FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

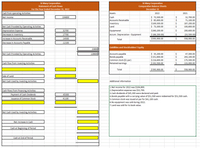

Having some issues with the empty fields for the Statement of Cash. I figured out most of the titles and need some assistance with the remaining fields. Provided are copies of my spreadsheet and the other information.

Transcribed Image Text:St Mary Corporation

St Mary Corporation

Comparative Balance Sheets

Statement of Cash Flows

For the Year Ended December 31, 2022

December 31

Cash from operating Activities

Assets

2022

2021

Cash

Accounts Receivable

Inventory

Land

$ 73,500.00

$ 85,600.00

$169,500.00

$ 73,300.00

Net Income

104800

32,700.00

71,100.00

187,200.00

Net Cash Provided by Operating Activities

100,800.00

Depreciation Expense

Equipmenet

Accum. Depreciation - Equipment

32700

$260,200.00

200,600.00

Decrease in Inventory

17700

$ (66,200.00)

(33,500.00)

Increase in Accounts Receivable

-14500

Total

$595,900.00

558,900.00

Decrease in Accounts Payable

-12100

Liabilities and Stockholders' Equity

23800

Accounts payable

Bonds payable

Common stock ($1 par)

Retained earnings

Net Cash Provided by Operating Activities

$ 35,200.00

$151,600.00

$216,600.00

128600

47,300.00

203,100.00

175,500.00

Cash Flow from Investing Activities

$192,500.00

133,000.00

Total

$ 595,900.00

558,900.00

Sale of Land

Net Cash Used by Investing Activities

Additional Information

1.Net income for 2022 was $104,800.

2.Depreciation expense was $32,700.

3.Cash dividends of $45,300 were declared and paid.

4.Bonds payable with a carrying value of $51,500 were redeemed for $51,500 cash.

5.Common stock was issued at par for $41,100 cash.

6.No equipment was sold during 2022.

7.Land was sold for its book value.

Cash Flows from Financing Activities

Payment of Cash Dividends

-45300

Issuance of Common Stock

41100

Net Cash Used by Investing Activities

Net Increase in Cash

Cash at Beginning of Period

Cash at End of Period

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- If a cash payments journal is supposed to save time spent writing, why are there so many entries in the Other Accounts Debit column?arrow_forwardHow do you record a debit card purchase in Quickbooks? A. Use the Enter Bills window to enter the information, then immediately go to the Pay Bills window and prepare th check. B. Prepare a journal entry to debit the expense account of the purchase and credit cash. C. Wait until you do the bank reconciliation and enter one journal entry for all of your debit card purchases. D. Using the Write Checks window, in the No. field,type “Debit.” Enter the vendor name and amount in the check area.arrow_forwardis the answer to this question correct If you received a check from Mr. Jones for $500 for work you performed last week, which journal would you use to record receipt of the amount they owed you? What would be recorded? This transaction will be recorded in the Cash Receipts Journal. The receipt of cash from the sale of goods, as payment on accounts receivable or from other transactions, is recorded in a cash receipts journal with a debit to cash and a credit to the source of the cash, whether that is from sales revenue, payment on an account receivable, or some other account. Chapter 7 Accounting Information Systems out of Principles of Accounting, Volume 1. CASH RECEIPTS JOURNAL Date Account Cash DR Accounts Receivable CR 2022 Mar.13 Mr. Jones $ 500 $ 500arrow_forward

- What are the four accounts that are typically affected by cash transactions. Please use the following illustration to help you answer this question.arrow_forwardHello, How do I solve this? Thanksarrow_forwardhow To do the following following in sage300 ? add a source code for each of the following types of transactions: a) GL-CR Cash Receipts b) GL-CD Cash Disbursements c) GL-BK Bank Charges d) GL-SA Sales Journal e) GL-SU Setup f) GL-PU Purchases Create the following Source Journal Profile: Profile: Bank Reconciliation Source Codes: Cash Receipts Cash Disbursements Bank Chargesarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education