FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Please do not give solution in image format thanku

Transcribed Image Text:Prepare a classified statement of financial position in good form. The numbers of authorized shares are as follows: unlimited common and 20,000 preferred. Assume that income tax

accounts, notes receivable, bank loan, and notes payable are short term, unless stated otherwise, and that the FV-NI investments are stated at fair value. (List Current Assets in order of

liquidity. List Property, Plant, and Equipment in order of Land, Buildings, and Equipment.)

Capital Shares

Current Assets

Current Liabilities

Long-Term Liabilities

Property, Plant, and Equipment

Shareholders' Equity

Total Assets

Total Current Assets

Total Current Liabilities

Total Liabilities

Total Liabilities and Shareholders' Equity

Total Long-Term Liabilities

Total Property, Plant, and Equipment

Total Shareholders' Equity

C

Pronghorn Inc.

Statement of Financial Position

Assets

LA

HAPP? VZEPT

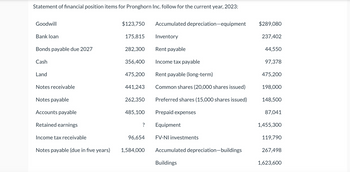

Transcribed Image Text:Statement of financial position items for Pronghorn Inc. follow for the current year, 2023:

Goodwill

Bank loan

Bonds payable due 2027

Cash

Land

Notes receivable

Notes payable

Accounts payable

Retained earnings

Income tax receivable

Notes payable (due in five years)

$123,750

175,815

282,300

356,400

475,200

441,243

262,350

485,100

?

96,654

1,584,000

Accumulated depreciation-equipment

Inventory

Rent payable

Income tax payable

Rent payable (long-term)

Common shares (20,000 shares issued)

Preferred shares (15,000 shares issued)

Prepaid expenses

Equipment

FV-NI investments

Accumulated depreciation-buildings

Buildings

$289,080

237,402

44,550

97,378

475,200

198,000

148,500

87,041

1,455,300

119,790

267,498

1,623,600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please don't use chat gpt and other ai other wise I give multiplie downvote Which of the following is sometimes called a currently attainable standard? O a. par b. normal standard O c. theoretical standard d. ideal standardarrow_forwardThe easiest way to change the order in a chart is in the __________. Multiple Choice underlying spreadsheet slicer chart options chart itselfarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education