Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

None

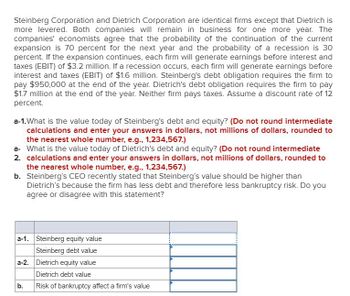

Transcribed Image Text:Steinberg Corporation and Dietrich Corporation are identical firms except that Dietrich is

more levered. Both companies will remain in business for one more year. The

companies' economists agree that the probability of the continuation of the current

expansion is 70 percent for the next year and the probability of a recession is 30

percent. If the expansion continues, each firm will generate earnings before interest and

taxes (EBIT) of $3.2 million. If a recession occurs, each firm will generate earnings before

interest and taxes (EBIT) of $1.6 million. Steinberg's debt obligation requires the firm to

pay $950,000 at the end of the year. Dietrich's debt obligation requires the firm to pay

$1.7 million at the end of the year. Neither firm pays taxes. Assume a discount rate of 12

percent.

a-1.What is the value today of Steinberg's debt and equity? (Do not round intermediate

calculations and enter your answers in dollars, not millions of dollars, rounded to

the nearest whole number, e.g., 1,234,567.)

a- What is the value today of Dietrich's debt and equity? (Do not round intermediate

2. calculations and enter your answers in dollars, not millions of dollars, rounded to

the nearest whole number, e.g., 1,234,567.)

b. Steinberg's CEO recently stated that Steinberg's value should be higher than

Dietrich's because the firm has less debt and therefore less bankruptcy risk. Do you

agree or disagree with this statement?

a-1. Steinberg equity value

Steinberg debt value

a-2. Dietrich equity value

b.

Dietrich debt value

Risk of bankruptcy affect a firm's value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education