Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

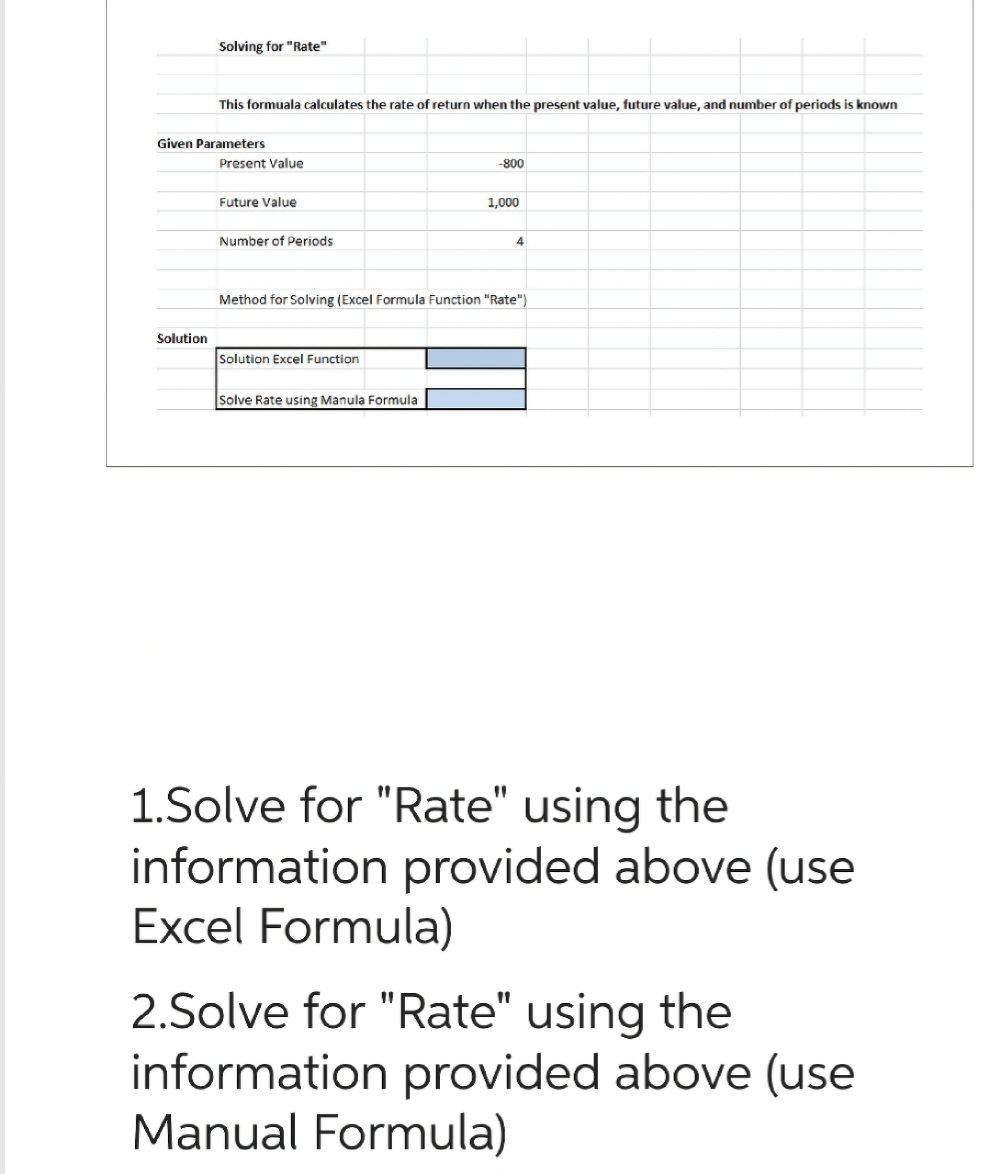

Transcribed Image Text:Solving for "Rate"

Solution

This formuala calculates the rate of return when the present value, future value, and number of periods is known

Given Parameters

Present Value

Future Value

Number of Periods

Solution Excel Function

-800

Solve Rate using Manula Formula

1,000

Method for Solving (Excel Formula Function "Rate")

4

1.Solve for "Rate" using the

information provided above (use

xcel Formula)

2.Solve for "Rate" using the

information provided above (use

Manual Formula)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Similar questions

- how come the CLV will be this, "CLV = ($30 * $24) / (1 + 0.1 - 0.9) = $72" Calculation is wrongarrow_forwardCreate a time value of money problem that involves all 5 variables.arrow_forwardDetermine the future value of the following single amounts (FV of $1. PV of $1. EVA of $1. PVA of $1. EVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) (Round your final answers to nearest whole dollar amount.): Invested Amount Future Value 1. 14,000 7% 15 2. 21,000 6% 16 3. 33,000 12% 15 54,000 5% 11 4.arrow_forward

- pf = 200] . PA = [pf = 200 = 100 - = 100] - 20 & PB = Find the expected pay off assets A and B under probability measures P & P . Using Poi -Ē(P;) find the period 0, price of assets A and B rf Rf =1.05 and Beta=0.95238arrow_forwardSuppose A=D+E, E=$350,000 and E/A=0.7. Solve for D.arrow_forwardDetermine the present value of the following single amounts. Note: Use tables, Excel, or a financial calculator. Round your final answers to nearest whole dollar amount. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Determine the present value of the following single amounts. Note: Use tables, Excel, or a financial calculator. Round your final answers to nearest whole dollar amount. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) 1. 2. 3. 4. Future Amount $ 25,000 $ 19,000 $ 30,000 $ 45,000 ¡= 6% 10% 12% 11% n = 11 14 29 10 Present Valuearrow_forward

- Ok I understand that they all sum to one now and how to calculate the weights. How do I find the rate of return?arrow_forwardThe following information relates to four assets: Probability Return on E Return on F Return on G Return on H 0.1 10% 6% 14% 2% 0.2 10% 8% 12% 6% 0.4 10% 10% 10% 9% 0.2 10% 12% 8% 15% 0.1 10% 14% 6% 20% (a) What is the expected return for each of the assets? (4) (b) Calculate the variance of each asset. (8) (c) Determine the covariance of asset F and G. (4) (d) What is the correlation coefficient between assets F and G? (4)arrow_forwardNet Present Value (NPV) ■ Definition • Formula & Calculation in 6 Steps . 2 Illustrative Examples Advantages and Disadvantages Net Present Value NPV = = Σ NCFt t=0 (1+i)arrow_forward

- Determine the present value of the following single amounts. Note: Use tables, Excel, or a financial calculator. Round your final answers to nearest whole dollar amount. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) 1. 2. 3. 4. Future Amount $ 24,000 $ 18,000 $ 29,000 $ 44,000 i 5% 9% 11% 10% n= 10 13 25 9 Present Valuearrow_forwardIts npv vs discount rate graph please help with conceptarrow_forwardCalculate the arithmetic average of the following returns. Year Return1 0.12 20.16 3 0.24 4 0.13 50.02 Enter the answer with 4 decimals, e.g. 0.1234.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education