FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

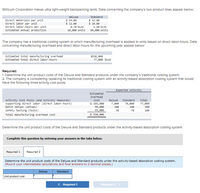

Transcribed Image Text:Stillicum Corporation makes ultra light-welght backpacking tents. Data concerning the company's two product lines appear below:

Deluxe

$ 54.00

$ 12.00

standard

$ 42.00

$ 10.00

Direct materials per unit

Direct labor per unit

Direct labor-hours per unit

Estimated annual production

e.70 DLHS

1.40 DLHS

10, e00 units

50, e00 units

The company has a traditional costing system In which manufacturing overhead Is appled to units based on direct labor-hours. Data

concerning manufacturing overhead and direct labor-hours for the upcoming year appear below:

Estimated total manufacturing overhead

Estimated total direct labor-hours

$530, 000

77,000 DLHS

Requlred:

1. Determine the unit product costs of the Deluxe and Standard products under the company's traditional costing system.

2. The company is considering replacing Its traditional costing system with an activity-based absorption costing system that would

have the following three activity cost pools:

Expected Activity

Estimated

Overhead

Activity Cost Pools (and Activity Measures)

Supporting direct labor (direct labor-hours)

Batch setups (setups)

safety testing (tests)

Cost

Deluxe

standard

Total

$ 385, 000

90, e00

7,000

70,000

77,000

200

100

300

55,000

$ 530,e00

30

70

100

Total manufacturing overhead cost

Determine the unit product costs of the Deluxe and Standard products under the activity-based absorptlon costing system.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Determine the unit product costs of the Deluxe and Standard products under the activity-based absorption costing system.

(Round your intermediate calculations and final answers to 2 decimal places.)

Deluxe

Standard

Unit product cost

< Required 1

Required 2 >

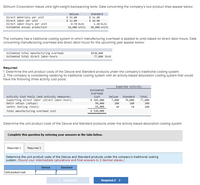

Transcribed Image Text:Stillicum Corporation makes ultra light-weight backpacking tents. Data concerning the company's two product lines appear below:

Deluxe

standard

$ 42.00

$ 10.00

Direct materials per unit

Direct labor per unit

Direct labor-hours per unit

Estimated annual production

$ 54.00

$ 12.00

e.70 DLHS

1.40 DLHS

10, e00 units

58, ee0 units

The company has a traditional costing system in which manufacturing overhead is applied to units based on direct labor-hours. Data

concerning manufacturing overhead and direct labor-hours for the upcoming year appear below:

Estimated total manufacturing overhead

Estimated total direct labor-hours

$530, 000

77,000 DLHS

Required:

1. Determine the unit product costs of the Deluxe and Standard products under the company's traditional costing system.

2. The company is considering replacing Its traditional costing system with an activity-based absorption costing system that would

have the following three activity cost pools:

Expected Activity

Estimated

Overhead

Activity Cost Pools (and Activity Measures)

Supporting direct labor (direct labor-hours)

Batch setups (setups)

Safety testing (tests)

Cost

$ 385, e00

9e, e00

55, e00

Deluxe

Standard

Total

7,000

70,000

77,000

200

100

300

30

70

100

Total manufacturing overhead cost

$ 530, 000

Determine the unit product costs of the Deluxe and Standard products under the activity-based absorption costing system.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Determine the unit product costs of the Deluxe and Standard products under the company's traditional costing

system. (Round your intermediate calculations and final answers to 2 decimal places.)

Deluxe

Standard

Unit product cost

< Required 1

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Godoarrow_forwardPreble Company manufactures one product. Its variable manufacturing overhead is applied to production based on direct labor-hours and its standard cost card per unit is as follows: Direct material: 5 pounds at $9.00 per pound Direct labor: 3 hours at $14 per hour Variable overhead: 3 hours at $9 per hour Total standard variable cost per unit The company also established the following cost formulas for its selling expenses: Variable Cost per Unit Sold Advertising Sales salaries and commissions Shipping expenses $ 45.00 42.00 27.00 $ 114.00 Fixed Cost per Month $ 300,000 $ 300,000 $22.00 $ 13.00 The planning budget for March was based on producing and selling 20,000 units. However, during March the company actually produced and sold 24,800 units and incurred the following costs: Spending variance related to shipping expenses a. Purchased 155,000 pounds of raw materials at a cost of $7.20 per pound. All of this material was used in production. b. Direct-laborers worked 65,000 hours at a…arrow_forwardPreble Company manufactures one product. Its variable manufacturing overhead is applied to production based on direct labor-hours and its standard cost card per unit is as follows: Direct material: 5 pounds at $8.00 per pound Direct labor: 2 hours at $14 per hour Variable overhead: 2 hours at $5 per hour Total standard variable cost per unit $ 40.00 28.00 10.00 $ 78.00 The company also established the following cost formulas for its selling expenses: Advertising Sales salaries and commissions Shipping expenses Variable Cost per Unit Sold Fixed Cost per Month $ 200,000 $ 100,000 $ 12.00 $ 3.00 S The planning budget for March was based on producing and selling 25,000 units. However, during March the company actually produced and sòld 30,000 units and incurred the following costs: a. Purchased 160,000 pounds of raw materials at a cost of $7.50 per pound. All of this material was used in production. b. Direct-laborers worked 55,000 hours at a rate of $15.00 per hour. c. Total variable…arrow_forward

- Rahularrow_forwardLockTite Company produces two products, Pretty Safe (PS) and Virtually Impenetrable (VI). The following two tables give pertinent information about these products. Solve, a. What is the cost per unit of Pretty Safe if LockTite uses traditional overhead allocation based on number of units produced? b. What is the cost per unit of Pretty Safe if LockTite uses activity-based costing to allocate overhead?arrow_forwardAarrow_forward

- Roca, Incorporated, manufactures and sells two products: Product M6 and Product X7. The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity: Estimated Overhead Cost Activity Cost Pools Labor-related Production orders Order size Multiple Choice O $360,294 O $443.424 O $369,879 Activity Measures DLHs orders MHS O $249,264 $ 152,100 63,035 505,452 $ 720,587 The total overhead applied to Product X7 under activity-based costing is closest to: (Round your Intermediate calculations to 2 decimal places.) Expected Activity Product M6 Product X7 3,000 400 4,800 300 3,700 3,600 saved Total 7,800 700 7,300arrow_forwardA Midwest producer of specialty farming equipment, Agriboon, has three products that the company needs costing information about. The following information is available for each product. XY263 GO987 TR345 Direct material cost per unit $2.00 $8.00 $10.00 Direct labor cost per hour $15.00 $16.75 $18.00 Agriboon presently applies overhead using a predetermined rate based on direct labor hours. Estimated Direct Labor hours for the year are 132,026. The product leader for GO987 has suggested that Agriboon switch to activity-based costing and identified the following activities, cost drivers, estimated costs, and estimated cost driver units for the year: Activity Recommended Cost Driver Estimated Cost Estimated Cost Driver Units Materials Handling Requisition Request $38,912 1,216 Request Machine Operations Machine Hours $142,500 12,000 Hours Safety Compliance Compliance Test $125,000 1,100 Test Total OH…arrow_forwardStillicum Corporation makes ultra light-weight backpacking tents. Data concerning the company's two product lines appear below: Standard Direct materials per unit Direct labor per unit Direct labor-hours per unit Estimated annual production Estimated total manufacturing overhead Estimated total direct labor-hours Deluxe $ 57.00 $15.00 The company has a traditional costing system in which manufacturing overhead is applied to units based on direct labor-hours. Data concerning manufacturing overhead and direct labor-hours for the upcoming year appear below: 0.70 DLHS 10,000 units Unit product cost Deluxe $ 45.00 $ 12.40 Required: 1. Determine the unit product costs of the Deluxe and Standard products under the company's traditional costing system. 2. The company is considering replacing its traditional costing system with an activity-based absorption costing system that would have the following three activity cost pools: Complete this question by entering your answers in the tabs below.…arrow_forward

- Standard Product CostsDeerfield Company manufactures product M in its factory. Production of M requires 2 pounds of material P, costing $8 per pound and 0.5 hour of direct labor costing, $14 per hour. The variable overhead rate is $12 per direct labor hour, and the fixed overhead rate is $16 per direct labor hour. What is the standard product cost for product M? Direct material Answer Direct labor Answer Variable overhead Answer Fixed overhead Answer Standard product cost per unit Answerarrow_forwardCrmration manufactures bwo models of office chairs, a standard and a deluxe model. The following activity and cost information has been compiled: Number of Number of Number of Setups Components Direct Labor Hours 10 290 Preduct Standard 13 18 235 32 Delue $72,000 $95,200 Overhead costs Amnealraditional costing system applies the overhead costs based on direct labor hours. What is the total amount of overhead costs assigned to the standard model? (Do not round interim calculations. Round the final anewes ln the a whole dollar) OA S92.358 OB $74,842 OC $83,600 OD. $52.587 O Time Remaining: 01:46:06 Next % 5 6. 7. 8. ఉం W R Y 314arrow_forwardA firm makes a range of running shoes. There are three models – Short; Middle; and Long distance. The products are aimed at different segments of the market. Product costs are computed using an overhead rate based on the labour hour method. Selling prices are set on full cost plus 20%. A unit refers to a pair of running shoes. The following information is available: Short distance Middle distance Long distance Direct material cost per unit $25 $35 $40 Labour hours per unit 2 hrs 2 hrs 2 hrs Labour rate per hour $12 $12 $12 Total labour hours used 120,000 hrs 24,000 hrs 16,000 hrs Total number of units 60,000 units 12,000 units 8,000 units Cost driver information: Short distance Middle distance Long distance No. of machine hours 60,000 48,000 48,000 No. of material orders 30 100 200 No. of sales orders 12 48 63 The total overhead costs for the business amount to $1.2…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education