FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Hi, can you help me solve this? My values are not correct but I followed the example video and did the same steps as shown. Thanks!

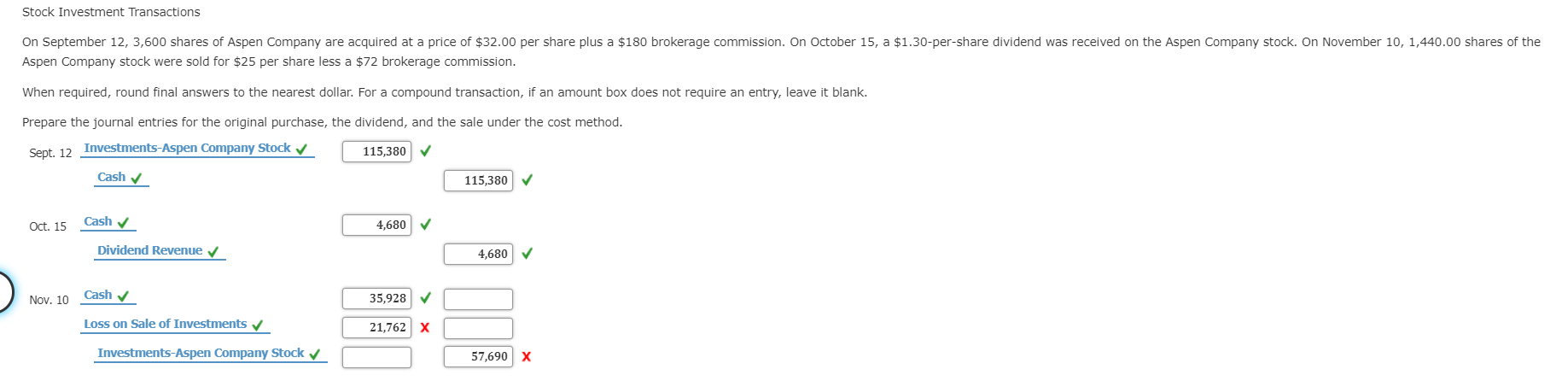

Transcribed Image Text:Stock Investment Transactions

On September 12, 3,600 shares of Aspen Company are acquired at a price of $32.00 per share plus a $180 brokerage commission. On October 15, a $1.30-per-share dividend was received on the Aspen Company stock. On November 10, 1,440.00 shares of the

Aspen Company stock were sold for $25 per share less a $72 brokerage commission.

When required, round final answers to the nearest dollar. For a compound transaction, if an amount box does not require an entry, leave it blank.

Prepare the journal entries for the original purchase, the dividend, and the sale under the cost method

Investments-Aspen Company Stock

115,380

Sept. 12

Cash

115,380

Oct. 15 Cash

4,680

Dividend Revenue

4,680 V

Nov. 10 CashY

35,928 V

Loss on Sale of Investments

21,762X

Investments-Aspen Company Stock

57,690 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sorry, to bother you but I am not sure where you came up with these numbers. They don't seem to be the same numbers in the question. I guess I am just really confused. Thank you for your help.arrow_forwardcan you please show me how to calculate this without using excel? Thanksarrow_forwardHi! Can you help me solve this problem? Thank youarrow_forward

- How would I calculate this problem? I just guessed on which answer made sense to me. Please help. thank you in advance.arrow_forwardCan anyone explain how to do these problems step by step?arrow_forwardI am confused on #36 of 3.3 in Finite Math for Business. My teacher wants me to find the interest using the TVM solver on my TI-84 and using the formula I=PRT. I am not sure what values to plug into my calculator though.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education