Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

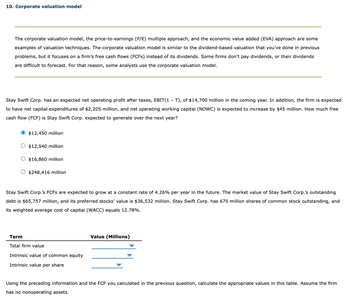

Transcribed Image Text:### 10. Corporate Valuation Model

---

The corporate valuation model, the price-to-earnings (P/E) multiple approach, and the economic value added (EVA) approach are some examples of valuation techniques. The corporate valuation model is similar to the dividend-based valuation that you've done in previous problems, but it focuses on a firm’s free cash flows (FCFs) instead of its dividends. Some firms don’t pay dividends, or their dividends are difficult to forecast. For that reason, some analysts use the corporate valuation model.

---

Stay Swift Corp. has an expected net operating profit after taxes, EBIT(1 – T), of $14,700 million in the coming year. In addition, the firm is expected to have net capital expenditures of $2,205 million, and net operating working capital (NOWC) is expected to increase by $45 million. How much free cash flow (FCF) is Stay Swift Corp. expected to generate over the next year?

- $12,450 million (selected)

- $12,540 million

- $16,860 million

- $248,416 million

---

Stay Swift Corp.'s FCFs are expected to grow at a constant rate of 4.26% per year in the future. The market value of Stay Swift Corp.’s outstanding debt is $65,757 million, and its preferred stocks’ value is $36,532 million. Stay Swift Corp. has 675 million shares of common stock outstanding, and its weighted average cost of capital (WACC) equals 12.78%.

---

#### Term and Value (Millions) Table

| Term | Value (Millions) |

|--------------------------------------|------------------|

| Total firm value | |

| Intrinsic value of common equity | |

| Intrinsic value per share | |

---

Using the preceding information and the FCF you calculated in the previous question, calculate the appropriate values in this table. Assume the firm has no nonoperating assets.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Tin Roof's net cash flows for the next three years are projected at $72,000, $78,000, and $84,000, respectively. After that the cash flows are expected to increase by 2.5 percent annually. Recently issued debt carries an interest rate of 7.85%. Tin Roof's marginal tax rate is 21%. The cost of equity is 11.4 percent. a) What is the value of the firm if it is financed with 40 percent debt and 60 percent equity? b) Tin Roof has 20,300 outstanding shares and are currently trading for $29.00 per share. At this price do you believe that Tin Roof shares are over priced, under priced or fairly priced. Please justify your answer. Please show excel formulas, Thank youarrow_forwardYou are considering an investment in Fields and Struthers, Inc., and want to evaluate the firm's free cash flow. From the income statement, you see that Fields and Struthers earned an EBIT of $64 million, had a tax rate of 21 percent, and its depreciation expense was $5 million. Fields and Struthers's NOPAT gross fixed assets increased by $30 million from 2020 and 2021. The firm's current assets increased by $26 million and spontaneous current liabilities increased by $15 million. Calculate Fields and Struthers's NOPAT operating cash flow for 2021. (Enter your answer in millions of dollars rounded to 2 decimal places.) Operating cash flow Calculate Fields and Struthers's NOPAT investment in operating capital for 2021. (Enter your answer in millions of dollars.) Investment in operating capital million Free cash flow Check my work million million Calculate Fields and Struthers's NOPAT free cash flow for 2021. (Enter your answer in millions of dollars rounded to 2 decimal places.)arrow_forwardKosm Inc. forecasts a positive Free Cash Flow for the coming year, with FCF1 = $10,000,000, and it expects a growth rate of 30% for the next two years. After Year 3, FCF is expected to grow at a constant rate of 4% forever. The Weighted Average Cost of Capital (WACC) is 11%, and the company has $65,000,000 of long-term debt (the remainder is comprised of common equity) and 10.0 million shares of common stock outstanding. What is the firm's estimated intrinsic value per share of common stock?arrow_forward

- Young & Liu Inc.'s free cash flow during the just-ended year (t = o) was $100 million, and FCF is expected to grow at a constant rate of 5% in the future. If the weighted average cost of capital is 15%, what is the firm's value of operations, in millions? a. $998 O b. $1,050 Oc$1,158 Od. $948 Oe. $1,103arrow_forwardA firm has Sales of $25,000,000, total assets of $22,000,000, current assets of $8,000,000, spontaneous liabilities of $5,000,000, a profit margin of 5 percent, a tax rate of 40%, and a dividend payout rate of 20 percent. Sales are expected to increase to $28,000,000 for the coming year, and the firm will need to increase its fixed assets at this level of sales (that is, fixed assets will increase proportionately with sales). Given this information, and using the equation approach, determine the additional funds needed for the coming year. O $950,000 O $1.010,000 Ⓒ$920.000 $980,000 O $1,040,000arrow_forwardA company is projected to generate revenues of $336 million and $406 million over the next two years. After that, the company is assumed to enter its terminal phase with steady growth. Given the following information, how much is each share worth today? Answer in dollars rounded to one decimal place. Forecasted operating margin: 35.4%. Forecasted tax rate: 22.2%. Forecasted reinvestment rate: 30%. Forecasted steady growth rate of free cash flow: 1.3% per year. Cost of capital: 13.2%. Debt: $40 million. Cash: $35 million. Shares outstanding: 12 million.arrow_forward

- MaxValue is expected to have EBIT of $1,500,000.00 one year from now. Because MaxValue is in a mature industry, the CEO expects the company's EBIT to grow at the stable growth rate of 2% per year forever. The firm's WACC is 9% and its corporate tax rate is 40%. Capital expenditures are 25% of EBIT while changes in networking capital is 10% of EBIT. Depreciation is 15% of EBIT. What is the value of the firm? a) $21,428,571.43 b) $8,742,857.14 c) $17,142,857.14 d) $8,571,428.57 e) $16,071,428.57arrow_forwardI need help with both questionsarrow_forwardJenBritt Incorporated had a free cash flow (FCF) of $72 million in 2019. The firm projects FCF of $205 million in 2020 and $480 million in 2021. FCF is expected to grow at a constant rate of 5% in 2022 and thereafter. The weighted average cost of capital is 10%. What is the current (i.e., beginning of 2020) value of operations? Do not round intermediate calculations. Enter your answer in millions. For example, an answer of $1 million should be entered as 1, not 1,000,000. Round your answer to two decimal places.arrow_forward

- Victoria Enterprises expects earnings before interest and taxes (EBIT) next year of $2.1 million. Its depreciation and capital expenditures will both be $286,000, and it expects its capital expenditures to always equal its depreciation. Its working capital will increase by $47,000 over the next year. Its tax rate is 35%. If its WACC is 10% and its FCFs are expected to increase at 5% per year in perpetuity, what is its enterprise value? The company's enterprise value is $ (Round to the nearest dollar.)arrow_forwardYou are valuing Soda City Inc. It has $129 million of debt, $79 million of cash, and 179 million shares outstanding. You estimate its cost of capital is 10.1%. You forecast that it will generate revenues of $723 million and $777 million over the next two years, after which it will grow at a stable rate in perpetuity. Projected operating profit margin is 31%, tax rate is 24%, reinvestment rate is 43%, and terminal EV/FCFF exit multiple at the end of year 2 is 11. What is your estimate of its share value? Round to one decimal place.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education