FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:E 6-4

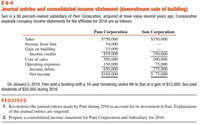

Journal entries and consolidated income statement (downstream sale of building)

Sun is a 90 percent-owned subsidiary of Pam Corporation, acquired at book value several years ago. Comparative

separate-company income statements for the affiliates for 2016 are as follows:

Pam Corporation

Sun Corporation

Sales

Income from Sun

Gain on building

$750,000

54,000

15,000

819,000

500,000

$350,000

350,000

200,000

75,000

275,000

$ 75,000

Income credits

Cost of sales

Operating expenses

Income debits

150,000

650,000

$169,000

Net income

On January 5, 2016, Pam sold a building with a 10-year remaining useful life to Sun at a gain of $15,000. Sun paid

dividends of $50,000 during 2016.

REQUIRED

1. Reconstruct the journal entries made by Pam during 2016 to account for its investment in Sun. Explanations

of the journal entries are required.

2. Prepare a consolidated income statement for Pam Corporation and Subsidiary for 2016.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1.) Abracada owns 90% interest of Deli Co. The following information are provided below: Deli Co Abracada Co Sales 2,000,000 5,400,000 Cost of goods sold (800,000) (2,700,000) Gross profit 1,200,000 2,700,000 Operating expenses (800,000) (500,000) Dividend Income 20,000 Net Income 400,000 2,240,000 Abracada Co. sold goods to Deli Co. for 60,000, 20% of these goods were sold for the year. Abracada also sold goods to Abracada Co. for 100,000, 20% of these goods were unsold at the end of the year. The ending inventory for Abracada Co is 240,000 and 100,000 for Deli Co. Compute for the non-controlling interest in Net Income.arrow_forward10 The following information has been extracted from the consolidated financial statements of P for the year ended 31 December 2017 The group has neither purchased nor disposed of any investment during this period. Group statement of profit or loss $ 000 Group operating profit 1,468 Share of associate's profit after tax 136 1,604 Tax on profit on ordinary activities: Income taxes: group (648) Profit on ordinary activities after tax 956 Group statement of financial position at 31 December 2017 2016 $00 $ 000 Investments in associates Share of net assets 932 912 Required What figure should appear in the group statement of cash flows for the year to 31 December 2017 for the associate? (a) (b) Under which heading would you expect this figure to appear in the group statement of cash flows?arrow_forwardfill in germano company and gable industriesarrow_forward

- What is the consolidated cost of sales for 2020?arrow_forwardPlease help me to solve this problemarrow_forwardDavis owns 70% of Free. In 2020 Davis reports Sales of $200,000 which include third party sales of $160,000 and intercompany sales of $40,000. Cost of Goods Sold for Davis are $80,000. Free reports sales of $150,000 of which $50,000 are intercompany. How much is Consolidated Sales ?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education