FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

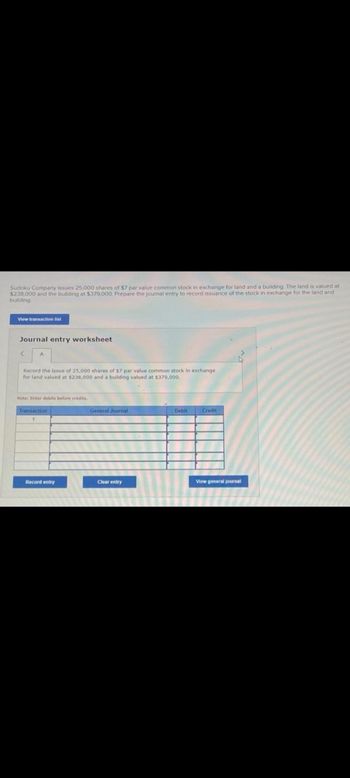

Transcribed Image Text:Sudoku Company issues 25,000 shares of $7 par value common stock in exchange for land and a building. The land is valued at

$238,000 and the building at $379,000. Prepare the journal entry to record issuance of the stock in exchange for the land and

building

View transaction list

Journal entry worksheet

Record the issue of 25,000 shares of $7 par value common stock in exchange

for land valued at $238,000 and a building valued at $379,000.

Note: Enter debits before credits

Record entry

General Journal

Clear entry

Debit Credit

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need help with thisarrow_forwardLexington Garden Supply paid $160,000 for a group purchase of land, building, and equipment. At the time of the acquisition, the land had a market value of $85,000, the building $51,000, and the equipment $34,000. Journalize the lump-sum purchase of the three assets for a total cost of $160,000, the amount for which the business signed a note payable. (Record a single compound journal entry. Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts and Explanation Debit Creditarrow_forwardOn April 10 a company acquired land in exchange for 2,500 shares of $23 per common stock with a current market price of $74. Journalize this transaction.arrow_forward

- Smith Company exchanges assets to acquire a building. The market price of the Smith stock on the exchange date was $38 per share and the bullding's book value on the books of the seller was $215,000. Which of the following is correct for Smith Company when Smith issues 10,000 shares of $10 par value common stock and pays $21,500 cash in exchange for the butlding? Murtiple cholce Total assets Increase $380,000. Stockholders equity increases $215.000. Total assets increase $350.500. stocknoiders' equity increases $358.500.arrow_forwardPlease help me to solve this problemarrow_forwardExercise 11-6 (Algo) Stock issuance for noncash assets LO P1 Sudoku Company issues 30,000 shares of $7 par value common stock in exchange for land and a building. The land is valued at $236,000 and the building at $364,000. Prepare the journal entry to record issuance of the stock in exchange for the land and building. No A Transaction 1 Answer is complete but not entirely correct. General Journal Land Building Common stock, $7 par value Paid-in capital in excess of par value, common stock ✓ Debit 236,000✔ 364,000 Credit 210,000 210,000 xarrow_forward

- Belize Biltmore Plaza acquires a patent from Camino Real in exchange for 3,000 shares of Belize Biltmore Plaza’s $6 par value common stock and $85,000 cash. When the patent was initially issued to Camino Real, Belize Biltmore Plaza’s stock was selling at $8.25 per share. When Belize Biltmore Plaza acquired the patent, its stock was selling for $9.50 per share. Belize Biltmore should record the patent at what amount?arrow_forwardfill in pleasearrow_forwardSmith Company exchanges assets to acquire a building. The market price of the Smith stock on the exchange date was $37 per share and the building's book value on the books of the seller was $210,000. Which of the following is correct for Smith Company when Smith Issues 10,000 shares of $10 par value common stock and pays $21,000 cash in exchange for the building? Multiple Choice Stockholders' equity increases $210,000. O Total assets increase $349,000. Total assets increase $370,000. Stockholders' equity increases $349,000.arrow_forward

- how do i journal entry this transaction - common stock has a par $1 Purchased land and a building from Gretchen Northway in exchange for stock issued at par. The building is mortgaged for $180,000 for 20 years at 6%, and there is accrued interest of $5,200 on the mortgage note at the time of the purchase. The corporation agreed to assume responsibility for paying the mortgage note and accrued interest. It is agreed that the land is to be valued at $60,000 and the building at $225,000 and that Gretchen Northway will be issued stock at par.arrow_forwardSudoku Company issues 20,000 shares of $8 par value common stock in exchange for land and a building. The land is valued at $226,000 and the building at $376,000. Prepare the journal entry to record issuance of the stock in exchange for the land and building. View transaction list Journal entry worksheet A Record the issue of 20,000 shares of $8 par value common stock in exchange for land valued at $226,000 and a building valued at $376,000. Note: Enter debits before credits. Transaction 1 General Journal Debit Creditarrow_forwardSudoku Company issues 21,000 shares of $8 par value common stock in exchange for land and a building. The land is valued at $239,000 and the building at $379,000. Prepare the journal entry to record issuance of the stock in exchange for the land and building. View transaction list Journal entry worksheet A Record the issue of 21,000 shares of $8 par value common stock in exchange for land valued at $239,000 and a building valued at $379,000. Note: Enter debits before credits. Transaction 1 Record entry General Journal Clear entry Debit Credit View general journalarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education