FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

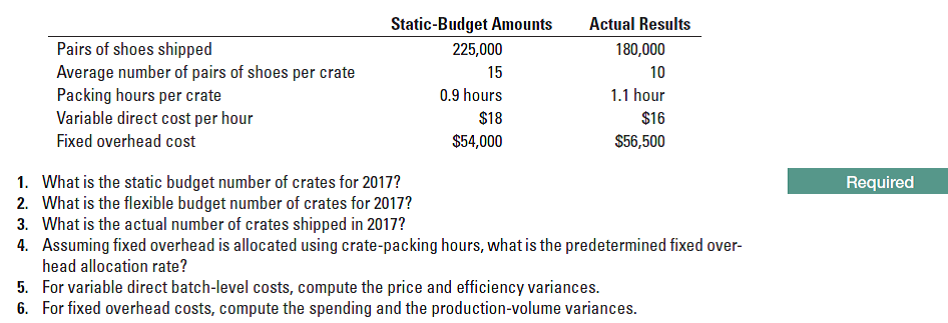

Activity-based costing, batch-level

Transcribed Image Text:Static-Budget Amounts

Actual Results

Pairs of shoes shipped

225,000

180,000

Average number of pairs of shoes per crate

Packing hours per crate

Variable direct cost per hour

Fixed overhead cost

15

10

0.9 hours

1.1 hour

$18

$16

$54,000

$56,500

1. What is the static budget number of crates for 2017?

2. What is the flexible budget number of crates for 2017?

3. What is the actual number of crates shipped in 2017?

4. Assuming fixed overhead is allocated using crate-packing hours, what is the predetermined fixed over-

head allocation rate?

Required

5. For variable direct batch-level costs, compute the price and efficiency variances.

6. For fixed overhead costs, compute the spending and the production-volume variances.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 10 steps with 10 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Dazzle Party is a small business that produces decorative balloons for events. Dazzle Party uses normal costing and assigns manufacturing overhead (MOH) costs using labour hours as the allocation base. Budgeted and actual production data for the year 2023 is provided below. Budget $60,000 120,000 Actual $52,000 MOH costs Labour-hours 110,000 Required: Calculate the difference between the allocated MOH cost and the actual MOH cost incurred in 2023. Clearly state whether this difference represents a case of under-allocation or over-allocation of MOH.arrow_forwardHardevarrow_forward● W S Required Information [The following information applies to the questions displayed below.] The Platter Valley factory of Bybee Industries manufactures field boots. The cost of each boot includes direct materials, direct labor, and manufacturing (factory) overhead. The firm traces all direct costs to products, and it assigns overhead cost to products based on direct labor hours. Required: 1. Compute the factory overhead flexible-budget variance, the factory overhead spending variance, and the efficiency variance for variable factory overhead for March and state whether each variance is favorable (F) or unfavorable (U). 2. Provide the appropriate journal entry to record the variable overhead spending variance and a second entry to record the variable overhead efficiency variance for March. Assume that the company uses a single account, Factory Overhead, to record overhead costs. The company budgeted $11,925 variable factory overhead cost, $96,750 for fixed factory overhead cost and…arrow_forward

- BARC Shannon Corporation manufactures custom cabinets for kitchens. It uses an actual costing system with two direct cost categories-direct materials and direct manufacturing labor-and one indirect-cost pool, manufacturing overhead costs. It provides the following information for 2017. E (Click the icon to view the information for 2017.) Read the requirement. Data table Begin by calculating the actual manufacturing overhead rate. (Assume the cost allocation base is direct labor hours.) Actual manufacturing Budgeted manufacturing overhead costs 1,368,000 overhead rate Budgeted direct manufacturing labor-hours 38.000 hours Actual manufacturing overhead costs 2$ 1,260,000 Actual direct manufacturing labor-hours 28,000 hours Print Donearrow_forwardPlease help me with all answers I will give upvote thankuarrow_forwardCosting methods and variances, comprehensive. Rob Kapito, the controller of Blackstar Paint Supply Company, has been exploring a variety of internal accounting systems. Rob hopes to get the input of Blackstar’s board of directors in choosing one. To prepare for his presentation to the board, Rob applies four different cost accounting methods to the rm’s operating data for 2017. The four methods are actual absorption costing, normal absorption costing, standard absorption costing, and standard variable costing. With the help of a junior accountant, Rob prepares the following alternative income statements:arrow_forward

- Pickul Awning manufactures awnings and uses a standard cost system. The company allocates overhead based on the number of direct labor hours. The following are the company's cost and standards data: (Click the icon to view the standards.) Requirement 1. Calculate the standard cost of one awning. Standard cost Direct materials Direct labor Variable MOH Fixed MOH Total standard cost Standard cost per unit Requirement 2a. Calculate the direct material variances. (Enter the variances as positive numbers. Enter currency amounts to the nearest cent and your answers to the nearest whole dollar. Label the variance as fa First determine the formula for the price variance, then compute the price variance for direct materials. Determine the formula for the quantity variance, then compute the quantity variance for direct materials. = DM price variance ) = First determine the formula for the efficiency variance, then compute the efficiency variance for direct labor. x( x( x ( x( = DM quantity…arrow_forwardPlease, look at image.arrow_forwardWhat is the actual number of crates shipped in 2017?arrow_forward

- Do not use chatgpt. Answer in step by step with explanation.arrow_forwardBulluck Corporation makes a product with the following standard costs: Direct materials Direct labor Variable overhead The company reported the following results concerning this product in July. Actual output Raw materials used in production Actual direct labor-hours Purchases of raw materials Actual price of raw materials purchased Actual direct labor rate Actual variable overhead rate The variable overhead efficiency variance for July is: Multiple Choice The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased. о C Standard Quantity or Hours 5.2 grams 0.7 hours 0.7 hours $851 F $874 U $874 F $851 U Standard Price or Rate $2.70 per gram $28.00 per hour. $ 3.70 per hour 4,700 units 13,070 grams 3,060 hours 13,800 grams $2.90 per gram $ 13.10 per hour $ 3.80 per hour.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education