Question

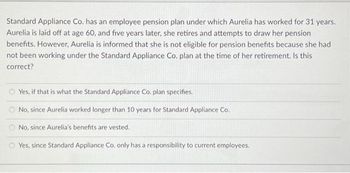

Transcribed Image Text:Standard Appliance Co. has an employee pension plan under which Aurelia has worked for 31 years.

Aurelia is laid off at age 60, and five years later, she retires and attempts to draw her pension

benefits. However, Aurelia is informed that she is not eligible for pension benefits because she had

not been working under the Standard Appliance Co. plan at the time of her retirement. Is this

correct?

Yes, if that is what the Standard Appliance Co. plan specifies.

No, since Aurelia worked longer than 10 years for Standard Appliance Co.

No, since Aurelia's benefits are vested.

Yes, since Standard Appliance Co, only has a responsibility to current employees.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- The insured is covered under O.A.P. 1 Owner’s Policy including Direct Compensation-Property Damage and is involved in an accident in Ontario with an automobile, for which he/she is not at fault. His/her car is severely damaged and personal belongings in the car are destroyed. Which one (1) of the following statements is correct? O A) Damage to the insured's car and reimbursement for a rental vehicle are covered by the third party’s policy. O B) Damage to the insured’s car, replacement of destroyed personal belongings and reimbursement for a rental vehicle are covered by the insured’s policy, less the policy deductible. O C) Damage to the insured’s car, replacement of destroyed personal belongings and reimbursement for a rental vehicle are covered by the third party's policy. O D) Only damage to the insured’s car and reimbursement for a rental vehicle are covered by the insured's policy.arrow_forwardLou-anne is a member of her employer's registered pension plan. Her employer contributed $5,000 to the plan; Lou-anne contributed $2,500. What statement is true? O a) Lou-anne can deduct her contribution from her taxable income; she must include her employer's contribution in her income. O b) Lou-anne can deduct her contribution from her taxable income; her employer's contribution is not considered a taxable benefit. Oc) Lou-anne cannot deduct her contribution from her taxable income; her employer's contribution is not considered a taxable benefit. Od) Lou-anne cannot deduct her contribution from her taxable income; her employer's contribution is considered a taxable benefit.arrow_forwardBased on your knowledge of contracts from your reading this week, discuss the following case. Be sure to support your view with the facts and the law.Maurice is an accountant who works for the firm of Addum, Upp, &Paymee. Maurice was approached by Shirley Eugest, who represents one of Addum’s competitors, BeanCounters, Inc. Maurice was offered a substantial raise to leave his company and work for BeanCounters. When Maurice’s boss heard this he called him in and said, “If you stay with us, I promise that next year you will receive a promotion with a 50% raise, and a 5-year contract.†Maurice turned down the offer from BeanCounters and stayed with Addum. Nine months later Maurice was dismissed due to corporate downsizing. Can Maurice legally enforce his boss’s promise? What theory or theories would Maurice use? Discuss fully.Topic 22. Read the scenario set out below and discuss the questions that follow it:Art…arrow_forward

- If Barney’s employer withholds $11,928 for federal taxes, which is 14% of his gross annual salary, then would Barney owe additional taxes by April 15th of the next year or would he receive a refund, and in either case, by how much?arrow_forwardYou have a job bidding provision in the contract which says. Vacancies in bargaining unit positions shall be posted for seven (7) days. All bids filed with the posting period shall be considered. If qualifications are relatively equal, the more senior bidder shall be granted the position, provided, however, that employees granted a position hereunder shall be ineligible to be granted a new position for one year from the date of promotion. You hire an external applicant who is far better than the senior bidder. Under what circumstances could you hire the outside applicant under this language. What argument would you expect the union to make? What would you expect the union to say if you offered to grant the next vacancy to the senior person denied the position and why?arrow_forwardPisey needs $ 8,000 for her pig farm. After Sisey Pisey told her about the $ 8,000 she needed, the bank said she had collateral, such as a house, because borrowing, in principle, requires the bank to have collateral? Sister Pisey says I mortgaged the title deed to get a $ 8,000 loan from the bank. The bank assessed the land and told Pisey to borrow $ 25,000 (by submitting the land title), otherwise the bank would not lend her $ 25,000, not $ 8. $ 000) Do you agree? Sister Pisey said that I only need $ 8,000, $ 25,000 is more than I need! The bank said it was likely to force her to borrow $ 25,000 ... Finally, Pisey gave up the loan, fearing that the bank would not be able to confiscate land worth more than 25,000. Dollars. How do students understand the situation? Delay. As a Business Managerarrow_forward

- The personal feature of property insurance contracts means that: * A) subrogation always applies B) ambiguities in the wording will always be construed against the insurer C) insurance contracts cannot be freely transferred to other parties D) the buyer of insurance must have insurable interest in property before the policy is issuedarrow_forward1. A person with a disability has applied for a job with an employer who is subject to the ADA. The job applicant has the knowledge and experience required for the job and is the most qualified candidate. However, because of a disability, the applicant would need additional equipment, including an adjustable desk and an adapted keyboard and mouse, to perform the job. What kind of accommodations does the ADA require the employer to make? a) The employer must purchase the additional equipment so that the employee can do the job. b) The employer can hire a person who can do the job without adaptive equipment, even if that person is less qualified. c) The employer can hire the person, but require that they provide their own adaptive desk, keyboard, and mouse. d) The employer must make any accommodation the person requires to do the job, even if it presents a hardship for the employer. 2. Armand lives in a group home. He stays in his room almost all day, every day. The staff…arrow_forwardWhat are some examples of material facts that must be disclosed in connection with the purchase or sale of a security?arrow_forward

- Olivia pays an expensive fee to a sales associate in exchange for rental information. What must happen in order for Olivia to qualify for a refund? She must attend small claims court. She must ask for a refund within 60 days. She must fail to attain a rental unit. She must seek out an attorney.arrow_forwardJoe took out a loan to purchase a new house. In return, Joe's lender placed a lien on the property. Is this legal? O No. Only Joe can place a lien his property. O No. A lender is never allowed to place a lien on a property as long as the borrower is up-to-date ontheir payments. О Yes. This is a voluntary mortgage lien that allows the lender to foreclose on the property if Joe defaults on the loan. O Yes. However, the lien is only valid for 12 months.arrow_forwardThe Acme Electric Company worked day and night to develop a new current regulator designed to cut the electric power consumption in aluminum plants by 35%. They knew that, although the competition was fierce, their regulator could be produced more cheaply, was more reliable, and worked more efficiently than the competitors’ products. The owner, eager to capture the market, personally but somewhat hastily put together a 120-page proposal to the three major aluminum manufacturers, recommending that their regulators be installed at all company plants. She devoted the first 87 pages of the proposal to the mathematical theory and engineering design behind his new regulator, and the next 32 to descriptions of the new assembly line she planned to set up to produce regulators quickly. Buried in an appendix were the test results that compared her regulator’s performance with present models, and a poorly drawn graph showed how much the dollar savings would be. Acme Electric didn’t get the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios