ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

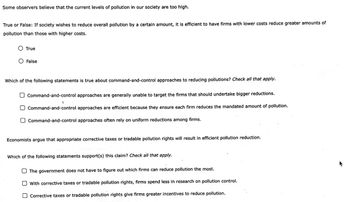

Transcribed Image Text:Some observers believe that the current levels of pollution in our society are too high.

True or False: If society wishes to reduce overall pollution by a certain amount, it is efficient to have firms with lower costs reduce greater amounts of

pollution than those with higher costs.

O True

O False

Which of the following statements is true about command-and-control approaches to reducing pollutions? Check all that apply.

Command-and-control approaches are generally unable to target the firms that should undertake bigger reductions.

Command-and-control approaches are efficient because they ensure each firm reduces the mandated amount of pollution.

O Command-and-control approaches often rely on uniform reductions among firms.

Economists argue that appropriate corrective taxes or tradable pollution rights will result in efficient pollution reduction.

Which of the following statements support(s) this claim? Check all that apply.

The government does not have to figure out which firms can reduce pollution the most.

O With corrective taxes or tradable pollution rights, firms spend less in research on pollution control.

Corrective taxes or tradable pollution rights give firms greater incentives to reduce pollution.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose the the government has set the trading price of a permit at $126 per permit. Complete the following table with the action each firm will take at this permit price, the amount of pollution each firm will eliminate, and the amount it costs each firm to reduce pollution to the necessary level. If a firm is willing to buy two permits, assume that it buys one permit from each of the other firms. (Hint: Do not include the prices paid for permits in the cost of reducing pollution.) Firm Firm A Firm B Firm C Initial Pollution Permit Allocation (Units of pollution) 2 2 2 Regulation Versus Tradable Permits Action Proposed Method Regulation Tradable Permits Final Amount of Pollution Eliminated (Units of pollution) Cost of Pollution Reduction (Dollars) Determine the total cost of eliminating six units of pollution using both methods, and enter the amounts in the following table. (Hint: You might need to get information from previous tasks to complete this table.) Total Cost of Eliminating…arrow_forwardThis is an end-of-chapter problem that I'm struggling with! thanks!arrow_forwardExplain: “Without a market for pollution rights, dumping pollutants into the air or water is costless; in the presence of the right to buy and sell pollution rights, dumping pollutants creates an opportunity cost for the polluter.” What is the significance of this opportunity cost to the search for better technology to reduce pollution?arrow_forward

- Air pollution creates a negative externality—a cost suffered by a third party as a result of an economic transaction. A standard solution to a negative externality is a Pigouvian tax, a tax that raises the marginal private cost of pollution emissions to the level of the marginal social cost. The socially optimal quantity of pollution emissions is then determined by the intersection of the marginal private benefit, or demand, curve and the marginal social cost curve. The article notes that "putting a dollar value on the benefits of cleaner air has been difficult." Assuming this problem has been resolved, in the accompanying diagram, move the endpoints of line Smarginal social cost to show the marginal social cost curve. Then move the line labeled "Tax" to show the amount of the tax needed to limit emissions to the socially optimal level.arrow_forward5B. Two textile mills, located across a river from each other, are polluting the river. The marginal costs of pollution reduction for each firm are MCE₁ = 4E₁ + 4 MCE2 = 4/3E2 + 4/3, where E is the reduction in pollution from unregulated levels. The associated marginal social benefit is estimated to be MSB = 10-E, where E = E₁ + E₂. a. What is the socially optimal level of water-pollution reduction? c. If instead the government imposed a standard requiring each firm to equally reduce the level of pollution to achieve the socially optimal solution in part (i), what are the costs for each firm?arrow_forwardConsider a manufactured good whose production process generates pollution. The demand for the product is Q=100-3P. The market supply function is Q=P. The marginal external cost is MEC=2Q. What is the emissions tax that needs to be imposed to achieve the social optimum? Illustrate on graph What is the economic incidence of this emissions tax? In other words, what proportion of this tax will be paid by producers of this product and what proportion of the tax will be paid by consumers?arrow_forward

- What is a negative externality? What is an example of a negative externality? What is a solution for dealing with a negative externality?arrow_forwardChapter 10 The first government employee suggests reducing pollution through regulation. To meet the pollution goal, the government requires each firm reduce its pollution by 2 units. Complete the following table with the total cost to each firm of reducing its pollution by 2 units. Firm Total Cost of Eliminating Two Units of Pollution (Dollars) Firm A Firm B Firm C ☐☐ Method 2: Tradable Permits Meanwhile, the other employee proposes using a different strategy to achieve the government's goal of reducing pollution in the area from 1 6 units. This employee suggests that the government issue two pollution permits to each firm. For each permit a firm has in its possession, i 1 unit of pollution. Firms are free to trade pollution permits with one another (that is, buy and sell them) as long as both firms can agree on For example, if firm A agrees to sell a permit to firm B at an agreed-upon price, then firm B would end up with three permits and would nee reduce its pollution by only 1 unit…arrow_forwardQ. 1arrow_forward

- Air horns impose many external costs on society: the risk of being deafened, the annoyance of being awakened in the middle of the night, and so on. Therefore, the market equilibrium quantity of air horns is not equal to the socially optimal quantity. The following graph shows the demand for air horns (their private value), the supply of air horns (the private cost of producing them), and the social cost of air horns, including both the private cost and external costs. Use the black point (plus symbol) to indicate the market equilibrium quantity. Next, use the purple point (diamond symbol) to indicate the socially optimal quantity.arrow_forwardHand written solution is not allowed please my dear.arrow_forwardWhat will a corrective tax equal to the external cost imposed on polluters result in? It will increase the level of pollution. It will force polluters to internalize the external cost resulting from their actions. It will eliminate all pollution. It will usually have NO impact whatsoever on pollution levels, but will generate tax revenue for the government.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education