FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

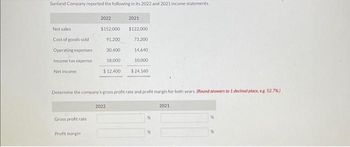

Transcribed Image Text:Sunland Company reported the following in its 2022 and 2021 income statements.

Net sales

Cost of goods sold

Operating expenses

Income tax expense

Net income

Gross profit rate

2022

Profit margin

$152,000

91,200

30,400

18,000

$12,400

Determine the company's gross profit rate and profit margin for both years. (Round answers to 1 decimal place, e.g. 52.7%)

2021

$122,000

73,200

14,640

10,000

2022

$24,160

%

2021

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company reports the following amounts at the end of the year: Sales revenue Cost of goods sold Net income $ 310,000 210,000 53,000 Compute the company's gross profit ratio. (Round your final answe Gross profit ratio %arrow_forwardSales Cost of goods sold Gross profit Operating expenses Income from operations Interest expense Income before income tax Income tax expense Net income (a) 2021 $1,595 900 695 524 171 80 Your answer is incorrect. 91 25 $66 2020 $1,387 $1,208 743 644 411 233 50 183 2019 46 596 612 402 210 40 170 43 $137 $127 Using horizontal analysis, calculate the horizontal percentage of a base-year amount, assuming 2019 is the base year. (Round answers to 1 decimal place, e.g. 5.2%. Enter negative amounts using either a negative sign preceding the number e.g. -45.1% or parentheses e.g. (45.1) %.)arrow_forwardHorizontal analysis (trend analysis) percentages for Pharoah Company's sales, cost of goods sold, and expenses are listed here. Horizontal Analysis 2023 Sales revenue Cost of goods sold Expenses 97.5 % Net income 104.0 107.0 2022 104.8 % 97.0 97.3 2021 100.0 % 100.0 100.0 Did Pharoah's net income increase, decrease, or remain unchanged over the 3-year period?arrow_forward

- Assume the following sales data for a company: Current year $770,668 Preceding year 635,551 What is the percentage increase in sales from the preceding year to the current year? a.121.26% b.17.53% c.82.47% d.21.26%arrow_forwardonly typed solutionarrow_forwardAssume the following sales data for a company: Line Item Description Amount Current year $883,993 Preceding year 542,076 What is the percentage increase in sales from the preceding year to the current year? a. 63.08% b. 61.32% c. 163.08% d. 38.68%arrow_forward

- Current Attempt in Progress Operating data for Grouper Corp. are presented as follows. Net sales Cost of goods sold Selling expenses Administrative expenses Income tax expense Net income 2022 $840,000 540,120 133,560 57,120 31,920 77,280 2021 $610,000 405,650 80,520 46,970 26,840 50,020 Prepare a schedule showing a vertical analysis for 2022 and 2021. (Round percentages to 1 decimal place, e.g. 12.1%.)arrow_forward10: Application of Financial Ratios Used to Measure Profitability The income statement of Garnet Mfg. Corp. for 2018 shows the following: Sales, net P 700,000 15,000 400,000 Net credit sales Cost of goods sold Cost of goods manufactured Net credit purchases 410,000 150,000 225,000 90,000 212,500 20,000 Raw materials used Net income Total operating expenses Depreciation Net income 90,000 The balance sheet figures as of December 31, 2017 and 2018 are as follows: December 31 2017 2018 P12,500 P 25,000 Cash 17,500 28,750 Marketable securities 10,000 20,000 Accounts receivable, net Inventories: 25,000 35,000 Finished goods Work in process 22,500 15,000 3,750 P 150,000 37,500 17,500 10,000 Raw materials Prepaid expenses Total current assets 2,500 P95,000 37,500 Investments 117,500 187,500 Plant, property and equipment, netarrow_forwardBelow is a comparative income statement for Akerley Co.: Akerley Co. Income Statement For the years ended December 31 2024 2023 $168,000 90,000 78,000 32,000 46,000 2,000 44,000 $151,000 78,000 73,000 Sales Cost of goods sold Gross profit Operating expenses Opcrating income Interest expense 30,000 43,000 3,000 40,000 10,000 $30,000 Income before taxes 11,000 $33,000 Income taxes Net income Required: USING MS EXCEL a. Prepare a horizontal analysis for the company calculating the change and percentage change of each line item from one year to the next. (Round your answers to the nearest tenth of a percent, ie 0.13578 → 13.6%) b. Which item/items in your analysis would you wish to investigate? Why?arrow_forward

- Miles Manufacturing has prepared the following sales budget for the first four months of the year: SALES: January - 20,000February - 22,000March - 25,000April - 21,000 Miles estimates that it will begin the year with 3,000 units in inventory. The company wants to end each month with inventory equal to 25% of the next month's projected sales. Prepare a production budget for each month: January, February and March. Show your work!arrow_forwardK McDaniel and Associates, Inc. reported the following amounts on its 2024 income statement: Year Ended December 31, 2024 Net income Income tax expense Interest expense $ 22,950 6,600 3,000 What was McDaniel's times-interest-earned ratio for 2024? OA. 7.65 OB. 10.85 OC. 9.85 OD. 8.65 point(s) possible ...arrow_forwardBlanco, Inc. has the following income statement (in millions): BLANCO, INC. Income Statement For the Year Ended December 31, 2010 Net Sales $200 Cost of Goods Sold 120 Gross Profit 80 Operating Expenses 44 Net Income $ 36 Using vertical analysis, what percentage is assigned to operating expenses? Select one :- a. 22% b. 18% c. 55% d. 70%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education