FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

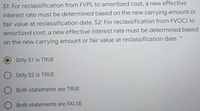

Transcribed Image Text:S1: For reclassification from FVPL to amortized cost, a new effective

interest rate must be determined based on the new carrying amount or

fair value at reclassification date. S2: For reclassification from FVOCI to

amortized cost, a new effective interest rate must be determined based

on the new carrying amount or fair value at reclassification date.

Only S1 is TRUE

O Only S2 is TRUE

Both statements are TRUE

Both statements are FALSE

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- [S1] An investor should buy an asset when it is undervalued and sell the asset when it is overvalued. [S2] An investor should hold onto an investment when it is expected to appreciate in value.a. Only S1 is true.b. Only S2 is true.c. Both are true.d. Both are false.arrow_forwardThe forward contract value today is denoted as a.Vo(0,T) b.Fo(0,T) c.So(1 + r)^T d.Fo(0,T)/(1 + r)^(T – t)arrow_forwardt29arrow_forward

- 1) Impairment affects the historical cost of a liability over time. 2) Inflation affects the historical cost of a liability over time. a. both statements are true b. both statements are false c. 1st statement is true, 2nd is false d. 1st statement is false, 2nd is truearrow_forward34. The following statements are correct, except a. A liability will be reported at less than its maturity amount prior to the maturity date if the stated rate of interest on the liability is higher than the market rate of interest. b. A liability is created because of the acquisition of an asset, payment of another liability, incurrence of an expense, declaration of cash or property dividend, a loss, or a revenue collected in advance. In all cases, each of these “causes” usually provides the basis for measuring the liability. c. Accounts payable with customary term of 18 months is classified as current liability. d. Most liabilities have stated and effective interest rates that are the same; in such a situation the principal, face, and maturity amounts are all the same.arrow_forward10. Theoretically, unearned items (deferred revenues) should not be classified as a. deferred creditsb. contra to certain assetsc. long-term liabilitiesd. current liabilitiesarrow_forward

- 15.1 Liabilities liquidated is measured at: Group of answer choices None of the choices Realizable value Actual settlement amount Book valuearrow_forwardOn the balance sheet date, the book value (or carrying value) of an asset should always equal the asset's fair value. Select one: True Falsearrow_forward4. The order of the 'fair value hierarchy' nominated by the FASB's SFAS 157 is: i. Quoted prices for similar assets or liabilities in active markets, adjusted ii. Quoted prices for identical assets and liabilities in active reference markets, unadjusted iii. Multiple valuation techniques consistent with the market, income and cost approaches a. Levels ii, i, iii b. b. Levels i, ii, iii c. Levels iii, ii, i d. Levels ii, iii, itarrow_forward

- 18. Which of the following statements is false? Select one: a. Simple interest relates to present value whereas compound interest relates to future value b. Simple interest relates to future value whereas compound interest relates to present value c. Simple interest applies when an investor receives payments and compound interest applies when an investor makes payments d. All of the abovearrow_forwardVikrambahiarrow_forward(;). » - ( ) Consider two assets: rı = 3 If the asset prices are q1 = 1, q2 = 2 () 1+ a respectively, does the price of an asset with returns 1 in the two states - a. = 1 - a satisfy the no arbitrage property? (Record your answer as respectively, q 'True' (=yes) or 'False' (=no).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education