Financial Management: Theory & Practice

16th Edition

ISBN: 9781337909730

Author: Brigham

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

given answer General accounting question

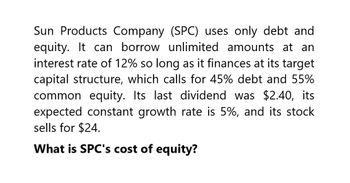

Transcribed Image Text:Sun Products Company (SPC) uses only debt and

equity. It can borrow unlimited amounts at an

interest rate of 12% so long as it finances at its target

capital structure, which calls for 45% debt and 55%

common equity. Its last dividend was $2.40, its

expected constant growth rate is 5%, and its stock

sells for $24.

What is SPC's cost of equity?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What is the value of equity and debt?arrow_forwardBruder & Co is a company with a market debt-equity ratio of 1.00. Suppose its current cost of debt is 5%, and its cost of equity is 12%. Suppose also that if Bruder & Co. takes some additional debt and uses the proceeds to buy some shares from the open market, which implies an increase in its debt- equity ratio to 1.50. a) This will also increase its cost of debt to 6 %. Determine the cost of equity after this transaction. b) Determine the WACC after this transaction.arrow_forwardAn unlevered firm has expected earnings of $2,401 and a market value of equity of $19,600. The firm is planning to issue $4,000 of debt at 6 percent interest and use the proceeds to repurchase shares at their current market value. Ignore taxes. What will be the cost of equity after the repurchase?arrow_forward

- A firm has a debt-to-equity ratio of 1.20. If it had no debt, its cost of equity would be 15%. Its cost of debt is 10%. What is its cost of equity if there are no taxes or other imperfections? A. 10% B. 15% C. 18% D. 21% E. None of these.arrow_forwardAlpha Corporation has average annual free cashflows to the equity holder and to the firmof P3,000,000 and P3,350,000 respectively. Assuming that the weighted average cost ofcapital and actual return of on assets is 16.75% while the market return on Alpha's debt is7%, what is the value of its equity? a. P34,358,974.36 b.P15,000,000.00 c.P17,910,447.76 d.P20,000,000.00arrow_forwardHorford Co. has no debt. Its cost of capital is 10 percent. Suppose the company converts to a debt-equity ratio of 1. The interest rate on the debt is 7.1 percent. Ignore taxes for this problem. a.What is the company’s new cost of equity? b.What is its new WACC?arrow_forward

- The Rivoli Company has no debt outstanding, and its financial position is given by the following data: What is Rivoli’s intrinsic value of operations (i.e., its unlevered value)? What is its intrinsic stock price? Its earnings per share? Rivoli is considering selling bonds and simultaneously repurchasing some of its stock. If it moves to a capital structure with 30% debt based on market values, its cost of equity, rs, will increase to 12% to reflect the increased risk. Bonds can be sold at a cost, rd, of 7%. Based on the new capital structure, what is the new weighted average cost of capital? What is the levered value of the firm? What is the amount of debt? Based on the new capital structure, what is the new stock price? What is the remaining number of shares? What is the new earnings per share?arrow_forwardAccording to MM propositions, at what debt-equity ratio should the cost of equity be the lowest?arrow_forward1) A firm that is currently unlevered has WACC = rS = 10%/year. This company plans to do a recapitalization by issuing debt and repurchasing equity. After the recapitalization, the debt-to-equity (D/E) ratio will be 0.5. If the cost of debt, rD, is 6%, what will be rS after the recapitalization? 2) A firm with wD = 0.35 and wS = 0.65 plans to issue another $100 million of permanent debt. The firm's tax rate is 21%. The bonds will be issued at par with coupon rate = rD = 7%/year. The firm's WACC is 11%/year. By how much will the new debt change the value of the firm, and who will receive this value? A) Firm value will increase by $21 million, and all $21 million will go to the shareholders B) Firm value will increase by $9 million, and 35% will go to the bondholders, 65% to the shareholders C) Firm value will increase by $18.6 million, and 35% will go to the bondholders, 65% to the stockholders D) Firm value will increase by $21 million, and all $21 million will go to the…arrow_forward

- Yang Centers wants to report at least $1.75 in earnings per share. Given the following information, how much debt should be in its capital structure? (Answer only in integers without $ sign.) Book value per share: $8.75 Cost of debt: 10 % EBI: T $500,000 Tax bracket: 30 % Total Capital: $4,000,000 Answer:?????????arrow_forwardStevenson's Bakery is an all-equity firm that has projected perpetual EBIT of $183,000 per year. The cost of equity is 13.1 percent and the tax rate is 21 percent. The firm can borrow perpetual debt at 6.3 percent. Currently, the firm is considering converting to a debt–equity ratio of .93. What is the firm's levered value? MM assumptions hold. A. $829,786 B. $1,215,262 C. $1,155,579 D. $997,511 E. $921,985arrow_forwardMidwest Electric Company (MEC) uses only debt and common equity. It can borrow unlimited amounts at an interest rate of rd = 10% as long as it finances at its targetcapital structure, which calls for 45% debt and 55% common equity. Its last dividend D0 was $2, its expected constant growth rate is 4%, and its common stock sells for $20. MEC’stax rate is 40%. Two projects are available: Project A has a rate of return of 13%, and Project B’s return is 10%. These two projects are equally risky and about as risky as the firm’sexisting assets.a. What is its cost of common equity? b. What is the WACC? c. Which projects should Midwest accept?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you