FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

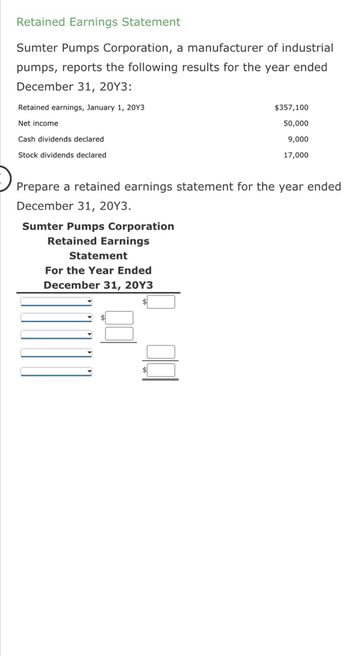

Transcribed Image Text:Retained Earnings Statement

Sumter Pumps Corporation, a manufacturer of industrial

pumps, reports the following results for the year ended

December 31, 20Y3:

Retained earnings, January 1, 20Y3

Net income

Cash dividends declared

Stock dividends declared

Prepare a retained earnings statement for the year ended

December 31, 20Y3.

Sumter Pumps Corporation

Retained Earnings

Statement

For the Year Ended

December 31, 20Y3

$357,100

50,000

9,000

17,000

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Noric Cruises Inc. reported the following results for the year ended October 31, 20Y9:Retained earnings, November 1, 20Y8 $12,400,000Net income 2,350,000Cash dividends declared 175,000Stock dividends declared 300,000Prepare a retained earnings statement for the fiscal year ended October 31, 20Y9.arrow_forwardMeasures of liquidity, solvency, and profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $82.60 on December 31, 20Y2. Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Retained earnings, January 1 $3,704,000 $3,264,000 Net income $ 600,000 $ 550,000 Dividends: On preferred stock (10,000) (10,000) On common stock (100,000) (100,000) Increase in retained earnings $ 490,000 $ 440,000 Retained earnings, December 31 $4,194,000 $3,704,000 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Sales $ 10,850,000 $10,000,000 Cost of goods sold (6,000,000) (5,450,000) Gross profit $ 4,850,000 $ 4,550,000 Selling expenses $ (2,170,000) $ (2,000,000) Administrative expenses (1,627,500) (1,500,000) Total operating expenses $(3,797,500) $ (3,500,000)…arrow_forwardam. 123.arrow_forward

- Retained Earnings Statement Sumter Pumps Corporation, a manufacturer of industrial pumps, reports the following results for the year ended December 31, 20Y3: Retained earnings, January 1, 20Y3 $509,400 Net income 71,300 Cash dividends declared 12,800 Stock dividends declared 24,200 Prepare a retained earnings statement for the year ended December 31, 20Y3. Retained earnings, January 1, 20Y3 Net Income Dividends Change in retained earnings Retained earnings, December 31, 20Y3arrow_forwardDetermining Retained Earnings and Net Income The following information appears in the records of Bock Corporation at year-end: Accounts Receivable $23,000 Retained Earnings ? Accounts Payable 00 Supplies Cash Common Stock 110,000 9,000 8,000 Equipment, net 154,000 a. Calculate the balance in Retained Earnings at year-end $ 0 b. If the amount of the retained earnings at the beginning of the year was $30,000 and $12,000 in dividends is paid during the year, calculate net income for the year. $42,000arrow_forwardRetained Earnings Statement Pressure Pumps Corporation, a manufacturer of industrial pumps, reports the following results for the year ended January 31, 20Y2: Retained earnings, February 1, 20Y1 $650,200 Net income 71,500 Cash dividends declared 12,900 Stock dividends declared 24,300 Prepare a retained earnings statement for the fiscal year ended January 31, 20Y2. Pressure Pumps CorporationRetained Earnings StatementFor the Year Ended January 31, 20Y2 $- Select - $- Select - - Select - - Select - $- Select -arrow_forward

- Retained Earnings Statement Willow Wanderer Cameras Inc. reported the following results for the year ended October 31, 20Y9: Retained earnings, November 1, 20Y8 $2,331,000 Net income 979,000 Cash dividends declared 85,000 Stock dividends declared 219,000 Prepare a retained earnings statement for the fiscal year ended October 31, 20Y9. Willow Wanderer Cameras Inc. Retained Earnings Statement For the Year Ended October 31, 20Y9 %24arrow_forwardA company's year-end selected financial data is shown below. Year 2 Year 1 Current assets $250,000 $175,000 Total assets 600,000 500,000 Total liabilities 300,000 225,000 Net sales 200,000 150,000 Net income 75,000 60,000 The company's rate of return on assets and rate of return on equity for Year 2 are: a. 12% and 22%, respectively. Ob. 13% and 25%, respectively. Oc. 14% and 26%, respectively. Od. 36% and 25%, respectively.arrow_forwardRetained Earnings Statement Financial information related to Healthy Products Company for the month ended November 30, 2018, is as follows: Net income for November $93,500 Cash dividends paid during November 7,000 Retained earnings, November 1, 2018 2,940,000 a. Prepare a retained earnings statement for the month ended November 30, 2018. If a net loss is incurred or dividends were paid, enter that amount as a negative number using a minus sign. Healthy Products Company Retained Earnings Statement For the Month Ended November 30, 2018 $fill in the blank 0079c8fa300c05b_2 $fill in the blank 0079c8fa300c05b_4 fill in the blank 0079c8fa300c05b_6 fill in the blank 0079c8fa300c05b_8 $fill in the blank 0079c8fa300c05b_10 b. Why is the retained earnings statement prepared before the November 30, 2018, balance sheet? To arrive at the number of shares outstanding. To calculate the net income for the year. To calculate the ending…arrow_forward

- Presented below are data for Caracas Corp. Assets, January 1 Liabilities, January 1 Stockholders' Equity, Jan. 11 Dividends Common Stock Stockholders' Equity, Dec. 31 Net Income Net income for 2012 is $684 income. $684 loss. $38 income. $38 loss. 2010 $3,800 2,280 ? 760 684 ? 760 2011 $4,560 ? ? 570 608 ? 684 2012 ? $2,736 2,850 646 650 2,166 ?arrow_forwardStatement of stockholders’ equity; net loss Selected accounts from the ledger of Restoration Arts for the fiscal year ended April 30, 20Y5, are as follows: Common Stock May 1 (20Y4) 10,000 July 1 7,500 Retained Earnings Dividends Apr. 30 31,200 May 1 (20Y4) 475,500 July 31 (20Y4) 1,250 Apr. 30 5,000 Apr. 30 5,000 Oct. 31 1,250 Jan. 31 1,250 Apr. 30 (20Y4) 1,250 Prepare a statement of stockholders’ equity for the year ended April 30, 20Y5. Restoration Arts Statement of Stockholders’ Equity For the Year Ended April 30, 20Y5 Common Stock Retained Earnings Total $ $ $ $ $ $arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education