FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

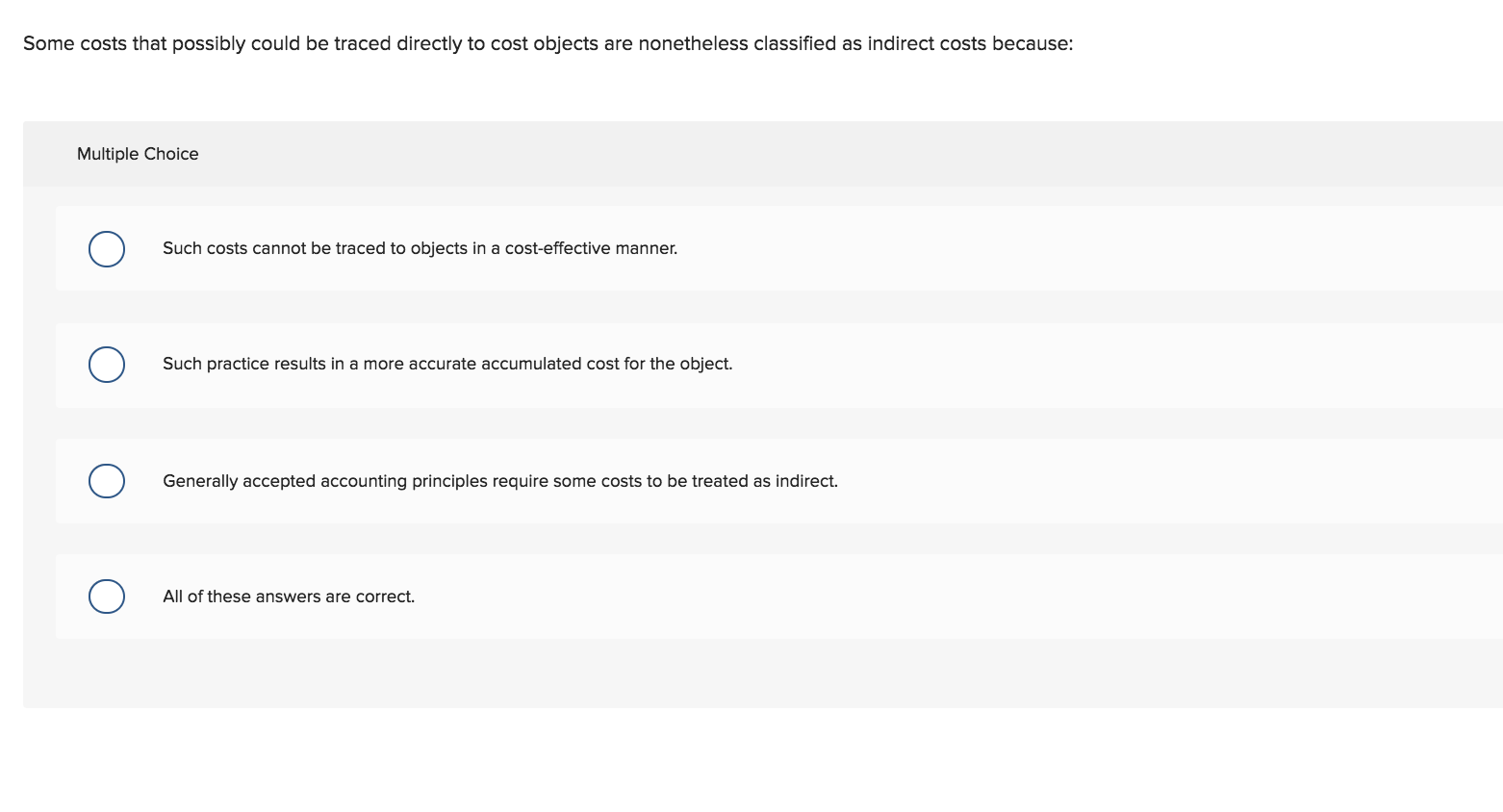

Transcribed Image Text:Some costs that possibly could be traced directly to cost objects are nonetheless classified as indirect costs because:

Multiple Choice

Such costs cannot be traced to objects in a cost-effective manner.

Such practice results in a more accurate accumulated cost for the object

Generally accepted accounting principles require some costs to be treated as indirect.

All of these answers are correct.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardWhich among the following does not hold good for Historical cost accounting? a. Historical cost is relevant for making economic decisions b. Sufficient provision for depreciation is made in historical cost accounting c. Historical cost accounting survives test of time. d. Historical cost is less subject to manipulation.arrow_forwardDirect costs are classified by controllability. True False Can be true, can be falsearrow_forward

- When using the general methods to estimate cost behavior, A. It is a good idea to use multiple methods so results can be compared B. Managers often apply their own best judgement as a first step in the estimation process C. Results are likely to differ from method to method D. Large differences in methods suggest that the cost cannot be estimated.arrow_forwardA cost that cannot be changed because it arises from a past decision and is irrelevant to future decisions is a. An uncontrollable cost. d. An opportunity cost. b. An out-of-pocket cost. e. An incremental cost. c. A sunk cost.arrow_forwardBriefly explain the importance of distinguishing between relevant and irrelevant costs for the purpose of decision making. Provide at least two examples of situations in which the relevant vs. irrelevant classification is usefularrow_forward

- 3. Costs of a product that are regarded as an asset for financial reporting under GAAP are called inventoriable costs. O mixed costs. O direct costs. O overhead costs.arrow_forwardWhich statement is correct regarding IFRS?(a) An advantage of the nature-of-expense method is that it is simple to apply because allocations of expense to different functions are not necessary.(b) The function-of-expense approach never requires arbitrary allocations.(c) An advantage of the function-of-expense method is that allocation of costs to the varying functions is rarely arbitrary.(d) IFRS requires use of the nature-of-expense approach.arrow_forwardThe following statements are correct excerpt? O A. Only avoidable costs are relevant for decision making B. Incremental cost may include both variable and fixed costs OC. All irrelevant costs are sunk costs OD. All direct or indirect cost depends on the cost objectarrow_forward

- Which of the following is one of the difference between management accounting and cost accounting. Select one: O a. Management accounting is based on double entry system but not cost accounting b. Management accounting used for decision making but cost accounting used for cost ascertainment O c. Management accounting is limited for internal use whereas cost accounting for external use d. Management accounting is optional but cost accounting is mandatoryarrow_forwardExplain why using cost as a transfer price is inappropri-ate when the center producing the product is evaluated as a profit center.arrow_forwardTFarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education