FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

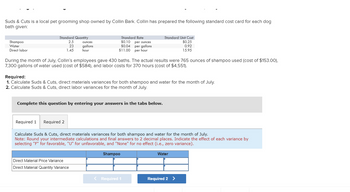

Transcribed Image Text:Suds & Cuts is a local pet grooming shop owned by Collin Bark. Collin has prepared the following standard cost card for each dog

bath given:

Shampoo

Water

Direct labor

Standard Quantity

2.5

23

1.45

ounces

gallons

hour

Standard Rate

$0.10 per ounces

$0.04 per gallons

$11.00 per hour

During the month of July, Collin's employees gave 430 baths. The actual results were 765 ounces of shampoo used (cost of $153.00),

7,300 gallons of water used (cost of $584), and labor costs for 370 hours (cost of $4,551).

Required 1 Required 2

Required:

1. Calculate Suds & Cuts, direct materials variances for both shampoo and water for the month of July.

2. Calculate Suds & Cuts, direct labor variances for the month of July.

Complete this question by entering your answers in the tabs below.

Direct Material Price Variance

Direct Material Quantity Variance

Standard Unit Cost

$0.25

0.92

15.95

Calculate Suds & Cuts, direct materials variances for both shampoo and water for the month of July.

Note: Round your intermediate calculations and final answers to 2 decimal places. Indicate the effect of each variance by

selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance).

Shampoo

< Required 1

Water

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Suds & Cuts is a local pet grooming shop owned by Collin Bark. Collin has prepared the following standard cost card for each dog bath given: Shampoo Water Direct labor Standard Quantity 2.9 27 1.65 ounces gallons hour Standard Rate $0.50 Standard Unit Cost per ounces $1.45 1.08 19.80 $0.04 per gallons $12.00 per hour During the month of July, Collin's employees gave 470 baths. The actual results were 785 ounces of shampoo used (cost of $471.00), 7,700 gallons of water used (cost of $616), and labor costs for 410 hours (cost of $5,371). Required: 1. Calculate Suds & Cuts, direct materials variances for both shampoo and water for the month of July. 2. Calculate Suds & Cuts, direct labor variances for the month of July. > Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Calculate Suds & Cuts, direct labor variances for the month of July. Note: Indicate the effect of each variance by selecting "F" for…arrow_forwardVia Gelato is a popular neighborhood gelato shop. The company has provided the following cost formulas and actual results for the month of June: Fixed Element Variable Element Actual Total per Liter $ 20.00 $ 5.45 $ 2.20 $ 1.00 per Month for June $ 122,540 $ 36,030 $ 20,200 Revenue Raw materials $ 6,400 $ 2,430 $ 3,400 $ 2,150 $ Wages Utilities $4 9,100 Rent $4 3,400 Insurance $ 2,150 Miscellaneous 730 $ 1.15 $4 8,050 While gelato is sold by the cone or cup, the shop measures its activity in terms of the total number of liters of gelato sold. For example, wages should be $6,400 plus $2.20 per liter of gelato sold and the actual wages for June were $20,200. Via Gelato expected to sell 6,300 liters in June, but actually sold 6,500 liters. Required: Calculate Via Gelato revenue and spending variances for June. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.)arrow_forwardHardevarrow_forward

- Via Gelato is a popular neighborhood gelato shop. The company has provided the following cost formulas and actual results for the month of June: Revenue Raw materials Wages Utilities Rent Insurance Miscellaneous Revenue Expenses: Raw materials Fixed Element per Month Via Gelato Revenue and Spending Variances For the Month Ended June 30 Wages Utilities Rent $ 7,200 $ 3,230 $ 4,200 $ 2,950 $ 810 While gelato is sold by the cone or cup, the shop measures its activity in terms of the total number of liters of gelato sold. For example, wages should be $7,200 plus $3.00 per liter of gelato sold and the actual wages for June were $26,300. Via Gelato expected to sell 6,200 liters in June, but actually sold 6,400 liters. Insurance Miscellaneous Variable. Element per Liter $ 28.00 $ 6.25 $ 3.00 $ 1.80 Required: Calculate Via Gelato revenue and spending variances for June. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e.,…arrow_forwardsavitaarrow_forwardSuds & Cuts is a local pet grooming shop owned by Collin Bark. Collin has prepared the following standard cost card for each dog bath given: Shampoo Water Standard Quantity 2.3 oz. 21 gal. Direct labor 1.35 hr. Standard Rate $ 0.60 per oz. $ 0.05 per gal. $11.00 per hr. Standard Unit Cost $ 1.38 1.05 14.85 During the month of July, Collin's employees gave 410 baths. The actual results were 755 ounces of shampoo used (cost of $520.95), 7,100 gallons of water used (cost of $639), and labor costs for 350 hours (cost of $4,375). Required: 1. Calculate Suds & Cuts direct materials variances for both shampoo and water for the month of July. 2. Calculate Suds & Cuts direct labor variances for the month of July Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Calculate Suds & Cuts direct materials variances for both shampoo and water for the month of July. (Round your answers to 2 decimal places. Indicate the…arrow_forward

- Trax Company manufactures 75 stationary bikes and 100 rowing machines with three activities. Activity rates to produce these products follow. Activity Rate $ 20 Activity Assembly Purchasing $ 10 Inspection $ 25 Activity usage for each product follows. Compute the overhead cost per unit for the stationary bikes and the rowing machines. (Round Overhead per unit amounts to 2 decimal places.) Activity Cost Driver Stationary Bikes Direct labor hours Purchase orders Inspections per direct labor hour per purchase order. per inspection Activity Usage Rowing Machines 300 12 15 500 18 20arrow_forwardbh.5arrow_forwardSuds & Cuts is a local pet grooming shop owned by Collin Bark. Collin has prepared the following standard cost card for each dog bath given: Standard Quantity Standard Rate Standard Unit Cost Shampoo 1.2 oz. $ 0.20 per oz. $ 0.24 Water 10 gal. $ 0.04 per gal. 0.40 Direct labor 0.8 hr. $ 9.00 per hr. 7.20 During the month of July, Collin’s employees gave 350 baths. The actual results were 700 ounces of shampoo used (cost of $182.00), 6,000 gallons of water used (cost of $420), and labor costs for 240 hours (cost of $2,448). Required: 1. Calculate Suds & Cuts direct materials variances for both shampoo and water for the month of July. 2. Calculate Suds & Cuts direct labor variances for the month of July.arrow_forward

- Hartley Uniforms produces uniforms. The company allocates manufacturing overhead based on the machine hours each job uses. Hartley Uniforms reports the following cost data for the past year: Budget Actual 7,600 hours 6,100 hours Direct labor hours Machine hours 7,200 hours 6,300 hours Depreciation on salespeople's autos $23,000 $23,000 Indirect materials $48,500 $50,500 Depreciation on trucks used to deliver uniforms to customers solla $13,000 $70,000 $40,000 $11,000 Depreciation on plant and equipment Indirect manufacturing labor $72,500 $42,000 Customer service hotline $19,000 $21,000 Plant utilities $35,900 $38,400 Direct labor cost $72,500 $85,500 Requirements 1odel tba 1. Compute the predetermined manufacturing overhead rate. 2. Calculate the allocated manufacturing overhead for the past year. 3. Compute the underallocated or overallocated manufacturing overhead. How will this underallocated or overallocated manufacturing overhead be disposed of? 4. How can managers usA accoarrow_forwardnarubhaiarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education