FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

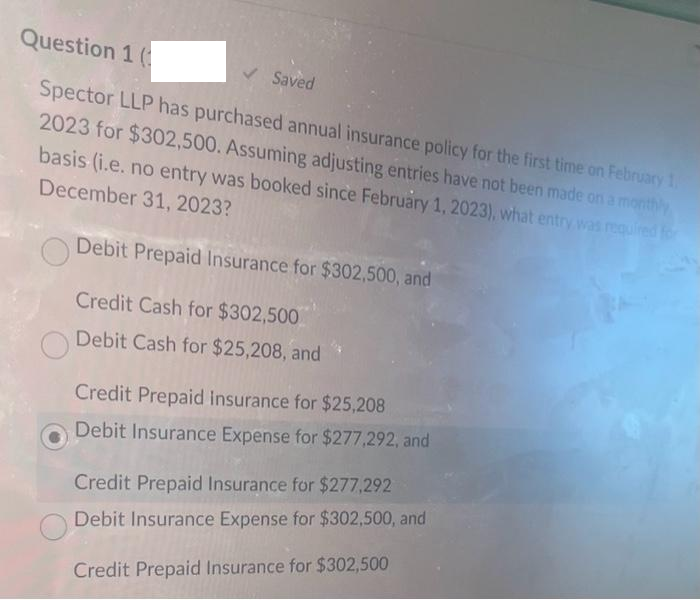

Question 1 ✓ Saved Spector LLP has purchased annual insurance policy for the first time on February 1, 2023 for $302,500. Assuming adjusting entries have not been made on a monthly basis (i.e. no entry was booked since February 1, 2023), what entry was required for December 31, 2023? Debit Prepaid Insurance for $302,500, and Credit Cash for $302,500 Debit Cash for $25,208, and Credit Prepaid insurance for $25,208 Debit Insurance Expense for $277,292, and Credit Prepaid Insurance for $277,292 Debit Insurance Expense for $302,500, and Credit Prepaid Insurance for $302,500

if not clear

Transcribed Image Text:Question 1 (

Spector LLP has purchased annual insurance policy for the first time on February 1,

2023 for $302,500. Assuming adjusting entries have not been made on a monthly

basis (i.e. no entry was booked since February 1, 2023), what entry was required for

December 31, 2023?

Debit Prepaid Insurance for $302,500, and

Credit Cash for $302,500

Debit Cash for $25,208, and

✓ Saved

Credit Prepaid insurance for $25,208

Debit Insurance Expense for $277,292, and

Credit Prepaid Insurance for $277,292

Debit Insurance Expense for $302,500, and

Credit Prepaid Insurance for $302,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- HANDOUT PROBLEM for CURRENT LIABILITIES I. Prepare journal entries for the following chronological transactions and a. You sold merchandise on account for $250,000 on account. The products cost $110,000. Your company uses a perpetual inventory system. Your sales included a two-year warranty on the product. spent $1,400 to repair products in part "a." which were under warranty. b. You с. On December 31, 2021, you estimated that there would be an additional $8,000 of repairs on products in part "a." You estimated that $5.000 of the repairs would occur in 2022. In 2022, you performed $4,800 of repairs on products from part "a." and $1,920 of repairs on products sold in 2022. On December 31, 2022, you estimated that repairs on products sold in 2021 d. e. would be an additional $3,500 and for products sold in 2022 would be an additional $9,000. You believe that $5,400 of the $9,000 of repairs would occur in 2023. II. Based upon the transaction above, determine the amount of current…arrow_forwardProblem 1 Kecord the transactions in the general Journal of Martin Tool Company. Martin closes its books on December 31 2021 Martin Tool Company received a $14,000, 12-month 12% note receivable in exchange for an outstanding account from John Glenn. May 1 Dec. 31 Accrued interest revenue on the note fort the 8 months (May 1- Dec. 31, 2021) 2022 May 1 Received principal plus interest on the John Glenn note. (No interest revenue has been recorded for the 4 months (January 1- Mayl, 2022) Мay 1. 2021. 6, Jets Company re et the 20 of the erchand ed $47,000. Dec. 31. 2021. May 1. 2022 Company recei ceived the alcearrow_forwardOn October 1, 2023 PT. Leci borrowed $500,000 from Pineapple Bank by signing a 10-month, 6% note. If on December 31 PT. Leci makes adjusting entries, then on August 1, 2024 what is the amount of interest expense recorded by PT. Lychee when paying off the notes? a. 17.500 b. 21 000 c. 9.000 d. 30.000 e. 7.500arrow_forward

- 7arrow_forwardA8arrow_forwardNet revenues Standard warranty liability, end of year 158 Charges incurred during the year 163 Extended warranty deferred revenue, end of year 573 Revenue deferred for new extended warranty contracts 260 Warranty expense Required: 1. Compute the amount of warranty expense for 2017 and 2018. (Enter your answers in millions of dollars.) No 1 View transaction list View journal entry worksheet 2 2018 2. Prepare journal entries to record both the warranty expense for 2018 and the payments made under the warranty during the year. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions of dollars.) Transaction A 2017 B 2018 2017 2016 $81,591 $81, 139 $81,919 192 205 606 307 Warranty expense Estimated warranty liability Estimated warranty liability Cash 196 204 571 303 General Journal Debit Credit Ⓒarrow_forward

- Do a journal entry based on this transections, round interest amounts to the nearest dollar,arrow_forwardView Policies Current Attempt in Progress Windsor Industries borrows $18800 at 8% annual interest for six months on October 1, 2022. Which is the appropriate entry to accrue interest if Windsor employs a December 31, 2022, fıscal year? O Dr Interest Expense $1504 Cr Interest Payable $1504 O Dr Interest Expense $376 Cr Interest Payable $376 O Dr Interest Expense $376 Cr Notes Payable $376 O Dr Notes Payable $1504 Cr Interest Payable $1504 Save for Later Attempts: 0 of 1 used Submit Answerarrow_forwardQUESTION 11 On August 1, 2024, a company lends cash and accepts a $15,000 note receivable that offers 14% interest and is due in nine months. How would the company record the year-end adjusting entry to accrue interest in 2024? (Do not round intermediate calculations. Round your answer to the nearest dollar amount.) O Interest Revenue esc O Interest Receivable. ption Interest Receivable. O Interest Receivable PI Interest Revenue Interest Receivable Interest Revenue. O Interest Revenue 1 A Interest Revenue. Click Save and Submit to save and submit. Click Save All Answers to save all answers. N Interest Receivable p #1 2 W S P 12 command X # 3 E D 8.0 C $ 4 a FA R F 07 20 5 V 2,100 4 FS 875 T 945 875 945 G 0) > A 6 B & F6 875 2,100 Y 945 875 MacBook Air 945 H & 7 8 F7 U N * 8 J DII FB I M ( 9 K DO F9 O < . O L 4 Save All Answers F10 P command I' V 4 I FIL optarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education