ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

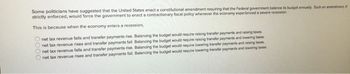

Transcribed Image Text:Some politicians have suggested that the United States enact a constitutional amendment requiring that the Federal government balance its budget annually. Such an amendment, f

strictly enforced, would force the government to enact a contractionary fiscal policy whenever the economy experienced a severe recession.

This is because when the economy enters a recession,

0000

net tax revenue falls and transfer payments rise. Balancing the budget would require raising transfer payments and raising taxes.

net tax revenue rises and transfer payments fall. Balancing the budget would require raising transfer payments and lowering taxes.

net tax revenue falls and transfer payments rise. Balancing the budget would require lowering transfer payments and raising taxes

net tax revenue rises and transfer payments fall. Balancing the budget would require lowering transfer payments and lowering taxes

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- What is fiscal policy? What effect does it have on the economy? What effect does the economy have on the budget? Why is it important to estimate likely levels of economic growth? Can you provide a case from your personal experience in which you have seen the effect of fiscal policy on the economy?arrow_forwardThe Federal Budget is divided into Mandatory and Discretionary spending. Decide which statement is correct. 1. Social Security is mandatory and interest on national debt is mandatory 2. Military spending is mandatory and interest on national debt is mandatory 3.Interest on national debt is discretionary and Medicare is discretionary 4.Medicare is mandatory and military spending is discretionary.arrow_forwardThe table below presents the tax revenue and spending for the government over five years. Government Revenue and Spending Spending (billions of dollars) Budget Anount (billions of dollars) Tax Revenue (billions of dellars) $400 Budget (Cick to select) (Click to select) ♥ (Click to select) (Click to select) (Click to select) Year $300 S00 450 3. 150 550 4 200 200 700 500 Instructions: Enter your answer as a whole number. If you are entering a negative number include a minus sign a. Under the "Budget Amount" column calculate the annual budget outcome. b. Under the "Budget" column determine whether the annual budget outcome is a budget surplus, budget deficit, or a balanced budget c Suppose the government has no debt entering into year 1. At the end of year 5, what is the government's level of debt? Enter your answer as a positive value %24 billionarrow_forward

- How many year's since 1994 has the federal budget had a surplusarrow_forward"Discuss the Impact of Taxes on Household Savings in the United States"arrow_forwardA government's debt is reduced when it Group of answer choices runs a surplus. runs a deficit. balances is budget. sells more bonds.arrow_forward

- When the total revenues in the federal government are greater than the total expenses in a given year, the budget: A. is balanced. B. has a profit. C. has a deficit. D. has a surplus.arrow_forward2) Transfer payments are the ________ in the government's budget. A) smallest expenditure source B) largest expenditure source C) smallest revenue source D) largest revenue source 3) Personal taxes are the ________ in the government's budget. A) smallest expenditure source B) largest expenditure source C) smallest revenue source D) largest revenue source 4) A government's debt is increased when it A) balances is budget. B) buys more bonds. C) runs a deficit. D) runs a surplus. 5) When a government runs a surplus A) its debt increases. B) it must raise taxes. C) its debt decreases. D) it must cut spending. 6) The amount the government owes to the public is the federal debt. 7) If tax receipts are greater than government expenditures the government is running a surplus. 8) If the government runs a surplus, then the government debt increases. 9) Transfer payments are the largest part of the U.S.…arrow_forwardWhat was the budget agenda for President George W. Bush's administration?arrow_forward

- 11arrow_forwardTo maintain a balanced budget during a recession, what should the government do? Group of answer choices Decrease taxes, increase transfer payments, and/or decrease government spending Increase taxes, increase spending, and/or increase transfer payments Increase taxes, decrease transfer payments, and/or decrease government spending. Decrease taxes, decrease government spending, and/or decrease transfer paymentsarrow_forwardThe Effects of Fiscal Deficits on an Economy.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education