Practical Management Science

6th Edition

ISBN: 9781337406659

Author: WINSTON, Wayne L.

Publisher: Cengage,

expand_more

expand_more

format_list_bulleted

Question

Simplex Method (Use Two-Phase Method by H. Taha)

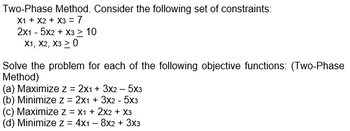

Transcribed Image Text:Two-Phase Method. Consider the following set of constraints:

X1 + X2 + x3 = 7

2x1 - 5x2 + x3 > 10

X1, X2, X3 > 0

Solve the problem for each of the following objective functions: (Two-Phase

Method)

(a) Maximize z = 2x1 + 3x2 - 5x3

(b) Minimize z = 2x1 + 3x2 - 5x3

(c) Maximize z = X1 + 2X2 + X3

(d) Minimize z = 4x1 - 8x2 + 3x3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 14 images

Knowledge Booster

Similar questions

- Lemingtons is trying to determine how many Jean Hudson dresses to order for the spring season. Demand for the dresses is assumed to follow a normal distribution with mean 400 and standard deviation 100. The contract between Jean Hudson and Lemingtons works as follows. At the beginning of the season, Lemingtons reserves x units of capacity. Lemingtons must take delivery for at least 0.8x dresses and can, if desired, take delivery on up to x dresses. Each dress sells for 160 and Hudson charges 50 per dress. If Lemingtons does not take delivery on all x dresses, it owes Hudson a 5 penalty for each unit of reserved capacity that is unused. For example, if Lemingtons orders 450 dresses and demand is for 400 dresses, Lemingtons will receive 400 dresses and owe Jean 400(50) + 50(5). How many units of capacity should Lemingtons reserve to maximize its expected profit?arrow_forwardWhich of the folowing linear programming model has an unbounded feasible region? = 3x + 2y subject to the following : O max z x+ y34 *< 10 – 4y x20 y20 O None of the above O max z = 3x + 2y subject to the following : x+ 2y <4 x- ys1 x20 y20 O max z = 4x +2y subject to the following : x + 2y 24 3x + y27 -x + 2y s7 x20 y20arrow_forwardProblem 2: Applications of Linear Programming: Visa Inc. Stock sells for $92 a share and has 3-year average annual return of $20 a share. The beta value is 1.06. JP Morgan Chase and Co. sells for $87 a share and has a 3-year average annual return of $17 a share. The beta value is 1.21. Derek wants to spend no more than $15,000 investing in these two stocks, but he wants to earn at least $2500 in annual revenue. Derek also wants to minimize the risk. Determine the number of shares of each stock that Derek should buy.arrow_forward

- Combined-cycle power plants use two combustion turbines to produce electricity. Heat from the first turbine’s exhaust is captured to heat waterand produce steam sent to a second steam turbine that generates additional electricity. A 968-megawatt combined-cycle gas fired plant can be purchased for $450 million, has no salvage value, and produces a net cash flow(revenues less expenses) of $50 million per year over its expected 30-year life. Solve, a. If the hurdle rate (MARR) is 12% per year, how profitable an investment is this power plant? b. What is the simple payback period for the plant? Is this investment acceptable?arrow_forwardLet’s consider the following LP problem: min Subject to: Solve the problem with the graphic method.arrow_forwardI’ve been able to find the optimal solution and resulting profit with excel solver. But can’t figure out how to set up the problem with POM QMarrow_forward

- A manufacturer has the capability to produce both chairs and tables. Both products use the same materials (wood, nails and paint) and both have a setup cost ($100 for chairs, $200 for tables). The firm earns a profit of $20 per chair and $65 per table and can sell as many of each as it can produce. The daily supply of wood, nails and paint is limited. To manage the decision-making process, an analyst has formulated the following linear programming model:Max 20x1 + 65x2 – 100y1 – 200y2s.t. 5x1 + 10x2 ≤ 100 {Constraint 1}20x1 + 50x2 ≤ 250 {Constraint 2}1x1 + 1.5x2 ≤ 10 {Constraint 3}My1 ≥ x1 {Constraint 4}My2 ≥ x2 {Constraint 5}yi={1, if product j is produced0, otherwiseyi=1, if product j is produced0, otherwiseWhich of the constraints limit the amount of raw materials that can be consumed? A. Constraint 1 B. Constraint 4 C. Constraint 5 D. Constraint 1 and 4 E. Constraint 1, 2 and 3arrow_forwardDickie Hustler has $2 and is going to toss an unfair coin(probability .4 of heads) three times. Before each toss, hecan bet any amount of money (up to what he now has). Ifheads comes up, Dickie wins the number of dollars he bets;if tails comes up, he loses the number of dollars he bets.Use dynamic programming to determine a strategy thatmaximizes Dickie’s probability of having at least $5 afterthe third coin toss.arrow_forwardA car company is planning the introduction of a new electric car. There are two options for production. One is to produce the electric car at the company’s existing plant in Illinois, sharing production with its other products that are currently being produced there. If the sales of the electric car are moderate, this will work out well as there is significant capacity to produce all of the products there. However, if sales of the electric car are strong, this option would necessitate Adding a 3rd shift, which would lead to significantly higher costs. Another option is to build a new plant in Ohio. The new plant would have sufficient capacity to meet whatever level of demand for the new car. However, if sales of the new car not strong, the plant would be underutilized and less efficient. Since this is a new product, sales are hard to predict. The forecast indicates there is a 60% chance of strong sales (annual sales of 100,000), and 40% chance of moderate sales (annual sales of…arrow_forward

- The sketch of a feasible region is given below, which point is not a point consistent with a production option for this programming problem? (0,10) (0,8) (0,0) O (0,6) O (4,0) O (4,2) O (6,0) (2,8) (6,4) (6,0) 27 (10,0) They are all in the feasible region.arrow_forwardPlease no written by hand solutionarrow_forwardDefine n/n problem with a suitable practical example. Multiple solution in case of certain n/2 problem? Explain.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,