ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

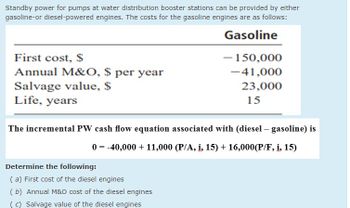

Transcribed Image Text:Standby power for pumps at water distribution booster stations can be provided by either

gasoline-or diesel-powered engines. The costs for the gasoline engines are as follows:

Gasoline

First cost, $

Annual M&O, $ per year

Salvage value, $

Life, years

- 150,000

-41,000

23,000

15

The incremental PW cash flow equation associated with (diesel – gasoline) is

0 = -40,000 + 11,000 (P/A, i, 15) + 16,000(P/F, i, 15)

Determine the following:

(a) First cost of the diesel engines

(b) Annual M&O cost of the diesel engines

(c) Salvage value of the diesel engines

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The capitalized cost (CC) of the given project whose Cash Flow diagram is given below is closest to:arrow_forwardA manufacturing company has the choice of two suppliers to buy a piece of equipment from to use in its process. Characteristics of these two suppliers and associated costs are tabulated below. The equipment from supplier A costs more to buy and maintain, but it also has more revenue per unit sold. Selling enough units will at some point make it worth the higher cost. How many units per year must the company sell in order to justify using supplier A (i.e. what is the breakeven number of units to sell)? Use an interest rate of 12% per year. Supplier A Supplier B Initial cost $4,000 $3,000 Sale price (revenue per unit) $4 $3 Transportation costs (per unit) $0 $1.25 Annual maintenance cost $1,400 $1,100 Salvage value $800 $700 Useful life of the equipment (years) 5 4arrow_forwardEquipment needed at Valero Corporation refinery for the conversion of corn stock toethanol, a cleaner burning gasoline additive, will cost $175,000 and have net cashflows of $35,000 the first year, increasing by $10,000 per year over the life of 5 years.Develop a spreadsheet chart that plots AW vs interest rate to show where (what interestrate) the project switches from financially justified to unjustified. Use AW as the verticalaxis of the chart, and interest (i) as the horizontal axis of the chart. Use a range ofinterest rates spanning from 10% to 20%, and use increments of 1%. Label both axesand use a title for the chart.arrow_forward

- The capitalized cost (CC) of the given project whose Cash Flow diagram is given below is closest to: = 10% per year 5 6 7 8 9 10 11 2 3 A= $2,000 PO=S30,000 C-55000 (Recurring every 5 y ears) C=55000 (Recurring every 5 years) Captalized Cost= ?arrow_forwardSince many U.S. Navy aircraft are at or near their usual retirement age of 30 years, military officials want a precise system to assess when aircraft should be taken out of service. A computational method developed at Carnegie Mellon maps in 3-D the microstructure of aircraft materials in their present state so that engineers can test them under different conditions of moisture, salt, dirt, etc. Military officials can then determine if an aircraft is fine, is in need of overhaul, or should be retired. If the 3-D system allows the Navy to use one airplane 2 years longer than it normally would have been used, thereby delaying the purchase of a $20 million aircraft for 2 years, what is the present worth of the assessment system at an interest rate of 8% per year?arrow_forward17) A professional photographer who specializes in wedding-related activities paid $24,800 for equipment that has a $2,000 estimated salvage value after five years. He estimates that his operating costs associated with hosting an event amount to $50 per day. If he charges $300 per day for his services, how many days (rounded up to the next integer) per year must he be employed in order to break even at an interest rate of 10% per year? (*arrow_forward

- A professional mechanics who specializes in truck engines paid $46,000 for equipment that will have a $4800 salvage value after 5 years. The costs with each usage amount to $60 per day. The income is $290 per day for his services, how many days per year must he be worked in order to break even at an interest rate of 7% per year?arrow_forwardRequired information Spectra Scientific of Santa Clara, California, manufactures Q-switched solid-state industrial lasers for LED substrate scribing and silicon wafer dicing. The company got a $72 million loan, amortized over a 7-year period at 8% per year interest. NOTE: This is a multi-part question. Once an answer is submitted, you will be unable to return to this part. What is the amount of the unrecovered balance immediately before the payment is made at the end of year 1. (Enter your answer in dollars and not in millions.) The amount of the unrecovered balance is $ 63930787.10arrow_forward1. The annual worth for years 1 through infinity of $75,000 now, $25,000 per year in years 1 through 15 and S40,000 per year in years 16 through infinity at a 10% interest per year is closest to: (a) $27,500 (b) $36,000 (c) $44,000 (d) $ 19,500 1. For the estimates in table below, calculate the equivalent annual cost of the project: First Cost, $ -950,000 Replacement Cost, year 2 AOC, $/ year Salvage value, $ -450,000 -600,000 175,000 Life, years 4 Interst Rate % 10arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education