%. Additionally, the organization currently has 300,000 shares of common stock outstanding for the entire year. No dividends were paid in 2021. Calculate Earnings per share. Calculate Dilutive Earnings per share using the if converted method.arrow_forward

- Nichols Corporation has the following convertible bonds. A $100,000 convertible bond was issued at par on January 1, 2021, at 4%. The bond is convertible into 30,000 shares of common stock. Additionally, there was a convertible bond that was purchased on November 1, 2021, at par, for $200,000 with an interest rate of 6%, this bond is convertible into 20,000 shares of common stock. Both bonds pay interest annually. Nichols Corporation has total revenue of 800,000 and expenses of 400,000, which does not include interest expense or taxes. The tax rate is 40%. Additionally, the organization currently has 300,000 shares of common stock outstanding for the entire year. No dividends were paid in 2021. A. Calculate Earnings per share. B. Calculate Dilutive Earnings per share using the if converted method.arrow_forwardOn January 1, 2022, Fancy Co issued $100,000 in 10 year bonds. The bonds have a stated rate of 5% but are issued at a discount as the market rate is 7%. Because the market rate is higher, Fancy receives the present value which is $92,640. The coupon is paid annually on December 31st of each year. Provide the journal entries for Jan 1, 2022, and Dec 31st, 2022.arrow_forwardMango Co. issued bonds payable on January 1, 2022. Each $1,000 bond is convertible to 10 shares of common stock after January 1, 2024. The bonds have a 5-year term, a stated rate of 8%, and pay interest annually on January 1. The bonds were issued at a premium of $25,274 which provides an effective interest rate of 6%. (Hint: Prepare an amortization table for the five-year term of the bonds. Note that 2023 is the second year in the term of the bonds.) Prepare the adjusting entry at Dec. 31 , 2023.arrow_forward

- On September 30, 2023, Sunland Inc. issued $3,280,000 of 10-year, 8% convertible bonds for $3,772,000. The bonds pay interest on March 31 and September 30 and mature on September 30, 2033. Each $1,000 bond can be converted into 80 no par value common shares. In addition, each bond included 20 detachable warrants. Each warrant can be used to purchase one common share at an exercise price of $15. Immediately after the bond issuance, the warrants traded at $3 each. Without the warrants and the conversion rights, the bonds would have been expected to sell for $3,444,000. On March 23, 2026, half of the warrants were exercised. The common shares of Sunland were trading at $20 each on this day. Immediately after the payment of interest on the bonds, on September 30, 2028, all bonds outstanding were converted into common shares. Assume the entity follows IFRS. (e) Your answer is partially correct. Prepare the journal entry to account for the exercise of the warrants on March 23, 2026. (Credit…arrow_forwardOn August 1, 2024, Perez Communications issued $36 million of 12% nonconvertible bonds at 105. The bonds are due on July 31, 2044. Each $1,000 bond was issued with 25 detachable stock warrants, each of which entitled the bondholder to purchase, for $50, one share of Perez Communications’ no par common stock. Interstate Containers purchased 20% of the bond issue. On August 1, 2024, the market value of the common stock was $48 per share and the market value of each warrant was $8. In February 2035, when Perez common stock had a market price of $62 per share and the unamortized discount balance was $2 million, Interstate Containers exercised the warrants it held. Questions: Prepare the journal entries on August 1, 2024, to record (a) the issuance of the bonds by Perez and (b) the investment by Interstate. Prepare the journal entries for both Perez and Interstate in February 2035, to record the exercise of the warrants.arrow_forwardTelta Inc. issued $15,000,000 of 12%, 40-year convertible bonds on November 1, 2025, at 97 plus accrued interest. The bonds were dated July 1, 2025, with interest payable January 1 and July 1. Bond discount (premium) is amortized semiannually on a straight-line basis. On July 1, 2026, one-half of these bonds were converted into 60,000 shares of $1 par value common stock. Accrued interest was paid in cash at the time of conversion. (a) (b) Prepare the entry to record the interest expense at December 31, 2025. Assume that accrued interest payable was credited when the bonds were issued. Credit Interest Payable for the full amount due; debit Interest Payable for the amount recognized at insurance. (Round to nearest dollar.) Prepare the entry to record the conversion on July 1, 2026. (Book value method is used.) Assume that the entry to record amortization of the bond discount and interest payment has been made.arrow_forward

- On March 1, 2024, Baddour, Incorporated, issued 10% bonds, dated January 1, with a face amount of $160 million. The bonds were priced at $142.00 million (plus accrued interest) to yield 12%. The price if issued on January 1 would have been $139.25 million. Interest is paid semiannually on June 30 and December 31. Baddour’s fiscal year ends September 30. Required: 1. to 3. What would be the amount(s) related to the bonds Baddour would report in its balance sheet, income statement and statement of cash flows for the year ended September 30, 2024?arrow_forwardOn July 1, 2018, Mason & Beech Services issued $33,000 of 10% bonds that mature in five years. They were issued at par. The bonds pay semiannual interest payments on June 30 and December 31 of each year. On December 31, 2018, what is the total amount paid to bondholders?arrow_forwardLibertine Co. issued $10,000,000 of 9%, 10-year, convertible bonds on January 1, 2020. Interest is paid annually on December 31. At the time of the bonds issuance, the market rate for non-convertible bonds was 10%. Each $1,000 bond is convertible into 15 common shares. In 2025, half of the bondholders decided to convert their bonds into common shares. How many shares were issued as a result of the conversion? Question 10 options: 75,000 140,783 15,000 150,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education