FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

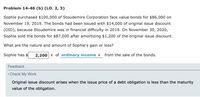

Transcribed Image Text:Problem 14-46 (b) (LO. 2, 3)

Sophie purchased $100,000 of Stoudemire Corporation face value bonds for $86,000 on

November 19, 2019. The bonds had been issued with $14,000 of original issue discount

(OID), because Stoudemire was in financial difficulty in 2019. On November 30, 202o,

Sophie sold the bonds for $87,000 after amortizing $1,200 of the original issue discount.

What are the nature and amount of Sophie's gain or loss?

2,200 x of ordinary income x from the sale of the bonds.

Feedback

Check My Work

Original issue discount arises when the issue price of a debt obligation is less than the maturity

value of the obligation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- K purchased all 100 shares of N Corporation in 2008 for $50,000.N Corporation adopts a plan of liquidation on January 1, 2017.On May 1, 2017, N sells its only asset, land, for $10,000 cash and an installment note with a face amount and fair market value of $90,000.On January 8, 2018, N distributes the cash and note to K.On her 2017 tax return, K will report the following as gain or loss from the liquidation.(Assume no collections on the installment note during 2017) A)$0B)$5,000C)$50,000D)$100,000arrow_forwardOn December 28, 2020, Kramer sells 150 shares of Lavender, Inc. stock for $77,000. On January 10, 2021, he purchases 100 shares of the same stock for $82,000. a. Assuming that Kramer's adjusted basis for the stock sold is $65,000, what is his recognized gain or loss? Kramer's recognized gain is $12,000. What is his basis for the new shares? His basis for the new shares is $82,000. b. Assuming that Kramer's adjusted basis for the stock sold is $89,000, what is his recognized gain or loss? Kramer's recognized loss is $_________. (Side note: 12,000 and -12,000 is wrong) What is his basis for the new shares? His basis for the new shares is $90,000.arrow_forwardJohn bought 1,000 shares of intel stock on October 18,2015, for $30 per share, plus a $750 commission he paid to his broker. On December 12, 2019, he sold the shares for $42.50 per share. He also incurred a $1,000 fee for this transaction. 1. What is John's adjusted basis in the 1,000 shares of intel stock? 2. What amount does John realize when he sells the 1,000 shares ? 3. What is the gain or loss for John on sale of his intel stock? 4. What is the character of the gain or loss?arrow_forward

- 1. Billy sells stock for $25,000 on August 30, 2021. Billy's adjusted basis is the stock is $18,000. a. If Billy acquired the stock on December 31, 2016, calculate the amount and nature of the gain b. If Billy acquired the stock on September 30, 2020, calculate the amount and nature of the gainarrow_forwardOn January 1, 2020, Leo paid $15,000 for 5 percent of the stock in BLS, an S corporation. In November, he loaned $8,000 to BLS in return for a promissory note. BLS generated a $600,000 operating loss in 2020. BLS generated $220,000 ordinary business income in 2020. In 2022, BLS repaid its $8,000 debt to Leo before he restored any basis in the debt. A) How much gain or loss, if any, will Leo recognize as a result of the debt repayment?arrow_forwardTonia acquires the following 5-year class property in 2019: Asset Date of Acquisition Cost X January 15 $ 70,000 Y May 28 45,000 Z November 23 90,000 Total $ 205,000 Tonia does not elect §179 or bonus depreciation. Tonia has $300,000 of taxable income from her business. Determine her total cost recovery deduction for the year.arrow_forward

- ohn purchased a 150-day $500,000 bank bill (at a simple interest rate) on 15 July 2021. The purchase price was $490,550. He sold this bank bill on 13 August 2021. (b) Assume that John sold this bank bill at a simple interest rate of 3.17% p.a. up to the maturity date of the above bank bill. What is the annualised (simple interest) yield for this investment from 15 July 2021 to 13 August 2021? Round your answer to 3 decimal places in terms of percentage. a. 9.924% b. 10.905% c. 11.182% d. 10.647%arrow_forwardRequired: Showing workings and citations, calculate Greg's Net Capital Gain or Loss. If the 50% discount applies, please state that this is the case and apply it without going into details about the requirements for the discount applying . Greg made the following acquisitions on 20 June 2019: • An antique desk for use in his home dining room $1100 • Shares in Bus Ltd for $40,000 • Shares in Nok Ltd for $80,000. During the current tax year on 10 January 2022, Greg sold these items as follows: • The antique desk for $300 • Shares in Bus Ltd for $60,000 • Shares in Nok Ltd for $70,00arrow_forwardMr. Z purchased 100 units of a private company's shares for $450 in 2020. If he sold the 100 units for $600 in 2021. What is the capital gain or loss on his disposition in 2021? Question 3 options: a) $150 gain b) $75 gain c) $450 loss d) $150 lossarrow_forward

- Dennis sells short 475 shares of ARC stock at $112 per share on January 15, 2019. He buys 950 shares of ARC stock on April 1, 2019, at $140 per share. On May 2, 2019, Dennis closes the short sale by delivering 475 of the shares purchased on April 1. a. What are the amount and nature of the loss upon closing the short sale? Dennis has loss in the amount of $ b. When does the holding period for the remaining shares begin? The holding period for the remaining shares begins on c. If Dennis sells (at $154 per share) the remaining 475 shares on January 20, 2020, what will be the nature of his gain or loss? Dennis has in the amount of $arrow_forwardOn September 6, 2016, Andrew, who is married, purchased Allstar Corporation stock for $220,000 from the corporation. The Allstar Corporation’s stock qualified as Section 1244 stock. On November 20, 2019, Andrew sold the Allstar stock for $100,000. How should Andrew report his realized gain or loss on the sale of the Allstar Corporation stock? Question 2 options: a) Andrew realized a $120,000 long term capital loss. b) Andrew realized a $50,000 Section 1244 ordinary loss and a $70,000 long term capital loss. c) Andrew realized a $100,000 Section 1244 ordinary loss and a $20,000 long term capital loss. d) Andrew realized a $120,000 Section 1244 ordinary loss.arrow_forwardOn September 1, 2020, Elizabeth bought a $10,000 three-year bond that pays 9% interest per year, compounded yearly. No interest is received until the maturity date of the bond on August 31, 2023. Which one of the following statements is correct, assuming the figure is rounded to the nearest dollar? (Show Calculations) (a) In 2020, Elizabeth must report $300 of interest income. (b) In 2021, Elizabeth must report $927 of interest income. (c) In 2022, Elizabeth must report $981 of interest income. (d) In 2023, Elizabeth must report all interest earned on the bond.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education