Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

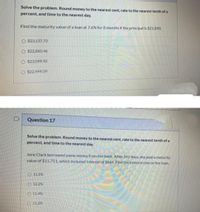

Transcribed Image Text:Solve the problem. Round money to the nearest cent, rate to the nearest tenth of a

percent, and time to the nearest day.

Find the maturity value of a loan at 7,6% for 8 months if the principal is $21,890.

O $23.137.73

O $22,860.46

O $23,099.92

O$22.999.09

D

Question 17

Solve the problem. Round money to the nearest cent, rate to the nearest tenth of a

percent, and time to the nearest day.

Jane Clark borrowed some money from her bank. After 242 days, she paid a maturity

value of $11,751, which included interest of $844. Find the interest rate on her loan.

O 11.5%

O 12.2%

O 11.4%

O 11.2%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- CAN U PLEASEE PLEASE PLEASE HELP ME WITH THISS 21. A bank recently loaned $18,204.00 to buy a car. The loan is for 4 years and is fully amortized. The nominal rate on the loan is 9.2%, and payments are made at the end of each month. What will be the remaining balance on the loan after you make payment number 35? 4,106.14 5,606.14 5,106.14 4,606.14 6,106.14arrow_forwardYou borrow money on a self liquidating installment loan (equal payments at the end of each year, each payment is part principal part interest) Loan amount Interest Rate $632,000 15.5% Life 49 years Date of Loan January 1, 2021 Use the installment method - not straight line Do NOT round any interrmediate numbers. Do NOT turn this into a monthly problem. Do NOT put in minus signs, answer all positive numbers.arrow_forwardK You expect to have $12,000 in one year. A bank is offering loans at 5.5% interest per year. How much can you borrow today? Today you can borrow $ (Round to the nearest cent.) Carrow_forward

- Find the interest paid on a loan of $2,600 for three years at a simple interest rate of 10% per year. .... The interest on the loan is $ st Help Me Solve This Calculator Get More Help - Cle JDecimals & Percents.6 J Decimals & Percents-7 / Decimals & Percents-8 ype here to search DELL prt sc F10 F2 F3 F4 F5 F6 F7 FB F9 %23 %24 & 4. 7. R. * CO 5arrow_forwardFind the effective yield on a discount loan with the given discount rate r and the time. (Round your answer to two decimal places.) r = 2%, 2 monthsarrow_forwardCalculate the maturity value of the simple interest loan. (Round your answer to two decimal places.) P = $2600, r = 8.8%, t = 5 monthsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education