FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

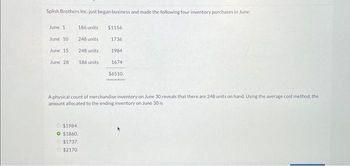

Transcribed Image Text:Splish Brothers Inc. just began business and made the following four inventory purchases in June:

June 1

June 10

June 15

June 28

186 units

248 units

248 units

186 units

$1984.

O $1860.

$1737.

$2170

$1116

1736

1984

1674

$6510.

A physical count of merchandise inventory on June 30 reveals that there are 248 units on hand. Using the average cost method, the

amount allocated to the ending inventory on June 30 is

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Swifty Corporation just began business and made the following four inventory purchases in June: June 1 123 units $738 June 10 164 units 1148 June 15 164 units 1312 June 28 123 units 1107 $4305 A physical count of merchandise inventory on June 30 reveals that there are 156 units on hand. Using the average cost method, the amount allocated to the ending inventory on June 30 is $1371. $1093. $1248. O $1170.arrow_forwardLewis Enterprises began business on April 1 and made the following four inventory purchases in April: April1 April 9 April 15 April 26 Totals: Units Purchased 150 units 200 units 250 units 400 units 1,000 units Unit Cost $5.20 $5.85 $6.40 $6.60 Total Cost $780 1.170 1,600 2,640 $6,190 A physical count of inventory on April 30 reveals that there are 650 units on hand. Use the Average Cost method to calculate April's cost of Cost of Goods Sold. (Round your average cost per unit to two decimal places. Include two decimals in your answer even if your answer is a whole number. For example, if your answer is 1,500, enter 1,500.00. Do NOT include a $ sign.) (See your Unit 4 notes, page 5)arrow_forwardAshley's Art Supplies began business on March 1 and made the following four inventory purchases in March: March 1 March 9 March 15 March 26 Totals: X Units Purchased 150 units 200 units 200 units 150 units 700 units 2,895 Unit Cost $5.20 $5.85 $6.30 $6.80 Total Cost $ 780 A physical count of inventory on March 31 reveals that there are 200 units on hand. Use the FIFO inventory method to calculate the Cost of Goods Sold for March. (Include two decimals in your answer even if your answer is a whole number. For example, if your answer is 1,500, enter 1,500.00. Do NOT include a $ sign.) (See your Unit 4 notes, page 3) 1,170 1,260 1,020 $4,230arrow_forward

- Oriole Company uses a periodic inventory system and reports the following for the month of June. Date June 1 12 23 30 Explanation Units Inventory Purchase Purchase Inventory Cost of the ending inventory 130 Cost of goods sold 400 210 212 $ Unit Cost $ $5 6 7 Compute the cost of the ending inventory and the cost of goods sold under FIFO, LIFO, and average-cost. (Round per unit cost to 3 decimal places, e.g. 15.647 and final answers to O decimal places, e.g. 5,125.) Total Cost FIFO $650 2,400 1,470 $ $ LIFO $ $ Average-costarrow_forwardPharoah Company just began business and made the following four inventory purchases in June: June 1 192 units $1152 June 10 256 units 1792 June 15 256 units 2048 June 28 192 units 1728 $6720 A physical count of merchandise inventory on June 30 reveals that there are 256 units on hand. Using the LIFO inventory method, the value of the ending inventory on June 30 isarrow_forwardAyayai Corp. just began business and made the following four inventory purchases in June: June 1 195 units $1170 June 10 260 units 1820 June 15 260 units 2080 June 28 195 units 1755 $6825 A physical count of merchandise inventory on June 30 reveals that there are 260 units on hand. Using the FIFO inventory method, the amount allocated to ending inventory for June isarrow_forward

- The units of Manganese Plus available for sale during the year were as follows: Mar. 1 Inventory 24 units @ $32 $768 June 16 Purchase 28 units @ $30 840 Nov. 28 Purchase 46 units @ $37 1,702 98 units $3,310 There are 12 units of the product in the physical inventory at November 30. The periodic inventory system is used. a. Determine the inventory cost using the FIFO method. b. Determine the inventory cost using the LIFO method. c. Determine the inventory cost using the weighted average cost methods. Round interim calculations and final answer to two decimal places.arrow_forwardCoronado has the following inventory information. July 1 Beginning Inventory 20 units at $20 $400 7 Purchases 50 units at $19 950 22 Purchases 10 units at $20 200 $1550 A physical count of merchandise inventory on July 31 reveals that there are 30 units on hand. Using the FIFO inventory method, the amount allocated to cost of goods sold for July is $1020. $970. $977. $996.arrow_forwardWan Tan Corp. made the following four inventory purchases in June: June 1 150 units $5.20 June 10 200 units $5.85 June 15 200 units $6.30 June 28 150 units $6.60 On June 22, 450 units were sold. The company uses the perpetual inventory system and the weighted average to value the inventory. Calculate the cost of goods sold for the sale. Round to the nearest whole dollar. Select one: a. $2,580 b. $2,628 c. $2,700 d. $1,572arrow_forward

- Concord has the following inventory information. July 1 Beginning Inventory 30 units at $15 90 units at $23 7 Purchases 22 Purchases 10 units at $20 O $2060. O $2090. O $2270. O $2173. $450 2070 200 $2720 A physical count of merchandise inventory on July 31 reveals that there are 30 units on hand. Using the FIFO inventory method, the amount allocated to cost of goods sold for July isarrow_forwardSunland has the following inventory information. July 1 Beginning Inventory 15 units at $270 $18 7 Purchases 75 units at $21 1575 22 Purchases 10 units at $23 230 $2075 A physical count of merchandise inventory on July 31 reveals that there are 40 units on hand. Using the LIFO inventory method, the amount allocated to cost of goods sold for July is O $1280. O $1230. $1256. O $1237.arrow_forwardAmsterdam Company uses a periodic inventory system. For April, when the company sold 600 units, the following information is available Unit Cost Units Total Cost 250 10 $2,500 April 1 Inventory April 15 Purchase 400 12 4,800 13 4,550 April 23 Purchase Compute the April 30 Cost of goods sold Balance utilizing the average cost method. 350arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education