Concept explainers

Preparing journal entries

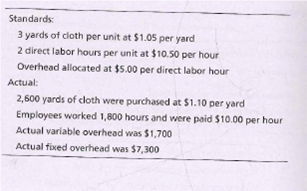

Marsh Company uses a

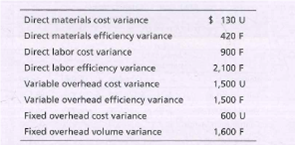

Marsh Company reported the following variances:

Marsh produced 1,000 units of finished product in 2018. Record the journal entries to record direct materials, direct labor, variable

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 5 images

- Please Do not Give image formatarrow_forwardPredetermined Overhead Rates, Overhead Variances, Unit Costs Primera Company produces two products and uses a predetermined overhead rate to apply overhead. Primera currently applies overhead using a plantwide rate based on direct labor hours. Consideration is being given to the use of departmental overhead rates where overhead would be applied on the basis of direct labor hours in Department 1 and on the basis of machine hours in Department 2. At the beginning of the year, the following estimates are provided: Department 1 Department 2 Direct labor hours 640,000 128,000 Machine hours 16,000 192,000 Overhead cost $384,000 $1,152,000 Actual results reported by department and product during the year are as follows: Department 1 Department 2 Direct labor hours 627,200 134,400 Machine hours 17,600 204,800 Overhead cost $400,000 $1,232,000 Product 1 Product 2…arrow_forwardButrico Manufacturing Corporation uses a standard cost system, records materials price variances when direct materials are purchased, and prorates all variances at year-end. Variances associated with direct materials are prorated based on the balances of direct materials in the appropriate accounts, and variances associated with direct labor and manufacturing overhead are prorated to Finished Goods Inventory and to Cost of Goods Sold (COGS) on the basis of the relative direct labor cost in these accounts at year- end. The following information is for the year ended December 31: The company had no beginning inventories and no ending Work-in-Process (WIP) Inventory. It applies manufacturing overhead at 80% of standard direct labor cost. Finished goods inventory at 12/31: Direct materials Direct labor Applied manufacturing overhead Direct materials inventory at 12/31 Cost of goods sold for the year ended 12/31: Direct materials Direct labor Applied manufacturing overhead Direct materials…arrow_forward

- In October, Pine Company reports 19,400 actual direct labor hours, and it incurs $122,380 of manufacturing overhead costs Standard hours allowed for the work done is 21,100 hours. The predetermined overhead rate is $5.75 per direct labor hour. Compute the total overhead variance Total Overhead Variancearrow_forwardPlease do not give solution in image format thankuarrow_forwardhd.11.arrow_forward

- Get the Answerarrow_forwardElm Industries uses a standard cost accounting system. During the month of May, Elm's actual total direct labor costs are $51,450. The direct labor rate variance is $1,800 unfavorable, and the direct labor efficiency variance is $750 favorable. What is the total amount of direct labor costs that Elm applies to its work in process inventory for the month of May? O $50,400 O $51,450 O $52,500 $53,250 O None of the abovearrow_forwardAmada Company's standard cost system reports this information from its December operations. Standard direct materials cost Direct materials quantity variance Direct materials price variance Actual direct labor cost Direct labor efficiency variance Direct labor rate variance Actual overhead cost Volume variance Controllable variance View transaction list Journal entry worksheet 1 Required: 1. Prepare December 31 journal entries to record the company's costs and variances for the month for (a) direct materials, (b) direct labor, and (c) overhead. Ignore the journal entry to close the variances. 2 3 Record direct materials costs and variances. Date December 31 Note: Enter debits before credits. $ 100,000 General Journal 3,000 U 500 F 90,000 7,000 F 1,200 U 375,000 12,000 U 9,000 U Debit Credit >arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education